Linking your Aadhaar with your PAN is no longer a routine formality—it has become a critical financial requirement. The Income Tax Department has once again cautioned taxpayers that failing to complete Aadhaar–PAN linking can quietly increase their tax burden and disrupt everyday banking and tax-related activities. If ignored, this small oversight can lead to higher tax deductions, delayed refunds, and an inoperative PAN card.

In today’s fully digital tax ecosystem, compliance gaps don’t just cause inconvenience—they directly impact your hard-earned income. Here’s everything you need to know, explained clearly, so you can avoid unnecessary losses.

Why Aadhaar–PAN Linking Is Mandatory NowUnder current tax regulations, every PAN must be linked with Aadhaar to remain valid. If the linking is not completed within the prescribed timeline, the PAN is marked inoperative. An inoperative PAN severely restricts your ability to manage finances efficiently.

Once your PAN becomes inactive:

-

You may not be able to file your Income Tax Return (ITR) smoothly

-

Processing of refunds can get delayed

-

Banks and financial institutions may deduct tax at higher rates

-

Certain high-value financial transactions may be blocked or questioned

In short, an unlinked PAN can create a chain reaction of financial hurdles.

How an Inoperative PAN Increases Your Tax BurdenThe biggest and most immediate impact is seen in TDS (Tax Deducted at Source). Normally, TDS is deducted at standard rates—often around 10% on interest income, professional fees, or certain payments.

However, if your PAN is inoperative:

-

TDS can jump to 20% or even higher

-

Your monthly cash flow gets affected instantly

-

Recovering excess tax later through refunds becomes time-consuming

For example, if your income usually attracts ₹10,000 as TDS, an inoperative PAN could push that deduction to ₹20,000. That’s double the amount deducted upfront, simply due to a missed compliance step.

It’s Not Just About Tax — It’s About Financial CredibilityMany taxpayers dismiss Aadhaar–PAN linking as a “technical detail.” Financial experts warn that this mindset can be costly. Beyond tax deductions, an inactive PAN can affect:

-

Bank account compliance checks

-

Loan and credit card approvals

-

Investment transactions in mutual funds or securities

In a system driven by data verification, mismatched or inactive credentials raise red flags across financial institutions.

How to Link Aadhaar and PAN EasilyThe good news? The process is simple and can be completed in minutes.

Online MethodYou can link Aadhaar and PAN through the official income tax e-filing portal by entering:

-

PAN number

-

Aadhaar number

-

Basic details for verification

If you prefer in-person assistance, PAN service centers also help complete the linking process.

Important TipBefore linking, ensure that your name, date of birth, and gender match exactly on both Aadhaar and PAN records. Even small discrepancies can cause the request to fail.

Expert Advice: Don’t Delay ComplianceTax and financial advisors consistently stress that Aadhaar–PAN linking should be treated as a priority, not an optional task. In a digitized tax framework, even minor lapses can snowball into long-term complications.

Completing the linking:

-

Protects you from higher TDS

-

Ensures timely tax refunds

-

Keeps your PAN fully operational

-

Safeguards your financial reputation

Aadhaar–PAN linking is no longer just paperwork—it’s a financial safeguard. A small delay can quietly drain your income through higher tax deductions and procedural roadblocks. By taking a few minutes to complete this step, you secure smoother tax filings, faster refunds, and peace of mind.

Remember, in the digital tax era, staying compliant is the easiest way to protect your money.

-

Anita Advani finally addresses struggles she faced after Rajesh Khanna’s demise, ‘The way I…’

-

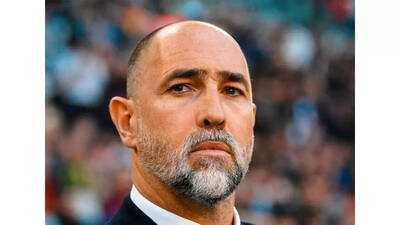

Why Tottenham appointed Igor Tudor as seven-manager battle for permanent job begins

-

Inter Kashi Holds FC Goa to a Draw in ISL Debut Match

-

Igor Tudor Appointed as New Head Coach of Tottenham Hotspur

-

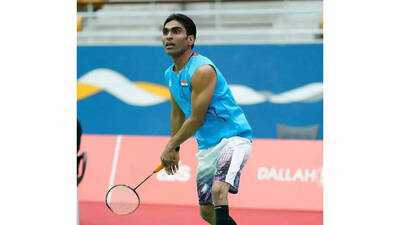

Pramod Bhagat Shines with Historic Double Gold at BWF Para Badminton Championships 2026