A woman from Mumbai fell victim to an e-SIM scam, losing ₹1.1 million in a matter of minutes. The perpetrators, impersonating employees of a telecom company, enticed her with an offer for a SIM upgrade. They managed to acquire her OTP and activated her number on their device using the e-SIM technology. This led to the transfer of banking OTPs to the fraudsters, allowing them to withdraw funds from her account.

This incident highlights a new fraudulent technique: the victim first lost her network connection, followed by the unauthorized withdrawal of ₹1.1 million from her bank account.

Understanding the Fraud Scheme

The method employed by the fraudsters is known as SIM swapping or e-SIM fraud. Initially, they contact the victim, posing as customer service representatives from major telecom providers like Jio, Airtel, or Vodafone. They create a sense of urgency by claiming that the old SIM is about to expire or that an upgrade to an e-SIM is necessary for enhanced 5G connectivity. Once the victim agrees, they send a QR code via email or request the victim to click on a dubious link. This action deactivates the physical SIM, transferring the number to the fraudster's device as an e-SIM.

With this access, the fraudsters can intercept all banking OTPs, UPI PINs, and credit card details. By the time the victim realizes there is a network issue, their account may already be drained.

Protective Measures

To safeguard against such scams, avoid using links or QR codes provided by unknown callers for e-SIM activation. Always utilize the official app or visit the store of your telecom provider.

Do not share OTPs: Never disclose OTPs over the phone under the pretext of a SIM upgrade or KYC verification. Remember, legitimate telecom companies will never request OTPs via phone calls. Be cautious if you receive such communications.

Enable SIM Change Alerts: Ensure that your bank has activated the SIM Change Alert service, which will notify you of any changes to your SIM status.

Avoid suspicious QR codes: Scanning QR codes from unknown emails or messages can compromise your account security.

Steps to Take if Scammed

If you notice a sudden loss of mobile signal and suspect foul play, take immediate action. First, contact your telecom provider from another phone to block your SIM. Next, reach out to the National Cyber Crime Helpline at 1930. Additionally, file a complaint at www.cybercrime.gov.in.

-

Khyber Pakhtunkhwa CM condemns alleged mistreatment of Imran Khan

-

Italy Clinch Maiden T20 World Cup Win, Thrash Nepal By 10 Wickets

-

BIG blow for Team India, BCCI provides major update on Abhishek Sharma, he will be…

-

Legendary Harold and Maude star Bud Cort passes away at 77

-

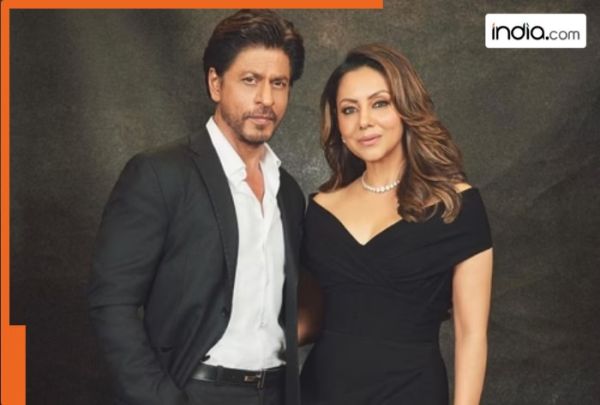

Inside Shah Rukh Khan’s wife Gauri Khan’s Dalhousie estate, where one night costs Rs…, once belonged to…