UPI Wrong Payment Rules: If a mistake occurs during a UPI payment, it's crucial to take immediate action instead of panicking. A timely complaint can save you from significant losses.

UPI Rules: UPI has made everyday transactions fast and easy. Pick up your phone, open the app, scan, and the payment is complete. This speed, however, can sometimes create problems. In haste, if you enter the wrong number, wrong UPI ID, or add extra digits to the amount, the money goes into an unknown account. Panic is understandable in such a situation.

The problem is even greater if the amount is large, as the transaction cannot be reversed immediately. However, if the right steps are taken at the right time, there is a chance of getting your money back. Prompt and intelligent action is your biggest help in this situation. Here's what you need to do.

Can a UPI transaction be canceled immediately?

Can a UPI transaction be canceled after the payment is made? If you're wondering the same thing, let us tell you that a payment confirmed with a UPI PIN cannot be canceled immediately. This means that if you've made a wrong payment, you cannot cancel it. But this doesn't mean your money is gone forever.

In such a case, first save the transaction details. Go to the app and take a screenshot of the transaction ID, date, time, amount, and the UPI ID to which the money was sent. Then try to contact the receiver. In many cases, the other person shows honesty and returns the money. If not, ask for a refund. Don't delay; do this immediately.

File a complaint through the UPI app and your bank

If the other person doesn't cooperate, you can then file a complaint. For this, open the transaction in the app you used for the payment and select the "Report" option. File your complaint there and fill in the necessary information. After this, contact your bank. Call customer care or submit a written complaint at the branch. Provide the bank with the transaction ID, amount, time, and details of the incorrect recipient. The bank will then handle the matter internally and contact the other bank involved.

You can also file a complaint on the NPCI portal.

If the problem is not resolved through the app or the bank, you can file a complaint on the NPCI grievance portal. You can register your complaint by entering the transaction ID. After filing the complaint, you will receive a reference number to track the status. To avoid these problems, always try to make payments by scanning a QR code. Double-check the amount when entering it. Carefully read the recipient's name displayed on the screen. A single hasty click can be costly. A little caution can save you from major financial losses.

-

Mohammed Siraj shares Suryakumar Yadav’s message before his T20 World Cup 2026 heroics, says ‘Miyan…’

-

Rhea Chakraborty reveals why she gave up on acting for years, now returns with Hansal Mehta: ‘I didn’t get…’

-

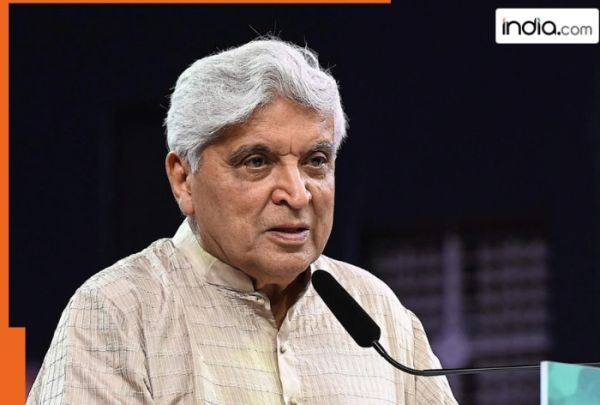

Javed Akhtar says no composer wanted to make ‘Breathless’, waited seven years before Shankar Mahadevan said yes: ‘No one dared…’

-

Kapil Sharma, Sunil Grover, Krushna: Who is the paid the highest on The Great Indian Kapil Show? Archana Puran Singh reveals

-

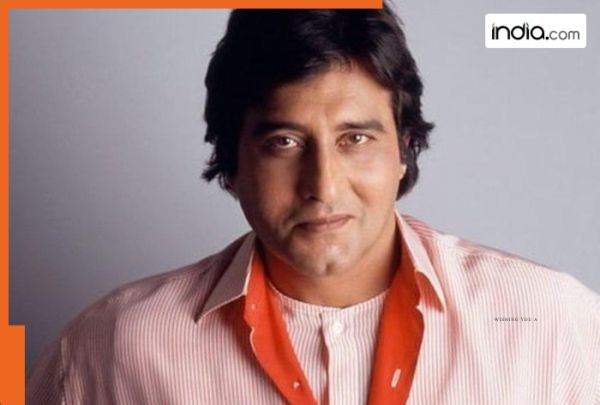

Vinod Khanna left stardom for Osho: Wife Kavita recalls his life as a gardener, model, and seeker