Listen to this article in summarized format

Loading...

×Agentic AI is impacting software services firms’ seat-based billing rates, and the launch of products such as Claude Cowork and OpenAI's Agent platform is expected to further exacerbate the scenario for these companies, experts told ET.

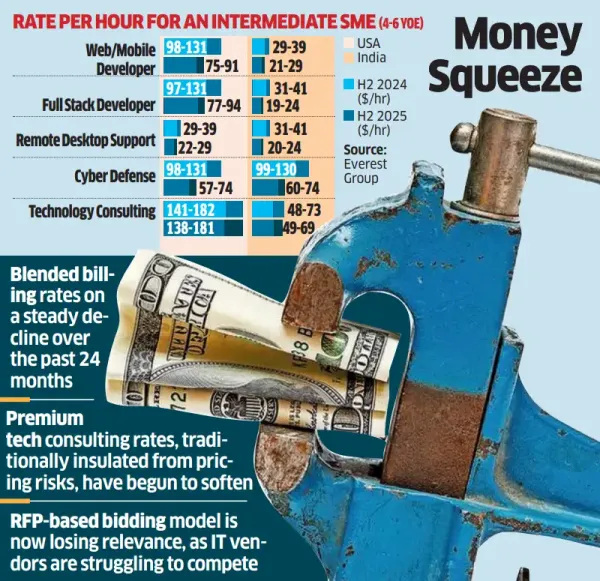

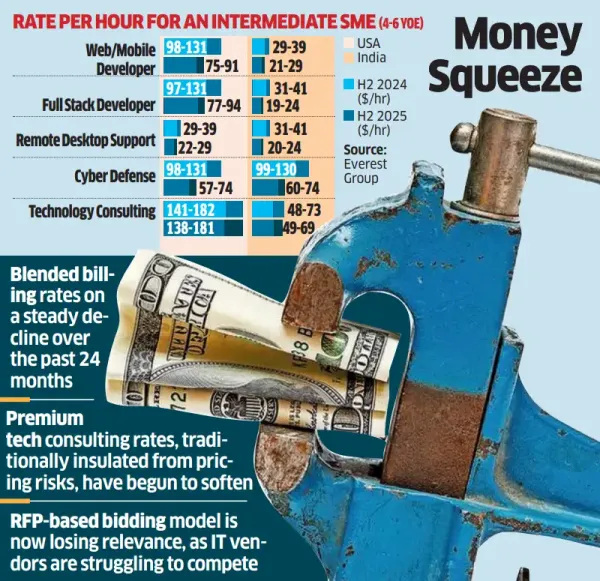

Blended billing rates across global IT services contracts have been on a steady decline over the past 24 months across the US and India for roles such as web and mobile developers, full-stack engineers, remote desktop support, and cyber defence professionals.

For instance, for intermediate-level engineers with 4-6 years of experience, US billing rates across core roles have fallen to $75-94 per hour in H2 2025 from $97-131 in H2 2024, while India rates have dropped to $19-29 per hour from $29-41, according to Everest Group.

Even premium technology consulting rates, traditionally insulated from pricing pressures, have begun to soften, with US billing ranges slipping to $138-181 per hour from $141-182 during the same period.

Clients are increasingly seeking massive productivity-linked discounts, which must be re-invested to either expand the scope of the project or build new AI use cases, analysts said. This has translated into a sharp compression in the total contract value (TCV) of a typical five-year deal, which shrank by 20%-35% in 2025 and is expected to decline even further, by 32%-44% this year, data showed.

Industry tracker firms HfS Research and Everest also agreed that the RFP-based bidding model is now losing relevance, as IT vendors are struggling to compete in a race to the bottom.

“You will see the rates have a modest decline, but the bigger issue is how for like for like scope the TCV is declining,” said Jimit Arora, chief executive, Everest Group. “It is 30-70% productivity on baseline fees which tend to not be rate card based, but managed services constructs,” he said.

The bigger change ahead is not just lower rates, but fewer billable hours per unit of work as AI reduces effort before prices fully reset, explained Phil Fersht, chief executive, HfS Research.

“In the near term, this is negative for revenue growth because effort-based volume no longer scales the way it once did,” he said. “The impact on margins is more nuanced. Firms that simply absorb AI into delivery without changing pricing will see margin pressure. Those that redesign delivery models, structurally reduce effort, and shift toward outcome-linked or productized services can protect, and in some cases expand, margins.”

As clients seek reduction in total tech or outsourcing spending, neither traditional fixed-price contracts nor simple time-and-material rate cuts are suited for uncertainty of the AI era, said Pareekh Jain, founder and chief executive of IT research firm EIIR Trend. He suggested that usage or subscription-based models could be a viable solution.

HfS’ Fersht agreed that the real adjustment is a business model shift, “where services are designed, delivered, and monetised as ongoing, AI-enabled capabilities rather than people-intensive projects.”

Blended billing rates across global IT services contracts have been on a steady decline over the past 24 months across the US and India for roles such as web and mobile developers, full-stack engineers, remote desktop support, and cyber defence professionals.

For instance, for intermediate-level engineers with 4-6 years of experience, US billing rates across core roles have fallen to $75-94 per hour in H2 2025 from $97-131 in H2 2024, while India rates have dropped to $19-29 per hour from $29-41, according to Everest Group.

Even premium technology consulting rates, traditionally insulated from pricing pressures, have begun to soften, with US billing ranges slipping to $138-181 per hour from $141-182 during the same period.

Clients are increasingly seeking massive productivity-linked discounts, which must be re-invested to either expand the scope of the project or build new AI use cases, analysts said. This has translated into a sharp compression in the total contract value (TCV) of a typical five-year deal, which shrank by 20%-35% in 2025 and is expected to decline even further, by 32%-44% this year, data showed.

Industry tracker firms HfS Research and Everest also agreed that the RFP-based bidding model is now losing relevance, as IT vendors are struggling to compete in a race to the bottom.

“You will see the rates have a modest decline, but the bigger issue is how for like for like scope the TCV is declining,” said Jimit Arora, chief executive, Everest Group. “It is 30-70% productivity on baseline fees which tend to not be rate card based, but managed services constructs,” he said.

The bigger change ahead is not just lower rates, but fewer billable hours per unit of work as AI reduces effort before prices fully reset, explained Phil Fersht, chief executive, HfS Research.

“In the near term, this is negative for revenue growth because effort-based volume no longer scales the way it once did,” he said. “The impact on margins is more nuanced. Firms that simply absorb AI into delivery without changing pricing will see margin pressure. Those that redesign delivery models, structurally reduce effort, and shift toward outcome-linked or productized services can protect, and in some cases expand, margins.”

As clients seek reduction in total tech or outsourcing spending, neither traditional fixed-price contracts nor simple time-and-material rate cuts are suited for uncertainty of the AI era, said Pareekh Jain, founder and chief executive of IT research firm EIIR Trend. He suggested that usage or subscription-based models could be a viable solution.

HfS’ Fersht agreed that the real adjustment is a business model shift, “where services are designed, delivered, and monetised as ongoing, AI-enabled capabilities rather than people-intensive projects.”

Subscription

Subscription