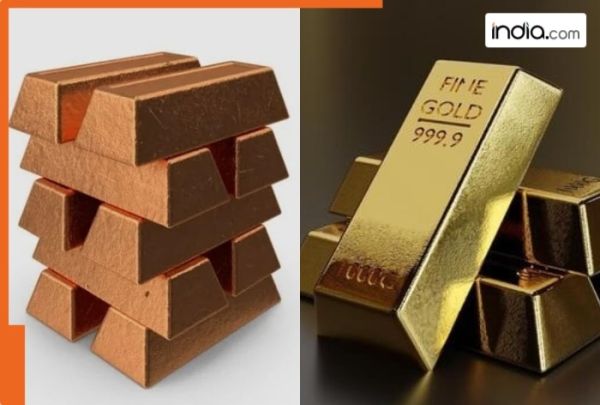

New Delhi: Amid the ongoing turmoil in the commodity market investors are left very confused. Also two very precious metals gold and silver have plunged. Amidst this uncertainty and volatility the biggest discussion in market circles is whether the power center of investment has shifted. Experts suggest if you invest in commodities then copper could be a good option during this period of upheaval. Market experts say that while gold has made investors rich in the last few years a similar trend could be witnessed with copper. They say that copper could prove to be the gold of the future. 20 years in making Gold has been for a long time considered the safest investment. In the changing global economy copper is now establishing itself as a growth haven. On the technical front COMEX copper recently broke out above its nearly 20-year-old rising channel on its weekly chart which is strong evidence that the demand and supply dynamics of copper worldwide have fundamentally changed and copper also appears to be moving in an upward trajectory. Copper’s value Presently governments around the world are spending billions of dollars on renewable energy smart power grids and electric vehicles (EVs) to reduce carbon emissions. Copper is the backbone of all these futuristic technologies. It is no longer just an industrial metal used in factories; it has become the most modern and significant symbol of the global economic growth cycle. According to a report the movement of the Nifty Metal Index in the Indian stock market is also confirming this while the analysis of technical tools like the Heikin Ashi chart shows the continuous formation of bullish candles in the Metal Index indicating a very large and long-term uptrend. Metal Index After a breakout between December 2023 and June 2024 this index showed a phenomenal surge of 48%. Another major breakout occurred in October 2025 and since then the index has risen by 20%. Experts believe that if this momentum continues the Metal Index could touch the magical level of 15000 in the coming months. Therefore instead of viewing the current market decline and volatility as a threat it should be seen as a golden opportunity to include quality metal stocks in ones portfolio.

-

Andy Murray's grandmother dies weeks after grandfather as heartbroken family pay tribute

-

Air quality improves slightly in Delhi with AQI remaining 'poor'

-

Packed schedule for Amit Shah during J-K visit; will review security, development

-

Elevator, escalator safety critical as Bengaluru metro set to expand to 175 km: Official

-

UPSC CSE 2026 Notification: UPSC CSE notification released, apply for 933 posts by February 24th..