On Tuesday, Netflix's CEO stated that Paramount has created significant commotion, deliberately causing confusion among shareholders and making it difficult for them to grasp the details of the deal.

- Netflix has allowed Warner Bros & Discovery to reopen talks with Paramount for a limited seven days ‘waiver’ period under its merger agreement.

- Black said the current overhang on the stock presents investors with a potential asymmetrical return opportunity.

- Black said his price target for Netflix is $98 (+27% upside) based on 2030 EPS of $5.70.

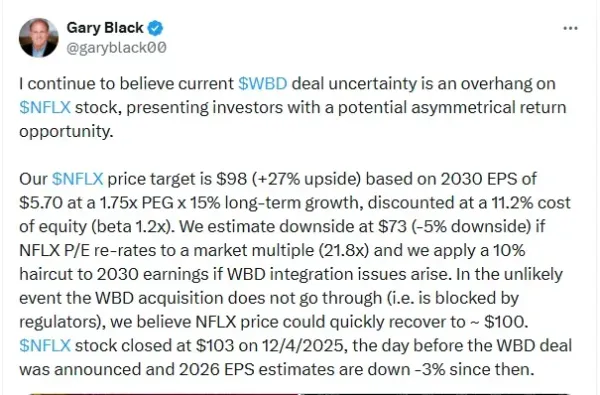

Gary Black on Tuesday in a social media post on X said that uncertainty over Warner bros deal is an overhang on Netflix’s (NFLX) stock.

Black said the current overhang on the stock presents investors with a potential asymmetrical return opportunity.

“Our $NFLX price target is $98 (+27% upside) based on 2030 EPS of $5.70 at a 1.75x PEG x 15% long-term growth,” Black said.

Uncertainty Over WBD Deal

Warner Bros & Discovery’s (WBD) deal with Netflix has been stretched ever since Paramount Skydance (PSKY) put forward an offer that values WBD higher than the Netflix agreement. However, WBD’s board has shown unanimous approval towards Netflix's offer.

However, a recent amended offer of $30 per share in cash from Paramount has forced Netflix to allow Warner Bros & Discovery to reopen talks with Paramount for a limited seven days 'waiver’ period under its merger agreement.

In response, Paramount Skydance on Tuesday urged Warner Bros. Discovery’s shareholders to vote in favor of its offer by tendering their shares.

Netflix’s CEO Response To 7-Days Waiver

“Paramount has been making a ton of noise, flooding the zone with confusion for sure, for shareholders so they don't really understand the deal, including floating all these hypothetical offers, talking directly to the shareholders and bypassing the Warner Brothers discovery board,” Netflix's Co-CEO Ted Sarandos said in an interview to CNBC on Tuesday.

He further added that Netflix has given the opportunity to allow the shareholders exactly what they deserve, which is complete clarity and certainty about what the value of these deals are. “What we're certain of is that the Netflix deal to acquire these assets is the best deal, generates the best value for their shareholders, and they think so too. That's why they recommend the deal,” he further added.

Despite the temporary reopening of talks, the Warner Bros. Discovery board said it continues to unanimously support the Netflix transaction.

How Did Stocktwits Users React?

Retail sentiment around NFLX trended in ‘neutral’ amid ‘normal’ message volume.

Shares in the company have fallen 27% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

-

Pastor, Four Firefighters Among Five Critically Injured In New York Church Explosion

-

DWP Cold Weather payments sent to households in 794 postcodes - full list

-

Stable Money Nets $25 Mn To Fuel Product Portfolio Expansion

-

M4 closed LIVE to traffic in all directions until beyond rush hour tomorrow

-

WhatsApp Introduces One-Tap High-Security Mode to Block Hackers and Cyber Attacks