Nearly two decades ago, InMobi helped put India’s startup ecosystem on the global map. Now, the company that once redefined what Indian startups could achieve is preparing to script yet another historic chapter. InMobi is gearing up for an initial public offering (IPO) expected to exceed $500 million — and in a move packed with symbolism and strategy, it is bringing its corporate headquarters back home to India from Singapore.

For many in the startup world, this is more than just another listing. It’s a story of evolution, ambition, and a full-circle moment for one of India’s earliest tech trailblazers.

Credits: The CSR Journal

A Carefully Planned Runway Before the Big Takeoff

Before stepping onto the public market stage, InMobi is building momentum through a pre-IPO fundraising round. While the company has remained tight-lipped about the size and timeline of this round, the intent is clear — strengthen its financial muscle and sharpen its valuation ahead of its market debut.

Pre-IPO rounds often act like a final dress rehearsal. They allow companies to test investor appetite, bring in strategic backers, and prepare financially for the scrutiny that comes with public listing. For InMobi, this round could provide the extra push needed to scale innovation, expand its product ecosystem, and strengthen its competitive positioning globally.

Eight Investment Banks, One Massive Mission

The IPO journey is rarely simple, and InMobi appears to be leaving no stone unturned. The company has reportedly approached eight investment banks to guide it through the high-stakes process of going public.

These advisors will help craft regulatory filings, ensure compliance with market norms, and design investor outreach strategies. The process will also involve deep financial audits, legal reviews, and corporate restructuring — all crucial steps in transforming a privately held tech company into a publicly traded entity.

The involvement of multiple banking giants signals that InMobi is aiming for a listing that is not just successful, but impactful.

The Story That Started It All

InMobi’s rise mirrors the early dreams of India’s startup ecosystem. Founded in 2007, when the mobile internet revolution was still taking shape, the company entered the market with a sharp focus on mobile advertising. At a time when global tech giants dominated the digital ad space, InMobi carved out its own identity with innovation and scale.

In 2011, it achieved a breakthrough that changed the narrative for Indian startups forever — becoming the country’s first unicorn by crossing the $1 billion valuation mark. That milestone wasn’t just about valuation; it was a statement that Indian startups could compete on the global stage.

Since then, InMobi has expanded into marketing cloud technologies and media platforms, building a diversified global business with strong operations across North America, Europe, and the Asia-Pacific region.

The Homecoming That Signals Bigger Ambitions

The decision to shift its headquarters back to India is both strategic and symbolic. India’s digital economy is growing at an unprecedented pace, fueled by rising smartphone usage, deeper internet penetration, and a surge in technology-driven consumption.

By relocating its base, InMobi is positioning itself closer to one of the world’s fastest-growing technology markets. The move could also help the company build stronger connections with Indian investors and regulatory bodies, potentially making its IPO more attractive to domestic stakeholders.

Yet, this return home doesn’t mean shrinking global ambitions. InMobi is expected to continue operating across international markets, maintaining its position as a global consumer technology powerhouse.

Navigating the Complex Road to Listing

Shifting corporate headquarters and preparing for an IPO simultaneously is no easy feat. InMobi will need to secure regulatory approvals, restructure internal corporate frameworks, and align with Indian capital market requirements.

Investors are eagerly awaiting the company’s regulatory filings, which will shed light on its financial performance, growth strategies, and valuation outlook. These disclosures will likely play a decisive role in shaping market sentiment around the IPO.

Credits: Inc42

A Defining Moment for India’s Startup Future

InMobi’s public listing could create waves across India’s entrepreneurial landscape. As one of the country’s earliest startup success stories, its decision to list domestically may inspire other Indian-origin tech giants to consider Indian stock exchanges over international markets.

The IPO is also expected to attract attention from global investors looking to tap into India’s rapidly expanding digital economy. If successful, InMobi’s listing could strengthen confidence in India’s startup ecosystem and open the floodgates for a new generation of public tech companies.

As InMobi prepares to step into this new phase, its journey stands as a powerful reminder of how far India’s startup ecosystem has come — and how much further it is ready to go.

-

I tried 5 supermarket own-brand toothpastes - a 50p tube beat Colgate

-

Moss will not ruin a lawn if gardeners do a simple 30-minute task before February ends

-

I asked 5 chefs which appliance they can't live without - only 1 said an air fryer

-

T20 World Cup: Suryakumar Yadav hammers his 25th T20I half-century

-

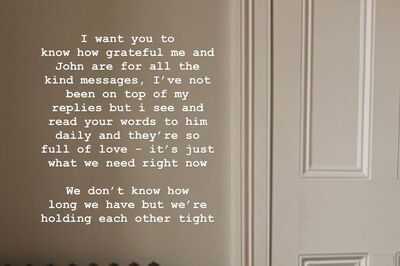

Lorna Luxe says 'we don't know how long we have left' amid husband's cancer battle