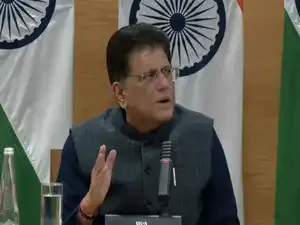

As India and US firm up its trade agreement, Union Minister Piyush Goyal said on Sunday that buying crude oil or LNG, LPG from Washington is in New Delhi's own strategic interests as the country diversifies its energy sources.

However, the union minister said that those decisions rest firmly with companies and commercial buyers, not with trade negotiators.

"The buying of crude oil or LNG, LPG from the US is in India's own strategic interests as we diversify our oil sources," Goyal said in conversation with ANI.

Also Read | India-US trade deal: America has stopped short of Indian red lines

Goyal sought to draw a clear distinction between India’s energy strategy and the scope of the India-US trade arrangement, stressing that the agreement does not prescribe where India should source its oil or gas from.

"But the decisions are taken by the buyers, by the companies themselves. So, the trade deal doesn't discuss who will buy what and from where. The trade deal ensures that the pathway to trade is smooth, ensures preferential access," the minister added.

According to the him, the purpose of the trade deal is not to direct procurement choices but to create a smoother, more predictable environment for bilateral commerce.

India and the US announced a framework for the deal last week, with the aim of concluding it by March and lowering tariffs while deepening economic cooperation.

"FTAs are all about preferential access to your competition. So, today when we got an 18% reciprocal tariff, we have a preference over other developing nations who are usually our competition," Goyal said.

The remarks come amid contrasting claims from Washington.

Also Read |India's immediate end of Russian oil after US trade deal to be a big disruption: Moody's

US President Donald Trump said earlier this week that India had agreed to stop buying Russian oil and sharply raise purchases from the US and possibly Venezuela as part of the trade understanding. The PM Modi-led Central government, however, has not confirmed such a commitment yet.

Refining and trading sources told the wire agency that major buyers have avoided fresh Russian oil purchases for delivery in April and are expected to stay away for longer, a move that could ease the path towards a trade pact with Washington.

The report found that Indian Oil, Bharat Petroleum and Reliance Industries are not accepting offers for Russian oil loading in March and April, though some deliveries for March had already been scheduled earlier.

Most other refiners, sources told Reuters, have also paused purchases of Russian crude.

Russia has been India’s largest crude supplier in recent years, largely due to deep discounts following Western sanctions after the Ukraine war. Indian imports of Russian oil averaged about 1.7 million barrels per day last year, far exceeding supplies from the US and Venezuela combined.

However, volumes have declined in recent months, with intake falling to a two-year low in December.

On the other hand, Moody’s Ratings said earlier this week that New Delhi is unlikely to make an abrupt exit from Russian crude purchases in the wake of the much anticipated trade deal with the Trump administration.

The ratings agency added that a rapid move away from Russian oil would not be without cost, noting that a wholesale switch to alternative suppliers could tighten global supply, push up crude prices and feed into higher inflation.

Given India’s position as one of the world’s largest oil importers, Moody’s said there are clear limits to how quickly the country can rework its energy sourcing without broader economic repercussions.

However, the union minister said that those decisions rest firmly with companies and commercial buyers, not with trade negotiators.

"The buying of crude oil or LNG, LPG from the US is in India's own strategic interests as we diversify our oil sources," Goyal said in conversation with ANI.

Also Read | India-US trade deal: America has stopped short of Indian red lines

Goyal sought to draw a clear distinction between India’s energy strategy and the scope of the India-US trade arrangement, stressing that the agreement does not prescribe where India should source its oil or gas from.

"But the decisions are taken by the buyers, by the companies themselves. So, the trade deal doesn't discuss who will buy what and from where. The trade deal ensures that the pathway to trade is smooth, ensures preferential access," the minister added.

According to the him, the purpose of the trade deal is not to direct procurement choices but to create a smoother, more predictable environment for bilateral commerce.

India and the US announced a framework for the deal last week, with the aim of concluding it by March and lowering tariffs while deepening economic cooperation.

"FTAs are all about preferential access to your competition. So, today when we got an 18% reciprocal tariff, we have a preference over other developing nations who are usually our competition," Goyal said.

The remarks come amid contrasting claims from Washington.

Also Read |India's immediate end of Russian oil after US trade deal to be a big disruption: Moody's

US President Donald Trump said earlier this week that India had agreed to stop buying Russian oil and sharply raise purchases from the US and possibly Venezuela as part of the trade understanding. The PM Modi-led Central government, however, has not confirmed such a commitment yet.

Pivoting away from Russia

Even so, according to a Reuter's report, market signals suggest Indian refiners are already paring exposure to Russian crude.Refining and trading sources told the wire agency that major buyers have avoided fresh Russian oil purchases for delivery in April and are expected to stay away for longer, a move that could ease the path towards a trade pact with Washington.

The report found that Indian Oil, Bharat Petroleum and Reliance Industries are not accepting offers for Russian oil loading in March and April, though some deliveries for March had already been scheduled earlier.

Most other refiners, sources told Reuters, have also paused purchases of Russian crude.

Russia has been India’s largest crude supplier in recent years, largely due to deep discounts following Western sanctions after the Ukraine war. Indian imports of Russian oil averaged about 1.7 million barrels per day last year, far exceeding supplies from the US and Venezuela combined.

However, volumes have declined in recent months, with intake falling to a two-year low in December.

On the other hand, Moody’s Ratings said earlier this week that New Delhi is unlikely to make an abrupt exit from Russian crude purchases in the wake of the much anticipated trade deal with the Trump administration.

The ratings agency added that a rapid move away from Russian oil would not be without cost, noting that a wholesale switch to alternative suppliers could tighten global supply, push up crude prices and feed into higher inflation.

Given India’s position as one of the world’s largest oil importers, Moody’s said there are clear limits to how quickly the country can rework its energy sourcing without broader economic repercussions.