Inside Peak XV’s Uneasy State

Inside Peak XV’s Uneasy State

Peak XV Partners can’t seem to keep its top partners around. Earlier this month, the VC major saw three senior-level exits amid simmering tensions over power concentration, carry, and legacy inside the firm. So, why is Peak XV suddenly facing a succession test?

A Pattern Of Exits: What looks like a sudden departure seems to have been building for close to two years now. At least eight partners have left Peak XV in the last 12-18 months, alongside 50 employees across incubator Surge, as well as marketing, product and advisory roles.

The Faultlines: At the heart of the departures lies the classic struggle over influence and economics. Insiders describe decision-making at Peak XV as highly centralised, with the old guard maintaining a tight grip on all strategic decisions, LP relationships and final calls on economics.

Many outgoing executives also believe that their upside (carry allocation) was capped relative to the value they’d created, while future fund participation remained in the air despite hefty exits.

The Founder Anxiety: For many Peak XV-backed founders, the most unsettling part of the churn is the relationship risk. They are worried that departing partners, who often serve as key board members or advisors, will be replaced by less familiar faces.

A Billion-Dollar Litmus Test: All of this is unfolding as Peak XV is trying to raise a $1 Bn fund to pitch itself as a serious AI investor. Post-Sequoia, the firm has set up a US office, brought in a partner to lead AI bets in Western markets, and built a claimed portfolio of 80+ AI companies.

However, the loss of the partners may not sit well with LPs looking to back the upcoming fund. While the old guard still maintains the credibility to raise big bucks, here is why the recent top-level exits at Peak XV Partners matter.

From The Editor’s Desk Fractal’s IPO Day 1

Fractal’s IPO Day 1

- The SaaS unicorn’s public issue was subscribed just 9% on the first day, with investors bidding for 15.8 Lakh shares against 1.85 Cr on offer. The retail portion saw 35% subscription, while NIIs lapped up 7% of their quota.

- Fractal’s IPO comprises a fresh issue of shares worth ₹1,023.5 Cr and an offer for sale component of ₹1,810 Cr. The company has set a price band of ₹857 to ₹900 per share, pegging the company at ₹15,480 Cr.

- Founded in 2000, Fractal offers AI-powered analytics tools to enterprises. The startup clocked an operating revenue of ₹1,559 Cr in H1 FY26, up 20% YoY, while profits dipped nearly 3% YoY to ₹70.9 Cr.

- The biotech startup has raised nearly ₹163 Cr in its Series B round led by Protons Corporate to shore up its product portfolio, scale up manufacturing and enter new geographies. With this, Pandorum has bagged $32 Mn to date.

- Founded in 2011, Pandorum engineers functional human tissues to restore damaged organs without donor dependency. It also develops tissue models for drug testing and disease research,

- The fundraise comes amid a broader push for the biotech sector. While the government has rolled out sops and incentives to create a $300 Bn bioeconomy by 2030, the sector is marred by long gestation periods and clinical milestones.

- The NBFC’s public issue was subscribed 12% as investors bid for 54.46 Lakh shares against 4.55 Cr on offer. Retail backers dominated the first day, with a 26% subscription, followed by QIBs at 13%.

- The lending company’s public issue comprises a fresh issue of shares worth ₹710 Cr and an OFS component of up to ₹300 Cr. At the upper end of its ₹124 to ₹129 price band, the IPO values the NBFC at about ₹3,183 Cr.

- Founded in 2014, Aye Finance offers small-ticket business loans to MSMEs by leveraging AI for underwriting. On the financial front, the NBFC reported a 21.8% YoY jump in top line to ₹843.5 Cr in H1 FY26, but profit tanked 40% YoY to ₹64.6 Cr.

- The erstwhile gaming giant’s parent reported a net loss of ₹478.9 Cr in FY25 compared to a profit of ₹1,295.3 Cr in the year-ago fiscal, hammered by an exceptional tax of ₹503.7 Cr due to its March 2025 reverse flip to India.

- Operating revenue fell 14.8% YoY to ₹6,759.3 Cr in FY25, while total expenditure rose 8.5% YoY to ₹7,122.6 Cr during the fiscal year under review.

- Dream11 was thrown into uncharted waters last year after the Centre prohibited real money gaming. Post-ban, Dream11 has pivoted to creator-led watch-along experiences, sports travel and live events to retain engagement.

Gujarat Taps Into Starlink

Gujarat Taps Into Starlink

- The state government has signed a letter of intent with the Elon Musk-led satcom operator to deliver high-speed satellite internet to remote, border, tribal and underserved areas.

- A joint working group of Gujarat officials and Starlink will oversee execution. This comes months after the Maharashtra government signed a similar agreement with the company in November 2025.

- Starlink received IN-SPACe clearance in July 2025 for commercial LEO operations, followed by another key regulatory nod from the telecom department. The company has planned 20 earth stations/gateways across Noida, Chennai and Navi Mumbai.

India’s credit boom is flooding households with loans, but it’s also bringing to the fore the cracks in the collections system. Traditional players rely on opaque and manual processes, leaving lenders exposed to defaults and reputational risk. DPDzero is building the tech stack to make recoveries transparent and efficient.

The Collections Stack: Founded in 2022, DPDzero (named for “zero days past due”) offers a plug-and-play collections platform for lenders, which absorbs operational complexity while delivering ethical outcomes. DPDzero blends AI borrower profiling with human advisors trained to educate rather than intimidate. The company claims 22% NPA reduction and up to 30% lower recovery costs for late-stage delinquencies.

Growing Client Traction: Backed by Better Capital and Blume Ventures, DPDzero claims to serve 30+ lenders, including RBL Bank, IndusInd, L&T Finance and Tata Capital. It claims to manage over ₹2,000 Cr monthly portfolios across 22 Lakh borrowers, with revenue tripling in the past year.

Going forward, DPDzero is looking to scale its AI voice agents and shore on-field presence. So, can DPDzero become the default collections layer for India’s lenders?

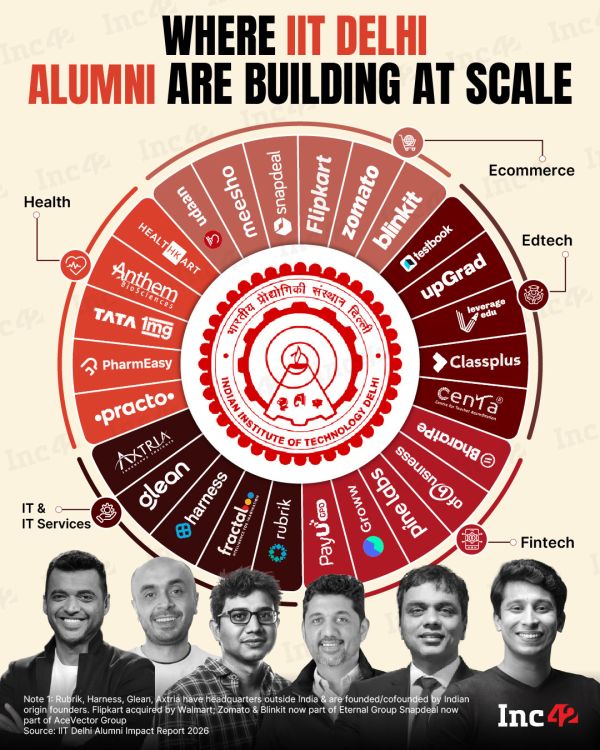

From fintech and ecommerce to edtech and healthtech, IIT Delhi is creating category leaders and global-scale companies. Here’s how the campus is shaping the Indian startup ecosystem’s story.

The post The Peak XV Churn, Fractal’s IPO Day 1 & More appeared first on Inc42 Media.

-

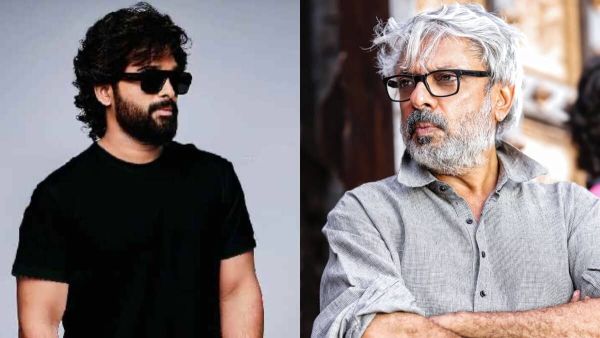

Is Allu Arjun’s big Bollywood debut with Bhansali still possible?

-

T20 World Cup 2026 Points Table Update: Group A, B, C And D Standings

-

Netflix Agrees To Rename ‘Ghooskhor Pandit’ After Matter Reaches Delhi High Court

-

Indian-origin Tesla VP Raj Jegannathan quits after 13 years

-

MIDASX Records Best Quarter Since Inception, 30% YoY Growth; SaaS Vertical Turns Cash-Flow Positive