Most home loan borrowers want to repay their loans ahead of schedule to reduce interest costs and shorten the loan tenure. However, making prepayments often requires withdrawing money from savings. If you opt for a home loan overdraft (OD) facility, you can save on interest and also withdraw the extra money deposited whenever needed.

However, there's a catch. Home loans with an overdraft facility usually have a slightly higher interest rate compared to regular home loans. Therefore, it's crucial to carefully weigh the pros and cons before making a decision.

What happens after opting for the overdraft facility?

When you choose a home loan with an overdraft facility, your loan account is linked to your savings or current account. Any extra money you deposit, in addition to the EMI, is considered a prepayment. This reduces the outstanding loan amount and lowers the interest payable. If you need that money later, you can withdraw it anytime. As soon as you withdraw the money, that amount is added back to the loan, increasing the outstanding balance and consequently increasing the interest again.

How is the interest calculated?

With this facility, interest is calculated on a daily reducing balance basis. The bank checks your balance every night and calculates interest only on the remaining amount after deducting the money in your account from the total loan amount. For example, Suresh has taken a home loan of ₹80 lakh at 9% interest, and his EMI is ₹81,141. If he deposits ₹10 lakh into his account on February 15, 2026, the bank will calculate interest only on ₹70 lakh that day. The next day, if the balance is ₹2 lakh, the interest will be calculated on ₹78 lakh. This will automatically reduce the interest component and increase the principal component in the March EMI.

Advantages of Home Loan Overdraft

Depositing extra money reduces the effective outstanding loan amount and saves a significant amount of interest in the long run. The deposited money can be withdrawn when needed, which is not possible with regular prepayments. With lower interest rates, a larger portion of the EMI goes towards paying off the principal, which reduces the loan tenure and the overall cost.

What are the disadvantages of this facility?

The interest rate on home loans with an overdraft facility is usually 0.10% to 0.30% higher. According to income tax rules, the extra money deposited in the OD account does not qualify for tax exemption under Section 80C, as it is not considered a formal prepayment.

Who is this facility suitable for?

This facility is more beneficial for people who frequently have surplus income. This includes business owners, self-employed individuals, or salaried employees who receive regular bonuses. Such individuals can save on interest by keeping the money in the account and withdrawing it when needed.

Should you opt for an OD or invest elsewhere?

This depends on whether the return you get from investing elsewhere (after tax) is higher than the interest rate on your home loan. According to Raj Khosla, founder of MyMoneyMantra.com, an overdraft gives you a safe return equivalent to the loan interest, while investments like mutual funds may offer higher returns in the long run. For those who are risk-averse and have high-interest loans, an OD is a better option. If the return from the investment is higher than the loan interest, then invest. If the loan interest is higher, then an OD account might be a better option.

Disclaimer: This content has been sourced and edited from TV9. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

T20 World Cup 2026 Group A Points Table: Pakistan rise to top after hard-fought win over Netherlands in opening match

-

T20 World Cup 2026: Suryakumar Yadav confirms India’s opening batter, his name is…

-

Pakistan vs Netherlands Highlights, T20 World Cup 2026: Faheem Ashraf FIREWORKS seal 3-wicket win for PAK

-

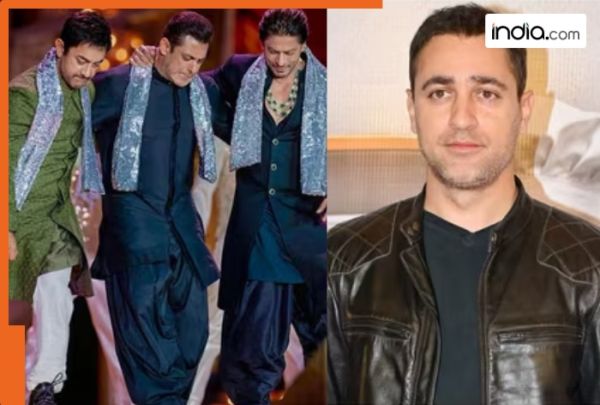

Imran Khan believes ‘The Khans’ must evolve with age and audience; says they should move to age-appropriate roles

-

Cognizant offers bonanza bonus of 100 per cent to employees; CEO calls it, ‘outcome of hustle’