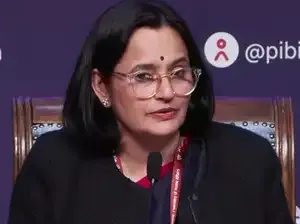

Economic Affairs Secretary Anuradha Thakur expects foreign capital inflows to improve in the coming months, backed by Budget measures aimed at sustaining growth while keeping inflation in check. She says India is navigating a “Goldilocks moment” — one where growth remains resilient even as inflation pressures ease.

Speaking in an interview, Thakur said core inflation appears to be stabilising, though the government remains cautious about allowing price pressures to flare up again. “We don’t want inflation to reach those highs again because it really hurts the poor,” she said, echoing Reserve Bank of India Governor Sanjay Malhotra’s recent description of the current environment as a balanced phase for policy.

The government, she said, has consistently followed a stimulus-oriented approach through high public capital expenditure, which is now being complemented by a visible uptick in private investment. “We can manage the growth that we are aiming at,” she added.

On monetary policy, Thakur said the flexible inflation-targeting framework — with headline inflation anchored in a 2–6% band — has served India well. “Headline inflation reflects the lived experience of inflation better than core inflation,” she said, signalling comfort with the current framework and little appetite for narrowing the target range.

Turning to foreign capital flows, Thakur drew a clear distinction between portfolio and direct investments. Foreign portfolio investment (FPI), she noted, is inherently cyclical and currently in a phase of outflows. “Some of it is because investors have had a good experience in India and are repatriating profits,” she said, adding that moderating valuations and shifting global interest-rate regimes could eventually turn the cycle.

Foreign direct investment (FDI), however, has remained stable in gross terms, even if net inflows have fluctuated at different points during the year. Thakur said the Budget’s targeted interventions should help draw more long-term investment, particularly in sectors such as chemicals and biopharma. “These are areas where we hope to see significant investments going forward,” she said.

On the government’s plans to raise ₹Rs 80,000 crore through divestment and asset monetisation in the next financial year, Thakur said asset monetisation is emerging as an increasingly credible route. “Sector specialists are feeling more confident about how to monetise assets,” she said, suggesting that activity could pick up this year.

She also highlighted the government’s focus on unlocking value from non-core real estate assets through CPSE real estate investment trusts (REITs). Traditionally, government buildings have not generated rental income streams that could be packaged into REITs. “We build buildings to sit in them,” she said, explaining the rationale behind recent policy moves.

The Economic Affairs Department now plans to share its learnings with the Department of Investment and Public Asset Management (DIPAM) and the Department of Public Enterprises to take the initiative forward. “After a few pilots, this could open up a significant chunk of assets — not land, but buildings that we’re already sitting in,” Thakur said. (With inputs from TOI)

Speaking in an interview, Thakur said core inflation appears to be stabilising, though the government remains cautious about allowing price pressures to flare up again. “We don’t want inflation to reach those highs again because it really hurts the poor,” she said, echoing Reserve Bank of India Governor Sanjay Malhotra’s recent description of the current environment as a balanced phase for policy.

The government, she said, has consistently followed a stimulus-oriented approach through high public capital expenditure, which is now being complemented by a visible uptick in private investment. “We can manage the growth that we are aiming at,” she added.

On monetary policy, Thakur said the flexible inflation-targeting framework — with headline inflation anchored in a 2–6% band — has served India well. “Headline inflation reflects the lived experience of inflation better than core inflation,” she said, signalling comfort with the current framework and little appetite for narrowing the target range.

Turning to foreign capital flows, Thakur drew a clear distinction between portfolio and direct investments. Foreign portfolio investment (FPI), she noted, is inherently cyclical and currently in a phase of outflows. “Some of it is because investors have had a good experience in India and are repatriating profits,” she said, adding that moderating valuations and shifting global interest-rate regimes could eventually turn the cycle.

Foreign direct investment (FDI), however, has remained stable in gross terms, even if net inflows have fluctuated at different points during the year. Thakur said the Budget’s targeted interventions should help draw more long-term investment, particularly in sectors such as chemicals and biopharma. “These are areas where we hope to see significant investments going forward,” she said.

On the government’s plans to raise ₹Rs 80,000 crore through divestment and asset monetisation in the next financial year, Thakur said asset monetisation is emerging as an increasingly credible route. “Sector specialists are feeling more confident about how to monetise assets,” she said, suggesting that activity could pick up this year.

She also highlighted the government’s focus on unlocking value from non-core real estate assets through CPSE real estate investment trusts (REITs). Traditionally, government buildings have not generated rental income streams that could be packaged into REITs. “We build buildings to sit in them,” she said, explaining the rationale behind recent policy moves.

The Economic Affairs Department now plans to share its learnings with the Department of Investment and Public Asset Management (DIPAM) and the Department of Public Enterprises to take the initiative forward. “After a few pilots, this could open up a significant chunk of assets — not land, but buildings that we’re already sitting in,” Thakur said. (With inputs from TOI)