New Delhi: The filing and submitting of Income Tax Returns (ITR) will become extremely easy from next year. According to the reports from 2027 the ITR will be pre-filled and if you feel that it has been filled correctly according to your income and expenses you just need to click and submit it. However if you are not satisfied with the pre-filled form you can make changes as per your requirements. It is important to note that the new income tax law will come into force from April this year and this arrangement is being made under it. The new law is likely to be officially notified next month in March. At present the department has released a draft of the proposed new law to seek public consultation. Here are some of the key details: In the ITRs to be filed in 2027 it will be mandatory to disclose information about crypto holdings. From the upcoming financial year the Income Tax Department will obtain complete information from crypto exchanges about people purchasing crypto Those holding crypto will have to declare it in their ITR. Several changes are being made regarding the Permanent Account Number (PAN). PAN details are required when more than ₹50000 is deposited in cash in a bank in a single day. PAN will be required if more than ₹10 lakh is deposited in cash in a financial year. According to the reports bank accounts are already linked to PAN hence the amount deposited is reflected in the Annual Information Statement (AIS). PAN will be mandatory only for purchasing a car costing more than Rs 5 lakh. At present PAN is required for buying a car of any price. Importance of PAN Card: PAN will be required for purchasing property worth more than Rs 20 lakh Currently this limit is Rs 10 lakh. PAN will also be mandatory if a hotel banquet or restaurant bill exceeds Rs 1 lakh. In cases of claiming HRA along with Delhi Kolkata Mumbai and Chennai cities like Hyderabad Bengaluru Pune and Ahmedabad are also being included in the metropolitan city category Which vehicles get income tax exemption on motor allowance? For vehicles up to 1600 cc a motor allowance of Rs 8000 per month For vehicles with higher capacity up to Rs 10000 per month will be kept outside the purview of income tax. As per the department unnecessary information will not be sought under the new law. According to the Income Tax Department 1.1 crore updated and revised returns have been filed in the current financial year. These individuals had underreported their income but could not escape the department’s scrutiny.

-

Domestic MFs double their holdings in new-age startups over a year

-

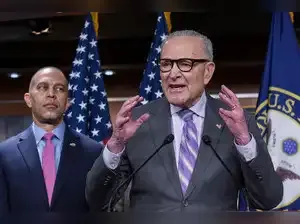

Democrats and White House trade offers as shutdown of Homeland Security looms

-

Domestic MFs double their holdings in new-age startups in a year

-

Viral Video: Couple Who Invited Bad Bunny To Their Wedding End Up Getting Married During His Super Bowl Halftime Show

-

After SLC, Emirates Cricket Board Steps In, Urges Pakistan To Play India In T20 World Cup 2026