Where Does Anthropic Fit In India?

Anthropic’s India playbook is shaping up. The AI giant is opening an office in Bengaluru and has hired ex-Microsoft MD Irina Ghose as its India head. The company is focussing on its strengths, which lie in building reliable, enterprise-grade AI systems. Will its B2B-first strategy stick?

Anthropic’s B2B Pitch: The AI giant’s India opportunity lies in helping businesses deploy AI safely in production, with strong support for coding, automation, and customer operations. If Anthropic succeeds, Claude could become the default layer powering codebases, voice agents, and decision workflows across Indian enterprises.

Problems Galore: Industry insiders believe that the AI major’s safety-first approach may hit headwinds in India as system-level controls and performance metrics matter more here. Then, there are also challenges like competition from startups, cost sensitivity of Indian enterprises, thin margins and data-localisation mandates.

Last Mile Solution: The AI juggernaut will have to build strong compliance guardrails as well as continuous monitoring and fallback systems into its stack. While Anthropic’s strong pull inside engineering and product teams may work, it will need to stitch a “last-mile” solution that can fit seamlessly into the low-margin economics of Indian businesses.

Why So Keen On India? The country is a valuable stress-test environment, as multilingual inputs, noisy real-world data, and scale can force models to get better. For a company trying to build enterprise credibility, succeeding in India can become a global proof point.

As AI use cases mature, can Anthropic become the default SaaS layer that keeps the operational engine of India’s enterprises running? Let’s find out…

From The Editor’s Desk

![📊]() Ather Applies Brakes On Q3 Losses

Ather Applies Brakes On Q3 Losses

- The electric vehicle major narrowed its losses 57% YoY to INR 84.6 Cr in Q3 FY26 on the back of operating revenue soaring 50% YoY to INR 953.6 Cr during the quarter under review.

- Adjusted gross margin expanded 700 bps YoY to 25%, signalling that the company is seeing sustained reductions in COGS per vehicle due to supply-chain optimisation, scale benefits and manufacturing efficiencies.

- Meanwhile, the EV major’s management expects to see significant headwinds in the near future due to volatile commodity and component markets.

![🤖]() Can ISM 2.0 Fix India’s Semicon Woes?

Can ISM 2.0 Fix India’s Semicon Woes?

- In the Union Budget 2026, FM Nirmala Sitharaman announced ISM 2.0, positioning the initiative as the next phase of India’s semiconductor mission to produce equipment and materials, build full-stack Indian IP, and fortify supply chains.

- While the policy intent is clear, industry insiders seek more clarity on execution. They want more patient capital and a focus on fabless companies, instead of capital-intensive fabrication ventures.

- Founders also want state-backed capital vehicles that de-risk late-stage rounds and government procurement. They also seek to incubate startups across the upstream and tooling segments to reduce foreign dependence.

PB Fintech Roars In Q3

- The insurance tech major’s profit soared 165% YoY to INR 189 Cr in Q3 FY26 on the back of improving margins and a 37% YoY jump in operating revenue to INR 1,771.1 Cr.

- In line with the top line, expenses also rose 27% YoY to 1,655.4 Cr. What cushioned the costs was EBITDA improving to INR 159 Cr versus INR 27.6 Cr in the year-ago quarter.

- Alongside the results, the company also announced plans for a qualified institutional placement to fuel inorganic growth. PB Fintech’s board will meet on February 5 to consider and approve the fundraise.

Siddarth Pai On The Buyback Blow

- Siddharth Pai argues that Budget 2026 corrected a distortion by treating buyback proceeds as capital gains for shareholders with less than 10% stake. He, however, flags that the move will create a bifurcated structure that is punitive for founders.

- Pai points out that the 10% promoter trap could spill into fundraising mechanics and distort secondary pricing and exit planning. He terms the new norms as a “bittersweet victory” where employees benefit, but founders and key backers pay more.

- On the flip side, Pai believes that this partial fix matters because buybacks are a practical liquidity tool in a market where IPO windows are cyclical and M&A exits are uncertain for many startups.

![💳]() UPI’s Global Ambitions

UPI’s Global Ambitions

- The Centre and the Reserve Bank of India are in talks to connect Ant International’s cross-border payments network, Alipay+, with the homegrown UPI.

- If implemented, the partnership would enable Indian tourists to pay Alipay+ merchants overseas with UPI. With this, the local payments system will look to piggyback on Ant’s stack to scale global adoption instead of building corridors in each country.

- This comes as UPI continues to operate at peak velocity domestically. Last month, the network clocked a record 21,700 Cr transactions worth INR 28.33 Lakh Cr.

Inc42 Markets

Inc42 Startup Spotlight

How Sanlayan Is Making Avionics In India?

India’s defence tech push is accelerating, but dependence on foreign components and supply chains remains a key bottleneck. Sanlayan Technologies is trying to solve this problem by building an indigenous electronic warfare and avionics stack.

Inside Sanlayan’s Arsenal: Founded in 2023, Sanlayan Technologies is a defence tech startup that manufactures mission-critical avionics and radar systems. It also develops antenna arrays, RF front ends and radar data processing sub-systems. The startup claims that its cost-effective electronic systems can detect, track and neutralise threats, including counter-drone capabilities, jamming and spoofing.

Acquisitions As An Accelerator: Over the past two years, Sanlayan has pursued strategic acquisitions, such as Dexcel Electronics and Versabyte Data Systems, to deepen its capabilities. This inorganic build-out has positioned Sanlayan to ship mature subsystems faster while widening its manufacturing and engineering depth.

Growing Traction: In the past year, the startup claims to have onboarded customers such as the Indian Armed Forces, DRDO, BEL and private defence contractors, signalling early product-market fit in the sensitive defence procurement landscape.

As the country doubles down on defence self-reliance, can Sanlayan become India’s indigenous electronics backbone for defence use cases?

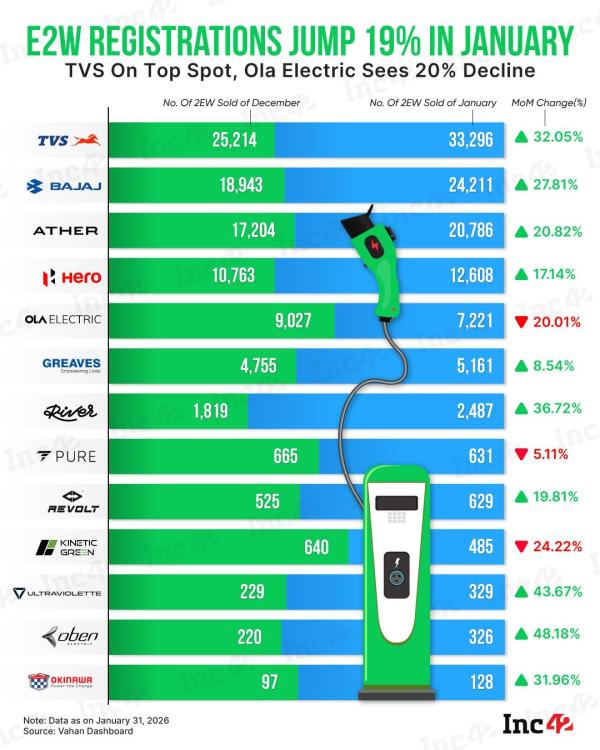

Infographic Of The Day

After a muted 2025, electric two-wheeler registrations rose 19% month-on-month in January, crossing 1.17 Lakh units. Here’s how the momentum looked…

-

Meri Zindagi Hai Tu actor recalls visiting Moula Ali dargah in Hyderabad

-

History Lit Fest to Vir Das’ show: 8 events to attend in Hyderabad this week

-

2 women nabbed for drug peddling in Hyderabad, 1.12 kg ganja seized

-

Commando-style training secret behind Abhishek Sharma’s striking power

-

We have been invited to join Iran-US talks to ease tension: Pakistan