Yorkshire Building Society has launched a new savings account offering 4.05% interest. The lender announced its Four Access eSaver on Thursday (February 12), hailing it as offering customers a "simple, flexible way" to grow their money over the year.

The account's 4.05% variable interest rate lets savers withdraw their money on any four days within the year. Yorkshire Building Society said this would help account holders keep on track with future financial goals while remaining ready for any unexpected costs. Tina Hughes, Director of Savings, said: "We know many people are focused on creating financial stability for their future and this account supports those reallife goals in a simple, flexible way."

The building society's Four Access eSaver can be opened online with as little as £1 and customers can save up to £500,000.

The account pays interest a year after its opening date and is aimed at people who want to grow their savings but don't want to lock their money away for a long time.

Available to UK residents aged 16 and over, the account can be managed online or via the Yorkshire Building Society mobile app.

Yorkshire Building Society said this will give customers a "convenient and accessible way" to stay on top of their savings.

The building society believes households navigating an uncertain financial landscape are looking for products which support resilience and their goals without limiting access.

Ensure our latest personal finance headlines always appear at the top of your Google Search by making us a Preferred Source. Click here to activate or add us as Preferred Source in your Google search settings.

Ms Hughes said: "Our Four Access eSaver is designed to help customers stay confident and motivated as they work towards their financial goals, whether that's building a safety net, planning for a future purchase, or saving for something important in their lives.

"It provides the ideal balance: a competitive rate, the flexibility to make withdrawals on four days within the year, and the convenience of online access."

Caitlyn Eastell, Personal Finance Analyst at Moneyfactscompare.co.uk, said with inflation still above target, many savers may find their cash struggling to keep pace and finding it harder to build real financial stability.

She added: "Yorkshire Building Society's new Four Access eSaver offers an inflation-busting rate and can offer around £160 more a year than the average easy access rate.

"This account may be an attractive option for savers who can plan ahead and don't expect to dip into their savings frequently.

"However, the rate is variable, which means it can fluctuate and as savings rates are expected to fade this year, it's crucial that savers stay vigilant and are prepared to switch if their money is no longer working hard enough."

The £160 figure is based on a £10,000 investment over one year. The current average easy access rate is 2.42%. After 12 months, the Four Access eSaver matures into an Easy Access Online Saver. CPI inflation rose by 3.4% in the 12 months to December 2025, according to the Office for National Statistics.

-

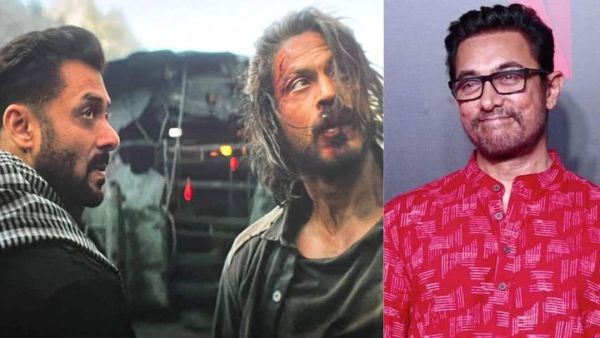

Aamir Khan Says Ranbir, Ranveer, Vicky Can ‘Give Us A Run For Our Money’ After Pathaan Scene

-

Tu Yaa Main Review: Adarsh Gourav, Shanaya Kapoor Shine In A Stretched-Out Adaptation That Never Fully Grips

-

IND VS NAM T20 WC 2026: Ishan Kishan Fires Warning To Pakistan, Slams 24-Ball 61 In Delhi

-

Sanju Samson Eyes Redemption As India Face Namibia During ICC T20 WC26 At Arun Jaitley Stadium In Delhi

-

AI Has Led To Industrialisation Of Cybercrime, Says Indian Cybercrime Coordination Centre CEO Rajesh Kumar