Budget 2026

Critics' choice rather than crowd-pleaser, Aiyar says

Sitharaman's Paisa Vasool Budget banks on what money can do for you best

Budget's clear signal to global investors: India means business

JioStar is targeting ad revenues of more than Rs 2,000 crore from the tournament across television and digital platforms. Without the India-Pakistan match, the estimated revenue loss could be as high as 20%. Subscription revenue is unlikely to be impacted, as deals are annual and fixed-fee in nature.

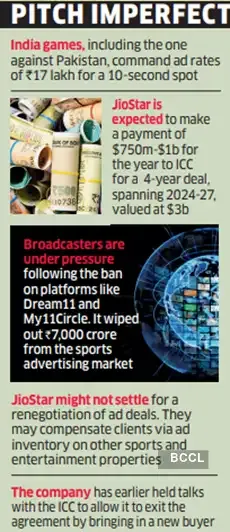

Marquee India games, including the one against Pakistan, command ad rates of Rs 17 lakh per 10 second spot.

Media planners said agencies and brands are seeking clarity from JioStar, which has maintained that the Pakistan Cricket Board (PCB) is yet to officially inform the ICC about its decision. The Pakistan government announced on Sunday that while the team will participate in the tournament, it would boycott the match against India.

If the India-Pakistan fixture slated for February 15 doesn’t go through, it will lead to renegotiation of ad deals, said a senior media planner requesting anonymity.

JioStar has roped in multiple sponsors including Thums Up, ChatGPT, Emirates, Mahindra and Sting for the tournament. “JioStar might not settle for a renegotiation of ad deals; instead, they might compensate clients through make-goods such as ad inventory on other sports and entertainment properties,” the official said.

However, some agencies feel it isn’t possible to recoup the likely loss of reach and impact from an IndiaPakistan match.

“It’s not possible to make good what an India-Pakistan match brings to any tournament, with any other match,” said Navin Khemka, president, South Asia, WPP Media, which represents P&G, Coca-Cola and Hero Moto Corp. “We’re telling fence sitters right now it’s a waitand-watch situation as the final confirmation is awaited. For advertisers which have already invested in the ICC T20 WC, we will work on the best alternative options for the tournament.”

Pakistan’s decision has come at a time when sports broadcasters are already under pressure following the ban on real money gaming (RMG) platforms such as Dream11 and My11Circle, which has wiped out Rs 7,000 crore from the sports advertising market.

Absence of the India-Pakistan game from the T20 WC could also impact ICC revenues, as JioStar may renegotiate its payment terms with the ICC. The broadcaster is expected to pay between $750 million and $1 billion for this year. The four-year deal, spanning 2024-27, is valued at $3 billion. JioStar had earlier held talks with the ICC to allow it to exit the agreement by bringing in a new buyer for the media rights. Any decline in media rights fees will also affect the revenues of the ICC and its member boards, including Pakistan.

“This could set a precedent for future tournaments too; that’s our main concern as things stand,” said a senior executive at a large consumer tech company, asking not to be named. “Our biggest returns-oninvestment on large cricket events happen in India-Pakistan matches.”

Nikhil Vyas, co-founder, ITW Universe, said the absence of an India–Pakistan match will be a setback for both fans and brands investing in the T20 WC, as several advertisers commit to the tournament keeping this marquee fixture in mind. “While the decision is likely to have some impact on overall advertising revenues, the effect may be partially contained given the length of the tournament and the strong viewership expected during the Super 8s and knockout stages,” he said.

With the India-Pakistan match in limbo, several fence sitters may back out, especially as the Indian Premier League (IPL) follows the T20 WC. “Many clients might want to hold back due to the uncertainty over the India-Pakistan match. They might instead go for a safer option in the IPL,” said a media planner.

TV ad rate for the tournament is `8.25 lakh per 10 second spot. For India matches, knockouts, and three non-India games for every India match, the ad rate is Rs 10 lakh per 10 seconds. If a brand opts for two non-India matches for every India match and knockouts, the ad rate rises to Rs 12.5 lakh per 10 seconds. The package with one non-India match for every India match is priced at Rs 17 lakh per 10 seconds.

For mobile, the ad rate is Rs 250 per 10 second CPM, while the connected TV rate ranges from Rs 5 lakh to Rs 7 lakh per 10 seconds.