For nearly two decades, India’s startup story has centred around three cities — Bengaluru, Delhi NCR, and Mumbai — which have concentrated most of the country’s capital, talent, and ambition.

Together, they attracted the bulk of venture funding and became default launchpads for founders. In fact, according to Inc42’s Annual Indian Startup Trends Report 2025, Delhi leads the Indian ecosystem in producing the most listed technology startups.

But, realities are changing now. Funding activity in the Mumbai & Delhi NCR regions slowed, with investments either falling or staying flat. Not just this, regions like Hyderabad, Pune and Jaipur are being seen as the upcoming startup hubs.

According to Inc42’s investor survey, 2025, 45% of investors identified Hyderabad as the next major epicentre of India’s startup revolution, followed by Pune (20%) and Jaipur (10%). Further, more than 56% investors see tier II-III purchasing power as the next consumer growth engine.

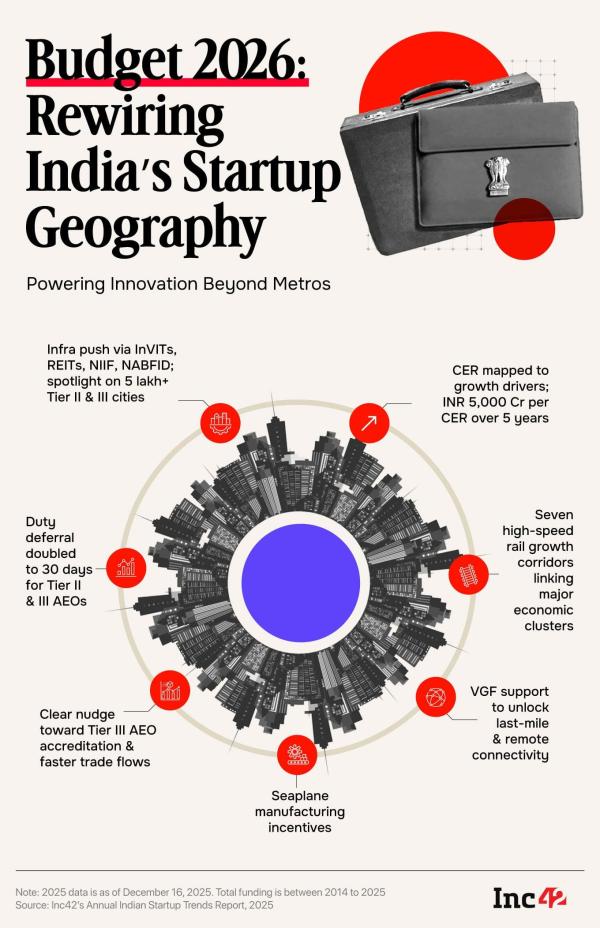

Over the past few years, policy nudges, state-led startup missions, and infrastructure investments have started pushing entrepreneurial activity beyond the traditional metro cities. From Coimbatore and Indore to Jaipur and Kochi, tier II and III cities are no longer just talent back-offices.

Lower operating costs, improving digital infrastructure, and targeted incentives are quietly reshaping where companies are being built next. However, the shift beyond metros does not automatically translate into strong startup ecosystems.

Vishal Mehta, the chairman and MD of AvenuesAI Limited (formerly Infibeam), a fintech company based in GIFT-City Gandhinagar, is of the view that startup ecosystems are strongest when organic forces are guided by purposeful policy leadership.

“While talent, entrepreneurship, and innovation mature over time, forward-looking state policy can meaningfully accelerate startup gravity by creating the right conditions, i.e. world-class infrastructure, regulatory clarity, and collaborative hubs,” he added.

For example, Gujarat’s IT policy vision behind GIFT City reflects this approach. It is not merely offering incentives but institutionalising a long-term platform for global fintech and deeptech companies.

At the national level, manufacturing-linked policy thrusts are also contributing to a more geographically distributed startup ecosystem. Earlier this year, the Centre approved 22 projects under the Electronics Component Manufacturing Scheme (ECMS), clearing investments worth INR 41,863 Cr.

Unlike earlier batches, these projects were spread across eight states — Andhra Pradesh, Haryana, Karnataka, Madhya Pradesh, Maharashtra, Tamil Nadu, Uttar Pradesh and Rajasthan — signalling rising investor and corporate interest beyond the traditional tech corridors.

Ruchit Agarwal, the group CFO of CARS24, a Gurugram-based marketplace for automobiles for buying and selling pre-owned cars, seconds Mehta’s opinion. He said that strong ecosystems tend to emerge organically, but the right policy environment can significantly accelerate that process.

“Infrastructure, digital connectivity and ease of doing business create the confidence founders need to take long-term bets. Policy may not manufacture innovation on its own, but it can meaningfully reduce friction and help ecosystems scale faster once entrepreneurial activity begins,” Agarwal added.

Even the Union Budget 2026 gives a clear signal towards this shift. In finance minister Nirmala Sitharaman’s words, “Cities are India’s engines of growth, innovation, and opportunities. We shall now focus on tier II and III cities, and even temple-towns, which need modern infrastructure and basic amenities.”

According to Deepak Padaki, president of Catamaran, while there are examples of policy-driven clusters being created, the success depends on a more ground-up creation of an ecosystem of suppliers and buyers.

For example, Aequs, a Catamaran portfolio company, set out to build a precision aerospace manufacturing cluster in Belagavi.

This reduces the time parts take to move through the production cycle and allows suppliers to develop nearby, with easier access to knowledge and process know-how. Other valid examples are the auto ancillary clusters in Pune, Tamil Nadu’s Sriperumbudur and Coimbatore.

Traditional startup hubs still offer strong network effects, particularly for early stage startups. But for scaled companies, ecosystem support and execution depth become more important than proximity to legacy networks. As companies grow, factors like operating efficiency, team stability and cost discipline start to outweigh the benefits of being in established hubs, making tier II ecosystems far more compelling.

Well-supported startup ecosystems outside big cities can be just as powerful as the advantages offered by metro hubs, particularly for deeptech companies. Tier II ecosystems backed by committed state leadership foster focussed, self-sufficient clusters rather than fragmented competition for attention and resources.

Today’s connectivity, cloud platforms, video collaboration, and instant communication have significantly reduced the need for physical proximity to legacy hubs.

When in-person interaction is required, mobility is easy and efficient. This makes operating from a well-planned tier II ecosystem not only viable but also more rational than absorbing the long-term cost and complexity of metro-centric setups.

Decoding Policy SignalsOverall, in any case, founders should focus less on announcements and more on execution track records. The most reliable policy signals are visible in operational infrastructure, regulatory follow-through, and institutions that already function at scale.

“A prudent approach is to begin with a pilot presence, test talent availability, governance responsiveness, and ecosystem depth and then commit fully. Cities that consistently convert policy vision into delivery tend to offer the most sustainable environments for growth,” said Mehta.

Further, tracking budgetary allocations, institutional investments and outcomes, not just incentives, helps founders distinguish real opportunity. Ultimately, the best cities are those where leadership demonstrates a long-term commitment to innovation, reinforced by clear near-term momentum and execution.

As Agarwal suggests, what really matters is how consistently policies translate into better infrastructure, smoother compliance and faster decision-making on the ground. “We have found that cities that focus on getting the fundamentals right over time tend to offer a more durable environment for building and scaling businesses,” he added.

The bigger question, for now, is — can governance truly decentralise India’s startup ecosystem, or will capital and scale continue to pull founders back to the top three hubs?

The post The Next Big Startup Hubs: Inside India’s New Innovation Engines appeared first on Inc42 Media.

-

WOFA 2.0: SARC and Associates organises sessions on capital flows, NFRA and Viksit Bharat 2047

-

'Our daughter didn't cry when she was born - I knew something was badly wrong'

-

'Unhinged' film dubbed 'corporate Lord of the Flies' leaves viewers 'squirming'

-

Helen Skelton uses this affordable moisturiser that 'really suits mature skin'

-

'Super smart' bedding set that's 'easy to iron' gets price slashed by 50% in winter sale