Kolkata|New Delhi: India’s consumption story is picking up pace, with both auto sales and demand or volumes for daily use consumer goods showing clear signs of recovery after months of muted growth following the goods and services tax (GST) rationalisation at September-end. Some companies are even seeing the rural-urban demand gap narrowing to half of last year’s level, reflecting a secular revival trend.

The pickup indicates India’s demand across categories may be turning a corner, helped by policy easing, improved rural liquidity, wedding season purchases and greater freight activity, marking a gradual return of demand across both essential and discretionary categories.

Vehicle registrations, a proxy for demand, expanded 17.6% to 2.72 million units last month from a year ago. After a slow start due to initial trade disruption amid GST rate cuts, fast moving consumer goods (FMCG) makers said they have started to see revival in volumes after products with lower price-tags reached retail shelves in December.

The existing regulations, which allow small car manufacturers higher emissions through a lower fuel-efficiency mandate, may be dropped.

This has led to intense lobbying by aggrieved small car makers that want the support to continue, said people familiar with the developments.

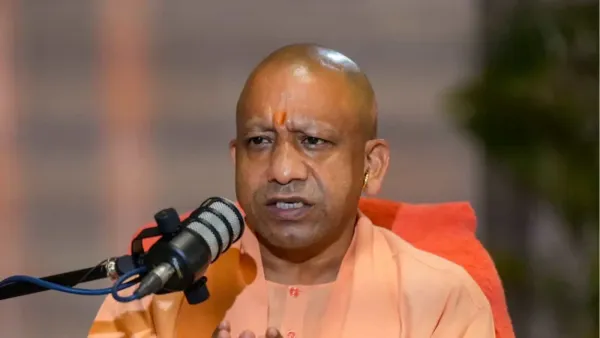

On Tuesday, domestic automobile majors held a meeting with the ministry of heavy industries, where Union Minister HD Kumaraswamy attempted to allay concerns.

“A final notification of CAFE norms is likely by February-end,” an industry representative who attended Tuesday’s meeting told ET.

It is not immediately clear if the concerns of small-car makers will be addressed in the new draft.

Kumaraswamy is said to have assured automobile companies that the new CAFE norms would not offer any undue favours or penalties. Representatives from Tata, Hyundai, Suzuki, Mahindra, Honda, Kia, BMW, Mercedes, Toyota, JSW-MG, Renault, Nissan, and Skoda-VW, along with the Society of Indian Automobile Manufacturers (SIAM), were present at the meeting. Officials from the Bureau of Energy Efficiency were also in attendance.

“There were heated discussions between automobile companies during the meeting,” multiple players present said, noting that government representatives had to step in to defuse the commotion regarding whether to extend the concessions on small cars or not. Intense lobbying is underway within the domestic automobile industry, which has largely divided itself along the lines of big versus small-car manufacturers.

Already, leading carmakers like Maruti Suzuki and Tata Motors are at odds over the proposed weight-based concessions for small cars in the third iteration of CAFE norms, which are set to come into force next year.

While Maruti Suzuki has urged the government to relax emission norms for small cars — which are more fuel-efficient compared to larger vehicles and are important for increasing motorisation levels among entry-level consumers — others like Tata Motors have held that there is “absolutely no justification” for giving concessions to any category of cars in the upcoming norms.

The pickup indicates India’s demand across categories may be turning a corner, helped by policy easing, improved rural liquidity, wedding season purchases and greater freight activity, marking a gradual return of demand across both essential and discretionary categories.

Vehicle registrations, a proxy for demand, expanded 17.6% to 2.72 million units last month from a year ago. After a slow start due to initial trade disruption amid GST rate cuts, fast moving consumer goods (FMCG) makers said they have started to see revival in volumes after products with lower price-tags reached retail shelves in December.

Fresh draft fuel efficiency norms expected

India is likely to propose a new draft of the Corporate Average Fuel Efficiency (CAFE) norms, followed by final rules later this month.The existing regulations, which allow small car manufacturers higher emissions through a lower fuel-efficiency mandate, may be dropped.

This has led to intense lobbying by aggrieved small car makers that want the support to continue, said people familiar with the developments.

On Tuesday, domestic automobile majors held a meeting with the ministry of heavy industries, where Union Minister HD Kumaraswamy attempted to allay concerns.

“A final notification of CAFE norms is likely by February-end,” an industry representative who attended Tuesday’s meeting told ET.

It is not immediately clear if the concerns of small-car makers will be addressed in the new draft.

Kumaraswamy is said to have assured automobile companies that the new CAFE norms would not offer any undue favours or penalties. Representatives from Tata, Hyundai, Suzuki, Mahindra, Honda, Kia, BMW, Mercedes, Toyota, JSW-MG, Renault, Nissan, and Skoda-VW, along with the Society of Indian Automobile Manufacturers (SIAM), were present at the meeting. Officials from the Bureau of Energy Efficiency were also in attendance.

“There were heated discussions between automobile companies during the meeting,” multiple players present said, noting that government representatives had to step in to defuse the commotion regarding whether to extend the concessions on small cars or not. Intense lobbying is underway within the domestic automobile industry, which has largely divided itself along the lines of big versus small-car manufacturers.

Already, leading carmakers like Maruti Suzuki and Tata Motors are at odds over the proposed weight-based concessions for small cars in the third iteration of CAFE norms, which are set to come into force next year.

While Maruti Suzuki has urged the government to relax emission norms for small cars — which are more fuel-efficient compared to larger vehicles and are important for increasing motorisation levels among entry-level consumers — others like Tata Motors have held that there is “absolutely no justification” for giving concessions to any category of cars in the upcoming norms.