New Delhi [India] Feb 13 (ANI): With the base year of CPI now shifted to 2023-24 headline inflation saw a sharp sequential print on month on month (mom) basis even as we believe that there won’t be any major change in monetary policy outlook based on this. “With CPI series revision India saw January 2026 headline CPI come in at 2.75 percent as expected. Core CPI meanwhile eased to 3.46 per cent comforting the bulls. We believe MPC will continue to maintain status quo on rates for upcoming quarters” Union Bank of India report said. According to the revised base year of 2023-24 headline inflation in January came in at 2.75 per cent as compared to 1.33 percent printed in December 2026 on base of 2011-12. However analysts expect that base revision will not have any significant impact on near-term policy read. Core CPI softening to 3.46 percent from earlier print of 4.73 percent under old series was mainly due to lower weightage of gold which came down to 0.62 percent from 1.1 percent previously. Excluding gold from core inflation basket it increased marginally to 2.91 percent. On the other hand food inflation resumed to positive zone of 2.11 percent. With revision of CPI series weightage of food has come down to around 40 per cent from the previous close to 46 per cent earlier. Higher frequency prints will be more important as month-on-month (mom) breaks will be available only from January 2025 as State-level data under new series will take time to come. “Points to note that new CPI series covers more markets towns goods and services compared to earlier” the report added. “In absence of detailed breakout of data under new series at sub-group level MPC will watch the inflation momentum closely rather than just seeing YoY number” it further added. Echoing similar views the bank further said that MPC is likely to maintain its current stance for coming quarters as clearly communicated by RBI Governor in the last policy meeting of February 2026. Focus on liquidity management will continue to be the key driver of policy action it concluded. (ANI) (This copy has been written with the inputs by ANI)

-

Valentine Special: Are you also afraid of anti-valentine groups? Don’t panic, adopt these methods silently

-

Wear these beautiful colors on Valentine’s Day

-

Big action of Crime Branch against drugs in Bhopal, two accused arrested with about half a kilo of hashish.

-

The first solar eclipse of the year will take place soon, know the rules of Sutak period.

-

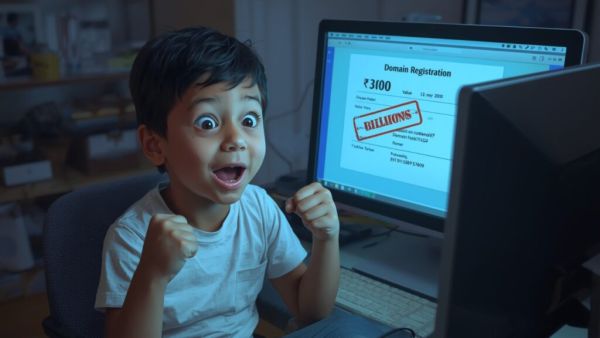

A deal worth Rs 300 turned into Rs 634 crore, a 10 year old child had bought such a domain, now becomes the owner of billions