Arbitrage Funds

If you want to keep your hard-earned money in a safe place for a short period of time like a few weeks, a few months or a year, then a savings bank account is definitely an option. But as you know, in the last few years the interest rates on savings accounts have fallen to around 2.53%. Even what were considered high-interest savings accounts have reduced returns.

In such a situation the question arises where to park the money? In this situation, two types of mutual funds emerge, liquid funds and arbitrage funds. The objective of both is to give decent returns at low risk. Now the question is which of these is better?

First understand liquid funds

Liquid funds invest only in debt and money market instruments with maturity up to 91 days. According to the rules, these are considered debt mutual funds. In these, your money is invested in safe options like treasury bills, call money, repo agreements, government short-term bonds, certificate of deposit (CD), commercial paper (CP) and term deposits.

Both interest and credit risk are low in these instruments, hence liquid funds are considered low risk. Their objective is to keep the capital safe and to make money easily available when needed. Liquid funds can be a good option for those who come in low tax slab, are risk averse and have money for emergencies. Slightly better returns are available from savings account.

tax issue

But keep in mind that capital gains from liquid funds are taxable as per your income tax slab. If you are in a high tax bracket, this can be harmful.

Now coming to arbitrage funds

Arbitrage funds are considered hybrid funds under the rules. Of these, at least 65% is invested in equity and the rest in debt and money market instruments. Now you might think that investing 65% in equities is not risky? Actually the special thing here is the arbitrage strategy. Arbitrage means taking advantage of the difference in share prices in the cash market and futures market. The fund manager buys the same share in the cash market and sells it in futures. It does not matter whether the market goes up or down, the difference in price gives profit. In this way the equity investment remains completely hedged and the risk is significantly reduced. The remaining 35% of the money is invested in secured debt instruments.

Effect of STT increase

However, STT has been increased in Budget 2026, which will increase the trading cost of arbitrage funds and may put some pressure on returns. Nevertheless, arbitrage funds are beneficial from tax point of view because they are considered equity funds. If sold in less than 12 months, 20% LTCG is applicable and if sold in more than one year, 12.5% LTCG (above ₹ 1.25 lakh) is applicable.

last thing

While parking money for a short period, do not chase high returns. Your priority should be capital protection. Choose liquid or arbitrage funds considering your time, risk appetite and tax slab.

-

Becks Prime restaurant closing Wilcrest diner after 35 years; see the remaining locations in Texas

-

At least 51 kidnapped, 3 killed in Nigeria attacks

-

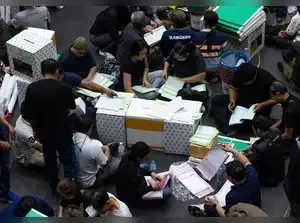

Thailand votes in three-way race as risk of instability looms

-

'We will pay,' US TV host Savannah Guthrie says in plea for mother's return

-

Haiti's presidential council dissolves after rocky tenure as unelected US-backed ruler remains