- Did you transfer money to the wrong account?

- If you want to get the money back, it is very important to have the permission of the other person

- NPCI investigates and directs the bank to refund the money if the case is valid

UPI payments have become an important part of our lives these days. From buying vegetables to shopping at the mall, UPI payments are used everywhere. Just click, enter the password and your money is transferred from the bank account. In that case, there is no need to carry a wallet or pocket of holiday money. UPI payments have made your life very easy and convenient. But this comfort can sometimes become a big problem for us. When you transfer a large amount of money to someone and then you realize that you have transferred the money to the wrong account… many people do not know what to do in such a situation and people panic. Many people also think that we will not get back the amount that we have transferred.

Airtel Update: Billions of users hit! Telecom company has deleted this free special facility, know in detail

Online UPI payment is designed in such a way that when you scan, enter the amount and password and click OK, the money from your account is transferred to another account instantly. There is no cooling period. Also, the option of automatic reverse is not available. So if you transfer money to the wrong account due to your mistake, it becomes difficult to get this money back. According to Indian law, if money is transferred to someone’s account, you cannot get back the money transferred without that person’s permission, even if you made the transfer by mistake…. (Photo Courtesy – Pinterest)

If you want to get your money back, it is very important to have that person’s permission. As a rule, it is very important to check whether the complete information is correct before making an online payment. In such case the bank does not give you another chance to get your transferred money. But you can definitely try to get your money back by following some rules and regulations. In case of wrong UPI transfer, the first thing you need to do is file a complaint.

Almost every UPI app has a Disput or wrong transfer option in the transaction history. Filing a complaint here will not result in an immediate refund, but it will keep your case on record. Keep your transaction receipt, UTR number, date and amount ready and file a complaint. The support team can request a refund through NPCI. Another option is to file a complaint directly on the NPCI website under the Dispute Redressal Mechanism section. It requires transaction ID, UTR number, amount and UPI ID of sender and recipient. NPCI then investigates and directs the bank to refund the money if the case is valid.

Users are fed up with this smartphone! Number 1 in sales, learn the secret to popularity

After you file a complaint, your bank will contact the receiving user’s bank and inform them of the entire incident. If the other party is willing to refund the mistakenly transferred money, the entire amount you transferred will be credited to your account in the next few days. But if the receiving user refuses to pay you back, there is nothing the bank can do about it. It is impossible to transfer money without the permission of the account holder. In such a situation, it is considered convenient to file a complaint with the police.

-

Airtel Discontinues Free Perplexity Pro Offer Worth Rs 17,000, Replaces It With New AI Subscription

-

ChatGPT Suffers Major Outage, Indian Users Largely Unaffected

-

JEE Main 2026 Session 1 Response Sheet, Answer Key Released Today at jeemain.nta.nic.in; How to Download Response Sheet, Raise Objections

-

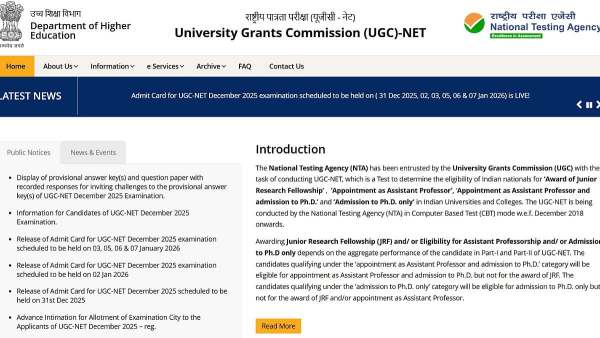

UGC NET December 2025 Result Expected By Today At ugcnet.nta.nic.in; How To Check Scorecard, Cut-off Details

-

AWKWARD! Ektaa Kapoor Forgets Aparshakti Khurana's Name On Stage, Ignores Him Even After He Introduces Himself At Mumbai Event—VIDEO