Over the past year, the company has launched products and software aimed at the fast-growing AI data center market.

- Cisco reports fiscal Q2 results after the markets close on Wednesday.

- The networking company’s revenue is expected to rise 8%, while profit could increase 9%.

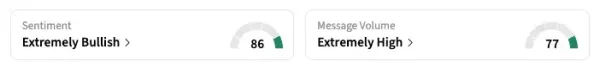

- Stocktwits sentiment has consistently advanced over the past month to ‘extremely bullish’ as of early Wednesday.

Shares of Cisco Systems Inc. have surged in recent weeks, propelling the stock to a record high and lifting retail optimism as the networking giant heads into its fiscal second-quarter report on Wednesday.

Cisco shares have advanced over 17% from their recent low on Jan. 20. On Stocktwits, retail sentiment for CSCO has climbed steadily over the past month to ‘extremely bullish’ as of the last reading.

“$CSCO Cisco always beats earnings. Great AI play without the volatility while getting paid a dividend,” said a user.

Cisco’s AI Pivot Gains Traction

Over the past year, the company has rolled out a series of products and software targeting AI data centers, a fast-growing segment of the market.

The efforts span hardware (chips), software (AgenticOps, IQ, AI agents), and ecosystem partnerships, indicating a shift from traditional networking toward full-stack, AI-ready infrastructure and operational tooling.

Just a day earlier, Cisco unveiled a new chip-and-router system for AI data centers, designed to compete with similar systems from Broadcom and Nvidia.

Q2 Earnings Expectations

Analysts expect Cisco’s fiscal second-quarter revenue to rise by over 8% to $15.1 billion, its best pace in the last three quarters, and adjusted profit to rise 9% to $1.02 per share, according to Koyfin.

Earlier this week, JPMorgan raised its price target to $95 from $90, while keeping an ‘Overweight’ rating. Evercore upgraded the stock to ‘Outperform’ from ‘In Line’ last week, and raised the price target twice - to $170 - over the last 30 days.

Currently, 17 of 26 analysts rate the stock ‘Buy’ or higher, with an average price target of $87.19, per Koyfin. That’s less than $1 higher than the stock’s last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

T20 World Cup 2026: South Africa vs Afghanistan ends in Double Super over drama, Here’s how the rules work

-

Shreyas Talpade lands in legal trouble as Bhogaon police book him under…

-

Support pours in for 'Mohammed Deepak' as his Kotdwar gym sees membership slump

-

High Return Scam: Thane Man Loses Rs 1.17 Crore in Facebook and TikTok Investment Fraud, Four Booked

-

French media react as Ethan Nwaneri blow confirmed after private Mikel Arteta chat