Avanti Feeds shares witnessed a sharp correction on Friday, slipping more than 6% in intraday trade, after delivering a stellar rally of over 30.21% in the past five trading sessions. The decline comes as investors booked profits following a strong run-up that had pushed the stock close to its 52-week high.

The stock opened at ₹1,049.00 and moved between an intraday low of ₹1,014.50 and a high of ₹1,063.55. This compares with the previous close of ₹1,081.20. Despite today’s fall, the stock remains well above its 52-week low of ₹601.55.

Why Avanti Feeds shares surged 30% in five days

The sharp rally in Avanti Feeds over the last week was driven by a major positive trigger for India’s fisheries and allied industries following the India–US trade deal. Fisheries stocks came into focus after India and the United States signed an agreement aimed at reducing tariff pressure on Indian exports.

India remains the largest exporter of fisheries and allied products to the US, with export values estimated at approximately $2.5 billion. Earlier, high tariffs had weighed heavily on exporters’ topline growth and operating margins, making Indian seafood less competitive in the global market. The easing of trade tensions has significantly improved sentiment across shrimp exporters, including Avanti Feeds, leading to aggressive buying interest and a sharp price surge.

-

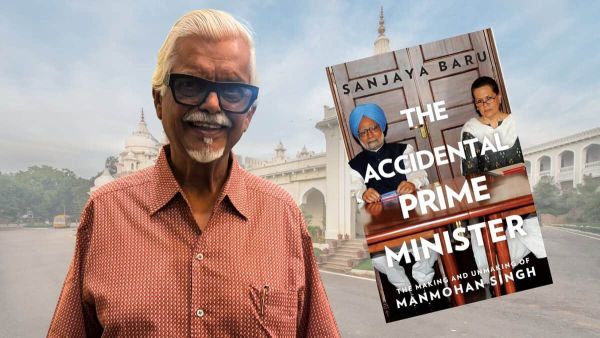

Interview: Mamata should be Congress president, says ex-Manmohan advisor Sanjaya Baru

-

Kerala minister visits nurse who survived Nipah infection twice

-

This method can convert CO2 and water into fuel

-

'I lost 11st with Slimming World and my family didn't recognise me'

-

T20 WC: Hat-trick man Romario Shepherd demolishes Scotland with fifer