Listen to this article in summarized format

Loading...

×Quote of the day by Ben Bernanke: Today’s quote by the former Federal Reserve Chair Ben Bernanke cuts straight to a common misunderstanding about money and price stability. Many people still discuss the idea of returning to a gold standard, a monetary system that once linked currency values directly to gold, believing it would stabilize everyday prices like groceries, rent, or gas. But Bernanke’s comment reminds us that price stability under such a system only applies to the price of gold itself, not the myriad prices we deal with in daily life. This matters because it helps demystify a complex economic topic and grounds policy discussions in real effects on people’s wallets. By focusing on what monetary systems actually do, rather than what advocates hope they might do, the quote gives readers context for ongoing debates about money, inflation, and economic policy

"A gold standard doesn't imply stability in the prices of the goods and services that people buy every day, it implies a stability in the price of gold itself," as per BrainyQuote.

Bernanke built his reputation in academia, teaching at Stanford University before becoming a full professor at Princeton University. Widely published, his research focused on macroeconomics, monetary policy, the Great Depression, and business cycles. His work earned him Guggenheim and Sloan fellowships, and in 2001 he became editor of the American Economic Review.

Bernanke’s tenure coincided with the global financial crisis of 2007–08. During this period, he worked with US officials to craft emergency measures, including the Emergency Economic Stabilization Act, aimed at preventing a collapse of the financial system, as per the Britannica report. He was confirmed for a second term in 2010 and served until 2014, when he was succeeded by Janet Yellen.

Quote of the Day Today

Quote of the day by Ben Bernanke:"A gold standard doesn't imply stability in the prices of the goods and services that people buy every day, it implies a stability in the price of gold itself," as per BrainyQuote.

Quote of the Day by Ben Bernanke Meaning Explained

Ben Bernanke’s quote highlights an important point: having a monetary system tied to gold doesn’t automatically keep everyday living costs stable. Under a gold standard, a country’s currency is linked to a fixed amount of gold, historically meaning paper money could be exchanged for a set weight of gold. The system was widely used in the 19th and early 20th centuries before countries gradually abandoned it in favor of fiat money, where the value isn’t backed by a physical commodity like gold.Quote of the Day February 2: Why Ben Bernanke’s Quote Still Matters Today

Some people assume that tying money to gold would protect consumers from inflation or price swings in goods and services. What Bernanke points out, though, is that the gold standard stabilizes the price of gold itself, not the prices of bread, gas, rent, or other everyday necessities. In practice, even when a currency is tied to gold, the prices of everyday items can rise or fall due to supply and demand, productivity changes, imports and exports, or shocks like wars and pandemics.Gold Price Stability vs Cost of Living: Understanding the Difference

Bernanke’s quote helps clarify that monetary policy isn’t just about anchoring money to a commodity. It’s also about understanding how different systems impact the real prices people care about, from food and housing to services and wages. By distinguishing between stability in gold prices and stability in everyday prices, the quote invites readers to think more deeply about how monetary frameworks affect real lives.Ben Bernanke’s Early Life, Education, and Academic Achievements

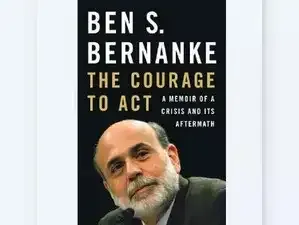

Ben Bernanke is one of the most influential economists of modern times, known for guiding the United States through one of its most severe financial crises. Born on December 13, 1953, in Augusta, Georgia, Bernanke grew up in Dillon, South Carolina, in a family rooted in public service, his father was a pharmacist and his mother a teacher, as per a Britannica report. His academic path was distinguished early on: he graduated summa cum laude in economics from Harvard University in 1975 and earned a Ph.D. from MIT in 1979.Bernanke built his reputation in academia, teaching at Stanford University before becoming a full professor at Princeton University. Widely published, his research focused on macroeconomics, monetary policy, the Great Depression, and business cycles. His work earned him Guggenheim and Sloan fellowships, and in 2001 he became editor of the American Economic Review.

Ben Bernanke: Leading the Fed Through the 2008 Global Financial Crisis

His move into public service came in the early 2000s, when he joined the Federal Reserve’s Board of Governors and later served as chairman of the President’s Council of Economic Advisers. In 2005, President George W. Bush nominated Bernanke to succeed Alan Greenspan as chair of the Federal Reserve. He took office on February 1, 2006, marking a shift from Wall Street–style leadership to a more academic approach.Bernanke’s tenure coincided with the global financial crisis of 2007–08. During this period, he worked with US officials to craft emergency measures, including the Emergency Economic Stabilization Act, aimed at preventing a collapse of the financial system, as per the Britannica report. He was confirmed for a second term in 2010 and served until 2014, when he was succeeded by Janet Yellen.

Nobel Prize in Economics: Why Ben Bernanke’s Research Mattered

In 2022, Bernanke was awarded the Nobel Prize in Economics, alongside Douglas Diamond and Philip Dybvig, for research that reshaped understanding of banks, financial crises, and modern bank regulation, as per the Britannica report.Quotes by Ben Bernanke on Monetary Policy and Economic Growth

Here are some more quotes by Ben Bernanke.- "The ultimate purpose of economics, of course, is to understand and promote the enhancement of well-being," as per BrainyQuote.

- "In many spheres of human endeavor, from science to business to education to economic policy, good decisions depend on good measurement," as per BrainyQuote.

- "The lesson of history is that you do not get a sustained economic recovery as long as the financial system is in crisis," as per BrainyQuote.

- "The best solution to income inequality is providing a high-quality education for everybody. In our highly technological, globalized economy, people without education will not be able to improve their economic situation," as per BrainyQuote.

- "Monetary policy is a blunt tool which certainly affects the distribution of income and wealth, although whether the net effect is to increase or reduce inequality is not clear," as per BrainyQuote.

Subscription

Subscription