From today 1st February, the prices of sirgat and pan masala are going to become expensive by 2 to 3 times. A cigarette priced at Rs 18 may reach Rs 70 to Rs 72 or some reports claim that the price will increase to Rs 21 to Rs 28, but one thing is certain – prices will increase and significantly. The reason for this is that there has been a change in the tax system. Till now, there are four types of taxes on cigarettes in the country.

1. Basic Excise Duty – Rs 5 to Rs 10 per 1 thousand cigarettes

2. NCCD (National Calamity Contingent Duty) Rs 230 to Rs 850 per 1 thousand cigarettes

3. GST (Goods and Services Tax) – 28%

4. Compensation Tax – Ad valorem (value based tax)

Ad valorem – ranges from 5% to 36% and Flat Rate – ₹2076 – ₹4170 (per 1 thousand cigarettes) can range from Rs 2 thousand 76 to Rs 4 thousand 1 hundred 70 per 1 thousand cigarettes. Overall, heavy tax has always been imposed on sirgate but this time the prices may increase significantly.

How expensive will cigarettes become?

In the year 2017, when GST was implemented in the country. Then tobacco products were put in the highest tax slab. 28% tax. But state governments feared that if all taxes were centralized, the state’s earnings could be affected because the money they received from the old tax system was merged into GST. The central government promised that it would not let this happen. Whatever tax the government levies on sirgate. An additional tax of up to 5% was imposed on it. Now this tax was to compensate the demand of the state government. That’s why it was called compensation tax.

The period of this compensation tax was till March 2026 only. The government was worried that with its removal, tobacco tax earnings might decline. In such a situation, the government brought a new bill. On the Central Excise Amendment Bill 2025 and the new bill, the government increased the tax on tobacco products.

Till now the excise duty on 1 thousand head was between Rs 200 to Rs 735. Which depended on the length of the head and its type. Small cigarette, big cigarette, long thin cigarette or cigar. In this way the duty used to be different but the new bill is going to increase it manifold. Due to this, it will cost Rs 2,500 to Rs 8,500 per 1,000 cigarettes. Tax on some special categories will increase to Rs 11,000.

Apart from this, there is a maximum slab of GST on Sirgat and Pan Masala. That means 40% will be imposed. As of now, 28% GST is levied on cigarettes and pan masala. This means that the overall tax burden can now reach 60 to 70 percent. Which earlier was around 50 to 55 percent. According to this data, it is being claimed that the prices of cigarettes will increase manifold. In some media reports, it has been claimed that the price of Rs 18 cigarette has increased to Rs 70 to Rs 72.

By when will prices increase?

Some experts believe that the price hike being talked about in the media is 300 to 400 percent. That has been exaggerated. Economist Rijo M John writes- ‘The price increase at ground level will be only 10 to 15 percent. That is, the cigarette which was worth Rs 18. She won’t turn 72 straight away. It can be sold between Rs 21 to Rs 28 because some cigarette companies will bear some loss to retain customers.

‘

The reason for this is that currently 4.5 crore people in India are directly or indirectly associated with the tobacco industry. If the price increases by 15 to 40 percent, there is a possibility of a decrease in the purchase of cigarettes.

Aanchal magazine of Indian Express has claimed in its report that initially the entire burden of increased tax is going to fall on cigarette making companies. In such a situation, to retain customers, these companies should not increase rates simultaneously. Increase the rate gradually while bearing some loss in the initial level. So that the customers are not suddenly burdened.

Something similar is going to happen with Pan Masala and Gutkha also. GST on pan masala without tobacco has also been increased from 28% to 40%. On top of this the government will impose another tax. HSNS Cess means Health Security National Security Cess. By combining this, the total tax on gutkha will be 91% and on tobacco 82%.

According to the report of Indian Express, now the government will charge excise duty on chewing tobacco like Khaini, Zarda, Gutakha on the basis of the production capacity of the machine making it. For example, if a machine can make 500 pouches per minute and the retail price of a pouch is Rs 2, then the duty on chewing tobacco will be around Rs 83 lakh per machine per month. If the price of a pouch is Rs 4 then the duty on the machine will increase further.

Tax will be imposed on production machines

The monthly tax for each machine will be decided after considering the maximum speed of the machine and the retail price of the pouch. The government claims that Pana Masala and some tobacco products are such where tax evasion can be done easily. Therefore, GST will be charged according to the sales and cess will be collected according to the production capacity of the machine. So that accounting is maintained from production to sale and tax evasion can be prevented.

Apart from this, the government will impose 33% duty on hookah, 60.5% duty on homogenized tobacco, while 279% duty will be imposed on smoking mixtures of pipes and cigarettes. Overall cigarettes, pan masala, khain, zarda, gutkha. Everything is going to be expensive but there is no need to get confused by seeing big figures. Tax on small cigarettes will increase by small amounts. A little more than that in larger cigarettes. A little more on special flavor cigarettes. More on imported cigarettes or flavored tobacco used to make cigarettes. There will be an additional tax of 279%.

What is the role of WHO?

While leaving, he answers one more question. After all, why is the government doing this? And what harm can it cause? The World Health Organization recommends to all countries that there should be a minimum tax of 75% on tobacco products like cigarettes. More than 85 countries of the world continuously increase taxes on cigarettes. Talking about the report of taxfoundation.org, the average tax on cigarettes in Europe is up to 60%, but many countries impose tax up to 80%. Ireland levies the highest tax on cigarettes in the world. It charges only 10.71 Euro tax on a box of 20 big cigarettes measuring 84 to 90 mm. Talking in Indian Rupees, only Rs 1100 to 1200 tax is charged on a pack of 20 cigarettes and there is also a ban on retail sale of cigarettes. You cannot buy 1-2 loose cigarettes here. If you want to take it, you will have to buy the entire packet of 20.

India is also moving in this direction now. Taxes are being increased. While presenting the new bill, Minister of State for Finance Pankaj Choudhary had said that with the introduction of this bill and increase in the prices of cigarettes, pan masala and tobacco, it is expected that people’s habit of consuming tobacco will reduce. Data from the Global Youth Tobacco Survey says that there are 8.5% people in the country who started using tobacco at a very young age. It is expected that price increases will make it more difficult and expensive for new smokers to start. This will reduce the cases of diseases like cancer, heart attack, COPD caused by tobacco but it will also have some negative impacts.

What will be the effect?

The first negative impact will be on the tobacco industry. As we mentioned above, about 4.5 crore people in India are directly and indirectly associated with the tobacco industry. This includes farmers, factory workers, retailers or staff looking after the supply chain. Due to increase in cigarette prices, companies will have to reduce production. Due to which jobs may be in danger. Especially in states like Bihar and Andhra Pradesh. Where tobacco is produced in good amounts.

The second concern is about black marketing and smuggling. According to the Indian Express report, the industry claims that for every 3 legal cigarettes sold in the country, 1 smuggled or fake cigarette is sold. Such a sudden increase in tax will further increase illegal trade. According to the industry, only 10 percent of the tobacco products sold in the country are cigarettes, but the tax that comes from the entire tobacco product is the same. 80% of its taxes come from cigarettes with a 10% share.

-

Baba Vanga: Baba Vanga's prediction has caused a stir, with a major revelation about gold and silver

-

EPF vs VPF Explained: Which Provident Fund Option Can Secure a Stress-Free Retirement?

-

How to Reduce Credit Card Interest Rates: Smart Strategies to Cut Debt and Save Thousands

-

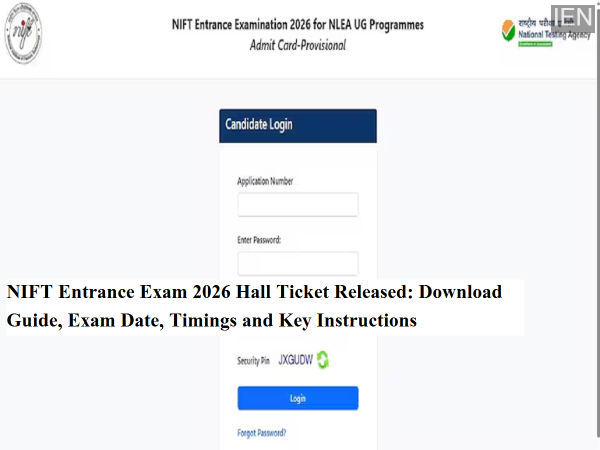

NIFT Entrance Exam 2026 Hall Ticket Released: Download Guide, Exam Date, Timings and Key Instructions

-

Government Deactivates Over 25 Million Aadhaar Numbers: Check If Your Aadhaar Is Still Active