JSW Paints, part of the JSW Group, has announced plans to fund its Rs 13,000 crore acquisition of Akzo Nobel India Ltd (ANIL) through a combination of promoter equity, debt financing, and private equity investments. The deal, which includes a Rs 8,986 crore purchase of the promoters' stake and a Rs 3,929 crore open offer, is expected to significantly boost JSW Paints’ position in the Indian decorative paint market.

Managing Director Parth Jindal shared details of the funding plan on Tuesday, stating that, “There is (fund) infusion by the family for equity, and there are private equities that are coming. So, roughly Rs 7,000 crore is being put in by the family between the debt at Paints level as well as the promoter infusion, and the rest is going to come in from private equity.”

"Otherwise, it will come as equity infusion by the family,” he added.

Targeting Market Leadership

Once the transaction is complete, JSW Paints anticipates the combined entity will achieve a turnover of Rs 6,000 crore initially and cross Rs 7,500 crore within three years. “We have to grow significantly to come into the number three player. We anticipate it would take a three-year period to come into the top three,” said Jindal.

He also noted that the deal will not leverage other JSW Group listed companies, clarifying, “No... I am assuming there will be a dilution of JSW Steel also in this transaction in the holding of JSW Paints.”

Strategic Partnership To Continue

Akzo Nobel CEO Greg Poux-Guillaume clarified that the company is not exiting India. “We see a lot of potential in that business, and it's a business in which Akzo Nobel is twice the size of the number two worldwide,” he said, referring to the powder coatings segment, which Akzo Nobel will retain along with its R&D center.

According to Guillaume, Akzo Nobel will maintain its role as a technology partner across coating categories. Under the agreement, JSW Paints will pay a 4.5% royalty on the industrial coatings business. “Before, it was the Indian entity (ANIL) paying to the parent company, and now it is JSW paying to the parent company,” he said.

Jindal also confirmed that the Dulux brand will continue under JSW Paints within India. “Now, ANIL has purchased the IP for the decorative business. So, now, after the transaction gets through, the 3.5 per cent royalty on decorative goes away. But the 4.5 per cent royalty on industrial continues as we continue to use their technology,” he explained.

Regulatory Approvals Awaited

JSW Paints expects all regulatory approvals—including from ANIL’s shareholders and the Competition Commission of India—by the end of this calendar year. “... if it happens earlier, the earlier the better, but you know we have to cross all those hurdles,” said Jindal.

Jindal also confirmed that proceeds from the recent stake sale in JSW Infrastructure by the Sajjan Jindal Family Trust would contribute to the funding. “Yes. It is part of the plan,” he added.

-

K Murali, an outstanding scientist, appointed Director of DLRL, Hyderabad

-

Cybersecurity Worries? Your MSP is Your First Line of Defense

-

Digital India has become people’s movements: FM NIRMALA Sitharaman | Technology news

-

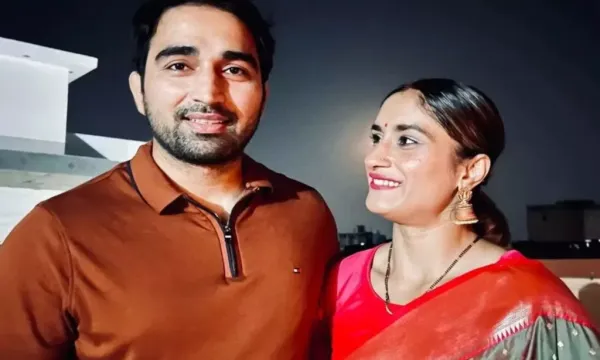

Vinesh Phogat gives birth to baby boy: Reports

-

Bumrah is available for Edgbaston Test, final call yet to be taken: Shubman Gill