Investors in the National Pension System (NPS) often assume that they can withdraw their entire savings whenever they need funds. However, the reality is different. The withdrawal process under the National Pension System is governed by structured rules, especially at retirement or in case of premature exit.

As per the updated 2026 guidelines, the conditions for full withdrawal depend largely on the total pension corpus accumulated by the subscriber. Understanding these rules is crucial for anyone investing in NPS to avoid surprises at the time of retirement.

Here’s a detailed breakdown of the revised withdrawal norms.

Full Withdrawal at Retirement: Corpus Limit Matters

Under the new rules, subscribers reaching the age of 60 can withdraw 100% of their NPS corpus only if the total accumulated amount is up to ₹8 lakh. In this case, the entire sum can be withdrawn tax-free.

However, if the corpus exceeds ₹8 lakh, the rules change significantly:

-

A minimum of 40% of the total corpus must be used to purchase an annuity.

-

The remaining 60% can be withdrawn as a lump sum.

-

The lump sum portion is generally tax-free as per prevailing tax norms.

This means that investors with higher savings cannot take out the entire amount in cash and must allocate a portion toward regular pension income through an annuity plan.

What Is an Annuity and Why Is It Mandatory?

An annuity is a financial product that provides fixed periodic income after retirement. By mandating annuity purchase for larger corpuses, regulators aim to ensure a steady income stream for retirees rather than allowing complete withdrawal, which could lead to financial insecurity later.

The requirement ensures that NPS fulfills its primary objective — providing long-term retirement income security.

Rules for Premature Exit Before Age 60

If an investor decides to exit NPS before reaching 60 years of age, stricter conditions apply.

In such cases:

-

Only up to 20% of the corpus can be withdrawn as a lump sum.

-

At least 80% must be used to buy an annuity.

This rule discourages early withdrawals and promotes disciplined retirement planning.

However, if the total corpus at premature exit is within the prescribed lower limit (as notified by authorities), full withdrawal may be permitted. Investors should always verify updated thresholds before making a decision.

Withdrawal in Case of Subscriber’s Death

In the unfortunate event of the subscriber’s death, the nominee or legal heir is generally allowed to withdraw the entire accumulated corpus.

This provision ensures financial protection for the family and offers flexibility in managing the funds as per their needs.

Why Understanding NPS Withdrawal Rules Is Important

Many investors contribute to NPS for tax benefits and long-term savings but overlook exit conditions. Lack of awareness may lead to unrealistic expectations regarding liquidity.

Before investing, individuals should consider:

-

Their retirement goals

-

Expected corpus size

-

Income requirements after retirement

-

Annuity options available

Financial planners often recommend aligning NPS investments with broader retirement strategies to balance growth, tax efficiency, and post-retirement income.

-

Karnataka Government Approves IPL Matches at M Chinnaswamy Stadium

-

Maha Shivratri vrat recipes: Dietitian shares simple, sattvic and nourishing dishes

-

What Makes VBAC Riskier for Some Women Than Others?

-

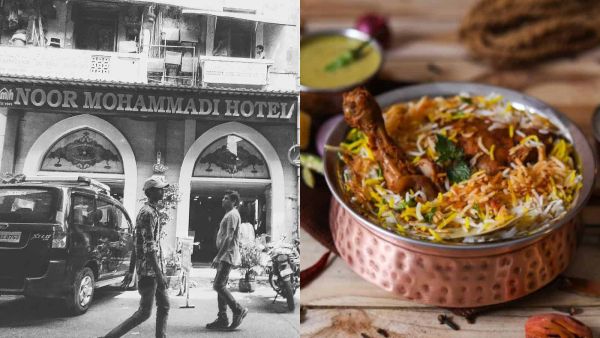

5 Oldest and iconic places to eat Hyderabadi Biryani in Mumbai

-

Tamannaah Bhatia, Junaid Khan to star in horror film‘Ragini 3’