Is India’s test prep market hitting a ceiling in terms of growth? That’s the soft signal from PhysicsWallah after its Q3 earnings call.

The edtech major made it clear: the next phase of growth won’t start at Class 11. It will start much earlier.

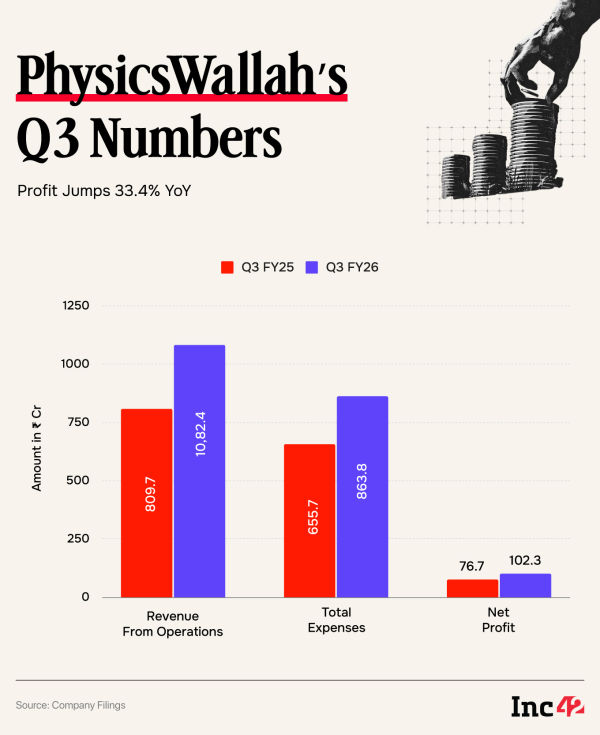

PW reported a 33.4% YoY jump in consolidated net profit to ₹102 Cr for the quarter ended December 2025, up from ₹76.7 Cr a year ago. Flush with IPO proceeds and ₹642.9 Cr in operating cash flows during 9M FY26, the company has over ₹5,000 Cr to invest in the next phase, clear on net letting it set idle.

Starting with expansion in high-demand regions, especially southern India, while doubling down on core unit economics to drive predictable, profitable scale. But the bigger story is its ambitious long-term bet on K-12 or school education.

“Focused investments in the K-12 platform form a key part of PhysicsWallah’s strategy. As you would have seen, we acquired Tender Heart, and we are now partnering with Tender Heart, and we find ourselves in a very leading position to now create a quality K-12 platform,” management said about the partnership with Tender Heart School in Ranchi.

However, PW has not disclosed any material investment in Tender Heart. During its Q3 results, PhysicsWallah announced an investment of ₹1.5 Cr to buy 50% stake in health and wellness company Kay Wellness, and acquired non-profit Nextseed Foundation in a deal worth ₹1 Lakh, but it did not mention any Tender Heart investment.

Why PhysicsWallah Is Betting Big On K-12With over 1.5 Mn recognised schools in the K-12 space and over 260 Mn estimated students, K-12 is nearly four times larger than the test prep market. PW sees schooling itself as the root of India’s coaching dependency.

“The entire coaching industry is the outcome of bad schooling in the country. We want to fix it at the root,” cofounder Prateek Maheshwari explained during the call.

The logic is that by the time students enter the 11th grade, learning gaps are already entrenched. Competitive exam prep becomes remedial rather than additive.

PhysicsWallah now wants to intervene upstream, at the foundation level, where learning habits, conceptual clarity and academic confidence are first shaped.

Globally, this shift mirrors patterns seen in China, where listed education giants such as New Oriental eventually built larger K-12 businesses than their test prep verticals. PW’s leadership believes India will follow a similar trajectory. For context, New Oriental reported $1.2 Bn revenue at 14.7% year-on-year growth in the second fiscal quarter of 2026.

“K-12 will be a larger business than test prep in five years,” CFO Amit Sachdeva claimed.

The move is also being driven by changing parent behaviour. Increasingly, families want integrated schooling and coaching models, instead of sending children to school in the morning and tuition in the evening.

“If you talk to any parent, they want an integrated setup, both school education and test prep under one roof,” Maheshwari said.

PW believes it already has a structural advantage here. The PhysicsWallah ecosystem today spans online learning from Grade 3 via Curious Junior, offline coaching through Vidyapeeth centres, and exam prep across JEE, NEET, UPSC and multiple state boards. The Sarrthi IAS deal has further strengthened the company’s UPSC vertical. K-12 is the natural extension of an existing pipeline, as per Maheshwari.

Besides, the edtech major’s board also approved the incorporation of a new subsidiary called Physicswallah Student Housing to provide hostel facilities to students enrolled with PW Group across applicable cities.

PhysicsWallah’s K-12 strategy rests on three pillars: owned schools, school partnerships, and online learning.

PW currently operates three schools and plans to add eight more, split evenly between greenfield and brownfield projects. The deal with Tender Heart has given the company control and a working blueprint to scale.

One of PW’s brownfield schools has already been turned around to host more than 1,200 students within just 18 months, an early proof point management repeatedly highlighted.

Each school targets over 1,000 students, with learners staying from Grade 1 through Grade 12, creating long-term lifetime value. At steady state, mature schools are expected to generate EBITDA margins of 20–25%.

Students enrolling early also feed naturally into PW’s higher-margin test prep ecosystem later.

The company believes its national brand, technology-driven pedagogy and outcome-oriented teaching give it an edge over fragmented, hyperlocal schools that dominate India’s K-12 landscape.

“Our competition is largely local, non-tech-led schools. Parents prefer a national brand with data-driven systems and learning outcomes,” he added.

Alongside its schools, PW is pursuing an asset-light model through its School Integrated Programme.

Here, PhysicsWallah partners with existing schools — currently around 50 have signed up — providing curriculum, teachers and technology while the school supplies infrastructure. The model already reaches about 25,000 students and generates roughly ₹25 Cr in topline. This is akin to a franchise model

This approach allows PW to scale faster with lower capital intensity, while still embedding its academic framework inside formal classrooms.

PW’s third layer is digital. Through Curious Junior — its grades 3–10 online learning platform — the company positions itself as an alternative to traditional tuition. The product is growing nearly 100% year-on-year and already serves tens of thousands of learners.

Management says Curious Junior has quietly made PhysicsWallah the largest online tuition player in India. This digital entry point allows PW to build relationships with students years before they enter competitive exam cohorts, strengthening retention and cross-sell potential across its ecosystem.

Capital, Saturation And The Bigger VisionPW’s K-12 push is being backed by serious capital. The company has already deployed ₹400 Cr into its K-12 platform via a wholly owned subsidiary. Further investments will be decided post FY26 planning, but management has openly stated that K-12 could become larger than test prep within five years.

This comes at a time when PW’s core exam businesses remain strong but are beginning to mature. JEE and NEET enrolments are now growing in low single digits, particularly in North India where penetration is already high. Growth is increasingly coming from newer categories and geographies.

UPSC revenues have more than doubled year-on-year. State board programmes have onboarded 275,000 paid learners, generating ₹22 Cr in nine months and vernacular courses attracted 94,000 learners with ₹24 Cr in revenue. Moreover, new verticals such as Class 11, NEET PG and IIT JAM are gaining traction, the company claimed.

Southern India is emerging as a major expansion frontier, both for offline centres and exam prep adoption.

Yet management is clear that K-12 represents something larger than just another category.

PhysicsWallah confirmed it is exploring the creation of India’s first digital university, with discussions underway with regulators. The company already offers professional courses via partnerships and sees formal education as the next logical extension of its platform.

Why Schools Won’t Be A CakewalkPhysicsWallah’s aggressive push into schools and K-12 comes at a time when the segment is undergoing a quiet but meaningful reset. Parents and students today are far more outcome-oriented than they were even a few years ago.

Whether it’s cracking competitive exams, landing better jobs, or acquiring industry-ready skills, education is increasingly being judged by tangible results, not just curriculum coverage. That shift has redirected demand toward test prep, professional upskilling, vocational courses, and outcome-led learning formats.

K-12, meanwhile, has entered a far more mature phase. After witnessing explosive growth during Covid-led remote schooling, the segment has cooled. For companies like PW betting big on this market, differentiation is no longer optional.

Unlike competitive exam prep, where success is measured through ranks and results, K-12 outcomes are harder to quantify. Customer acquisition costs are high, retention cycles stretch across years, and trust is built slowly, especially when parents are deciding on long-term schooling paths for their children.

“Founders often underestimate how difficult it is to crack K-12 at scale.You’re not just selling content here, you’re selling credibility,” a VC partner which invested in one of the large edtech platforms said.

To stay relevant, many players are now leaning on AI-led personalisation, adaptive learning journeys, and hybrid online-offline models. But even these are becoming table stakes, he added.

Markets Watch: New Issues, Post-IPO Journey & More

Fractal Analytics Mops Up ₹1,248 Cr From Anchors: Fractal Analytics raised ₹1,248.3 Cr from anchor investors ahead of its IPO by allotting 1.39 Cr shares at ₹900 apiece, the upper end of its price band, before the issue opens for subscription on February 9.

Capillary Tech Profit Dips: Capillary Technologies reported a 22% YoY decline in consolidated net profit to ₹8 Cr in Q3 FY26, though profit jumped sharply on a sequential basis from ₹28.8 Lakh in the previous quarter.

Nykaa Profit Soars: Nykaa reported a 156% YoY jump in consolidated profit after tax to ₹67.7 Cr in Q3 FY26 on strong revenue growth and margin improvement, while PAT also rose 105% sequentially from ₹33 Cr.

Nazara Returns To Profit: After slipping into the red in the September quarter, Nazara posted a net profit of ₹8.8 Cr in Q3 FY26, though this marked a 36% YoY decline from ₹13.7 Cr in the year-ago period.

[Edited by Nikhil Subramaniam]

The post Why PhysicsWallah Is Going Back To School appeared first on Inc42 Media.

-

UP Police Result: The final result for the UP Police Computer Operator recruitment has been released; 930 positions have been filled..

-

The admit card for the RRB Section Controller 2026 exam has been released; the exam will be held on February 11th and 12th..

-

UP Police Recruitment Result: UP Police Computer Operator Final Result released, Download Merit List and Cutoff from here..

-

RBSE 12th Exam Date 2026: Shift changes for three Rajasthan 12th board exam papers, check the revised date sheet..

-

UP Board Admit Card 2026: Admit cards for the board exams may be available anytime soon; students will be able to obtain them from their schools..