The rupee depreciated 8 paise to 90.69 against the US dollar in early trade on Friday, pressured by the strengthening of the American currency and a negative trend in domestic equities.

Forex traders said a firm dollar limited the upside for emerging-market currencies including the rupee.

At the interbank foreign exchange market, the rupee opened at 90.69 against the US dollar, registering a fall of 8 paise over its previous close.

On Thursday, the rupee appreciated 17 paise to settle at 90.61 against the US dollar.

The American currency strengthened on reports that Russia may consider returning to the dollar settlement system as part of a potential economic understanding with the US.

"Such a move, if it materialises, would reinforce the dollar’s dominance in global trade, especially in energy and commodities," CR Forex Advisors MD Amit Pabari said in a note.

"A stronger dollar creates a chain reaction. Most commodities -- gold, silver, platinum, copper -- are priced in dollars globally. When the dollar rises, these metals become more expensive for buyers using other currencies," he said, adding "and as usual, the rupee feels the pressure too." Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.02 per cent higher at 96.94.

Brent crude, the global oil benchmark, was trading 0.16 per cent lower at USD 67.41 per barrel in futures trade.

On the domestic equity market front, Sensex declined 683.72 points to 82,991.20 in early trade, while the Nifty dropped 207.15 points to 25,600.05.

On Thursday, foreign institutional Investors purchased equities worth Rs 108.42 crore, according to exchange data.

Meanwhile, India on Thursday introduced a new series of its Consumer Price Index (CPI), the benchmark that tracks retail inflation, starting with January data at 2.75 per cent.

The new series covers a higher number of goods and services and re-aligns the weightage of various constituents. Along with data collected from more rural and urban markets, the reading is expected to reflect the quality of data used in formulating monetary and fiscal policies.

"If inflation is within target and stable, the Reserve Bank of India has less urgency to cut rates aggressively. Fewer rate-cut expectations help support the rupee. So while the global environment leans dollar-positive, domestic fundamentals are providing some support," Pabari said.

(Disclaimer: This report has been published as part of the auto-generated syndicate wire feed. Apart from the headline, no editing has been done in the copy by ABP Live.)

-

Valentine Special: Are you also afraid of anti-valentine groups? Don’t panic, adopt these methods silently

-

Wear these beautiful colors on Valentine’s Day

-

Big action of Crime Branch against drugs in Bhopal, two accused arrested with about half a kilo of hashish.

-

The first solar eclipse of the year will take place soon, know the rules of Sutak period.

-

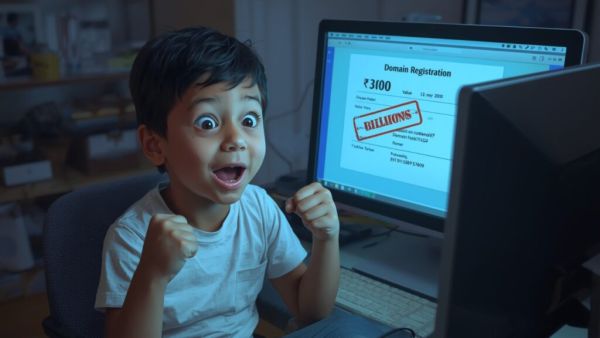

A deal worth Rs 300 turned into Rs 634 crore, a 10 year old child had bought such a domain, now becomes the owner of billions