The economist cited a recent Politico newsletter stating that, as Fed Chair, Kevin Warsh could bring a shift in the central bank’s communication.

- In a speech at the IMF Spring Meetings in April 2025, Warsh stated that the Fed’s current wounds are largely self-inflicted, adding that it’s time for the central bank to get policy back on track.

- He added that Fed leaders should skip opportunities to share their latest musings.

- Warsh said that rhetorically talking about the latest data release is a common problem and counterproductive.

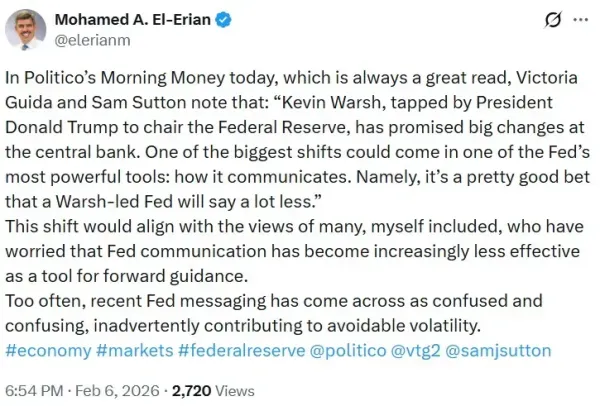

Mohamed El-Erian, Chief Economic Advisor at Allianz, stated on Friday that recent messaging from the Federal Reserve has come across as “confused,” contributing to avoidable volatility.

The economist cited a recent Politico newsletter stating that, as Fed Chair, Kevin Warsh could bring a shift in the central bank’s communication.

“This shift would align with the views of many, myself included, who have worried that Fed communication has become increasingly less effective as a tool for forward guidance,” El-Erian said.

The Politico newsletter stated that a Warsh-led Fed will “say a lot less,” citing the Fed Chair nominee’s distaste with respect to how the central bank conveys to financial markets about its next decision.

Warsh’s Criticism Of Fed’s Messaging

In a speech at the IMF Spring Meetings in April 2025, former Fed Governor Warsh stated that the Fed’s current wounds are largely self-inflicted, adding that it’s time for the central bank to get policy back on track.

“Near-term forecasting is another distracting Fed preoccupation. Economists are not immune to the frailties of human nature. Once policymakers reveal their economic forecast, they can become prisoners of their own words,” he said.

The Fed Chair nominee added that Fed leaders should skip opportunities to share their latest musings, noting that rhetorically talking about the latest data release is a common problem and counterproductive.

He said that he sees little value in the Fed’s data-dependent approach, arguing that relying on backward-looking data, which undergoes significant revision, reflects false precision and analytical complacency.

‘Decisive’ Upgrade To Powell

Jeremy Siegel, professor emeritus of finance at the University of Pennsylvania’s Wharton School of Business, said that Warsh is a “decisive upgrade” to outgoing Fed Chair Jerome Powell.

“His qualifications are superb, and most importantly, he brings genuine independent-minded thoughts back to the Fed—something that was too often lacking in recent years,” the economist said, adding that he expects the Senate to confirm President Trump’s nomination of Warsh.

Warsh’s Prior Experience

Apart from his stint as a Fed Governor, Warsh has prior experience as the Fed’s emissary to emerging and advanced Asian economies.

He was also a member of Morgan Stanley’s mergers and acquisitions team, having served as the firm’s Vice President and Executive Director.

Warsh is currently a partner at Stanley Druckenmiller's Duquesne Family Office LLC and also serves on the board of directors of United Parcel Service Inc. (UPS) and Coupang Inc. (CPNG).

Meanwhile, U.S. equities gained in Friday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.59%, the Invesco QQQ Trust ETF (QQQ) rose 0.47%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) gained 0.82%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up by 0.04% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Sportvot x FPJ: Mumbai Premier League 2025–26 Sees Dominant 4–0 Wins For MYJ-GMSC And ICL Mumbai

-

Is Elvish Yadav engaged to Jiyaa Shankar? Here’s the actual truth

-

CTET 2026 Exam: Important Details on Entry Times and Prohibited Items

-

Uttarakhand Education Department Opens Applications for 2364 Class IV Positions

-

Which? issues 'disturbing' alert as people 'cloned' after phone call