Fredun Pharmaceuticals is currently trading at Rs. 837.75, up by 7.30 points or 0.88% from its previous closing of Rs. 830.45 on the BSE.

The scrip opened at Rs. 844.90 and has touched a high and low of Rs. 844.90 and Rs. 830.05 respectively. So far 2422 shares were traded on the counter.

The BSE group ‘X’ stock of face value Rs. 10 has touched a 52 week high of Rs. 904.00 on 30-Jul-2024 and a 52 week low of Rs. 635.00 on 16-Jan-2025.

Last one week high and low of the scrip stood at Rs. 844.90 and Rs. 796.00 respectively. The current market cap of the company is Rs. 395.68 crore.

The promoters holding in the company stood at 48.93%, while Institutions and Non-Institutions held 1.59% and 49.48% respectively.

Fredun Pharmaceuticals’ (FPL) wholly owned subsidiary — Fredun Retail (FRPL) has taken a significant step toward expanding its consumer-centric portfolio with the acquisition of a controlling interest in One Pet Stop.

This acquisition marks FPL’s formal entry into the organized pet care services market and aligns with its long-term vision of becoming a holistic healthcare provider across human and animal wellness domains.

With this acquisition, Fredun gains access to a loyal and recurring customer base of over 4,000 pet owners, reflecting One Pet Stop’s established brand equity and trust in the pet care space. One Pet Shop has built a consumer-first business model focused on personalized service, reliability, and convenience. Its user-friendly mobile app allows pet owners to book pet grooming services, track appointments, and receive timely healthcare reminders, thereby fostering long-term customer engagement.

The acquisition creates strong synergies with Fredun’s Freossi brand, which offers a premium range of pet grooming products. By combining One Pet Stop’s B2C service delivery model with Fredun’s manufacturing capabilities and pan-India distribution network, the Group is poised to expand aggressively across high-consumption zones, particularly within the MMRDA region and other major urban markets.

Bhupendra singh chundawat is a seasoned technology journalist with over 22 years of experience in the media industry. He specializes in covering the global technology landscape, with a deep focus on manufacturing trends and the geopolitical impact on tech companies. Currently serving as the Editor at Udaipur kiranhis insights are shaped by decades of hands-on reporting and editorial leadership in the fast-evolving world of technology.

-

ICRA Forecasts 2–3% Growth For Indian IT Sector In FY26, Outlook Stable

-

JSW Paints To Acquire Akzo Nobel India In Rs 13,000 Crore Deal Funded Via Promoter Equity, Debt, And PE

-

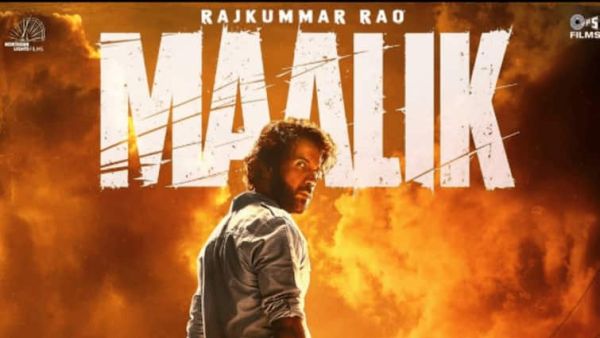

Rajkummar Rao Calls 'Maalik' A Chance To Break His Image, Plays Gangster In New Film

-

‘India Has Every Right To Defend Its People From Terrorism’: Jaishankar's Strong Message At Quad Meet

-

Bad news for Virat Kohli and RCB as CAT find this as main reason behind Chinnaswamy Stampede