SIP vs PPF: Investing has become increasingly important these days to secure your future. When it comes to long-term investment, most people think of two options: SIP (Systematic Investment Plan) and PPF (Public Provident Fund). Both are excellent investment instruments, but their financial goals, risks, and returns differ significantly. If you're considering investing your money and are unsure whether to invest in SIP or PPF, this article may be helpful. We're explaining the differences between the two in simple terms. Understanding this can help you choose the best option for you. Let's understand this in detail:

What is SIP, and how does it work?

A Systematic Investment Plan (SIP) is a method in which you invest a fixed amount each month in a mutual fund. You can start investing with small amounts, such as ₹500 or ₹1,000 per month.

SIP is market-linked. If the stock market performs well, SIPs can yield substantial returns. Although the value of investments may decline during market downturns, these fluctuations are balanced out over time.

A key advantage of SIPs is that funds invested can be easily withdrawn if needed. Furthermore, SIP options like ELSS also offer tax benefits under Section 80C of the Income Tax Act.

What is PPF, and why is it considered safe?

PPF, or Public Provident Fund, is a government-run savings scheme. It is considered ideal for those who want to invest without any risk.

PPF offers a government-fixed interest rate, which varies from time to time. The term of this scheme is 15 years, making it suitable for long-term goals such as retirement or children's education.

Money invested in PPF is completely safe, but it has low liquidity. Investors can only partially withdraw funds after seven years.

The biggest feature of PPF is its tax benefits. The amount invested, the interest earned, and the full amount received at maturity are all completely tax-free.

Key Differences Between SIP and PPF

The biggest difference between SIP and PPF is the risk and return. SIP carries a higher risk, but the potential for higher returns is also high. In contrast, PPF has almost no risk, but limited returns.

SIP has an edge in terms of flexibility. You can increase or decrease your investment amount and even stop investing if needed. PPF has a 15-year lock-in period.

In terms of liquidity, SIP allows for quick withdrawals, while PPF funds remain locked in for a longer period.

Which investment is right for you?

If you have a stable income, understand market fluctuations, and want higher returns over the long term, a SIP may be a better option for you. However, if you want a safe investment, guaranteed returns, and tax-free income, PPF may be right for you.

The most prudent approach is to invest in both. PPF will provide security, while SIP will provide growth. This way, you can balance risk and return.

Disclaimer: This content has been sourced and edited from NDTV India. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

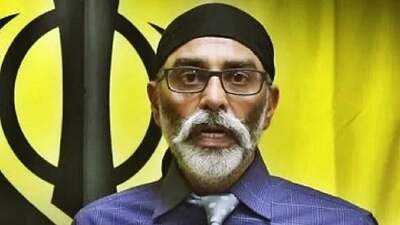

Fresh twist in 2023 plot against Pannun: Accused Nikhil Gupta pleads guilty

-

Mobile Blast Reasons: Why do mobile phones explode? Never make these 5 mistakes..

-

The beautiful little city that's Portugal's answer to Venice - 21C in April

-

GMC Rajouri hosts 'Antaradrishti-2026', its first-ever 2-day National Conference-cum-Workshop

-

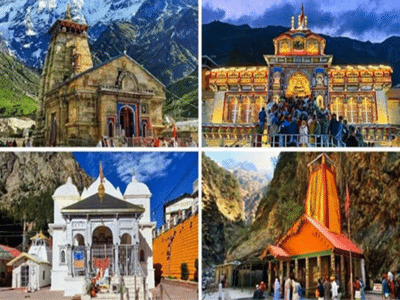

Char Dham Yatra 2026: When will the Char Dham Yatra begin? Find out when the doors will open and how to register..