New Delhi: According to Reserve Bank of India (RBI) statistics, the weighted average lending rate (WALR) for new rupee loans from scheduled commercial banks (SCBs) decreased from 9.26% in April to 9.20% in May 2025.

Additionally, according to RBI statistics, the weighted average lending rate on scheduled commercial banks’ outstanding rupee loans decreased slightly from 9.70 percent in April to 9.69 percent in May.

Scheduled commercial banks’ 1-year median Marginal Cost of Funds-based Lending Rate (MCLR) decreased from 8.95 percent in May to 8.90 percent in June.

External Benchmark-Based Lending Rate (EBLR)-linked loans accounted for 61.6 percent of all scheduled commercial banks’ outstanding floating-rate rupee loans at the end of March 2025 (60.6 percent at the end of December 2024), while MCLR-linked loans made up 34.9 percent (35.9 percent at the end of December 2024).

In contrast, scheduled commercial banks’ new rupee term deposit weighted average domestic term deposit rate (WADTDR) was 6.11 percent in May 2025 compared to 6.34 percent in April 2025.

Additionally, scheduled commercial banks’ weighted average domestic term deposit rate (WADTDR) on outstanding rupee term deposits fell from 7.10 percent in April 2025 to 7.07 percent in May 2025.

In an effort to pass down the advantages of the RBI monetary policy committee’s cumulative 100 basis point repo rate drop since early this year, some scheduled commercial banks have lowered the interest rates on their loans.

These actions are thought to be an attempt to make loans more affordable in India.

It makes sense that the RBI’s recent frontloaded repo rate drop was intended to stimulate the economy, which has slowed down somewhat. The economy will be revitalized by the policy rate decrease and the ensuing drop in bank interest rates, which will increase demand for new lending.

However, during the most recent monetary policy review meeting, RBI Governor Sanjay Malhotra said that there is little room for further rate decreases after a 100 basis point fall in repo rates since February 2025.

-

Two Dead, 43 Missing As Ferry Carrying 65 Sinks Near Indonesia's Bali, 20 rescued

-

Federal court blocks Trump's effort to deny asylum at border

-

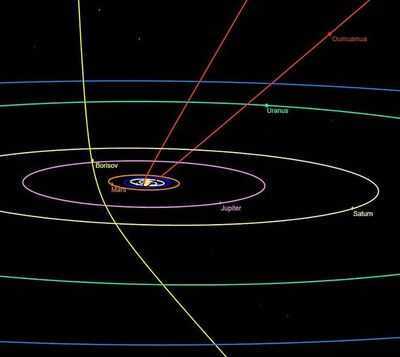

Mysterious object from 'another star system' is 'waking up' while heading towards Earth

-

Possible interstellar object spotted zooming through Solar System!

-

Royal Family: Meghan Markle's 'cruel' move 'has struck a nerve with Prince William'