The bank has cut rates by 35 basis points, which means that now people will get loans from HDFC Bank 0.30% cheaper. The bank had cut rates by 10 basis points in June and 15 basis points in May. In this way, the bank has cut rates by 60 basis points in 3 months.

Private sector HDFC Bank has announced a cut in MCLR. This cut by the bank will benefit the loan takers, because now they will have to pay less interest. The bank has cut rates by 35 basis points, which means that now people will get loans from HDFC Bank 0.30% cheaper. The bank had cut rates by 10 basis points in June and 15 basis points in May. In this way, the bank has cut 60 basis points in 3 months.

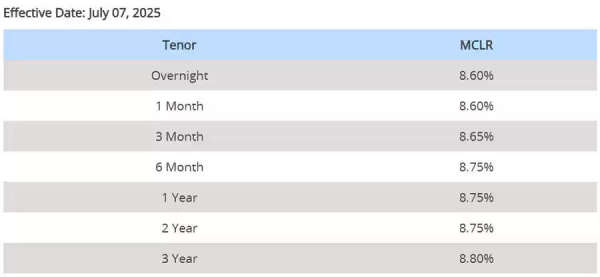

After this cut, the bank's MCLR range has now become 8.6 percent to 8.8 percent. This cut by HDFC Bank has come into effect from July 7, 2025. This cut by the bank has come after the Reserve Bank of India cut the repo rate by 50 basis points in June. Earlier in February and April also, RBI had cut 25-25 basis points. That is, till now the central bank has cut the repo rate by a total of 100 basis points i.e. 1 percent.

What is the new rates now?

After the cut, the bank's overnight and one-month MCLR has been cut by 30 basis points. Now it has come down from 8.9 percent to 8.6 percent. At the same time, the bank's 3-month MCLR has been reduced by 20 basis points, from 8.95 percent to 8.75 percent. Apart from this, 6-month MCLR has been reduced by 30 basis points, after which it has now come down from 9.05 percent to 8.75 percent.

If we talk about one-year MCLR, then it has also been reduced by 30 basis points, after which this rate has come down from 9.05 percent to 8.75 percent. If we talk about 2-year MCLR, then the maximum reduction of 35 basis points has been done in it and it has come down from 9.10 percent to 8.75 percent. With a reduction of 30 basis points in 3-year MCLR, it has been reduced from 9.10 percent to 8.80 percent.

What is MCLR?

MCLR is a rate fixed by the Reserve Bank of India which is used by commercial banks to determine the interest rate of loans. It has been implemented in India since demonetization. This has made it easier for customers to take loans. MCLR is the minimum rate below which no bank can give loans to customers. Actually, when you take a loan from a bank, the minimum rate of interest charged by the bank is called the base rate. Now banks are using MCLR in place of this base rate.

Why does the loan become expensive when MCLR increases?

MCLR is the minimum rate, so it is clear that banks cannot give loans to customers below its rate, that is, the more the MCLR increases, the higher the interest on the loan will also go up. In such a situation, interest rates on loans related to marginal cost such as home loan, vehicle loan etc. will increase. However, it is not that as soon as MCLR increases, your EMI will also increase from the next month. The point to note here is that when the MCLR rate increases, the interest rates on your loan do not increase immediately. The EMI of the loan takers proceeds only on the reset date.

What is the purpose of MCLR?

MCLR was implemented with the aim of improving the transmission of policy rates of banks' lending rates and making the interest rate determination process of all banks transparent. Loans like home loans have become cheaper since the implementation of MCLR. MCLR is calculated on the basis of Marginal Cost of Funds, Period Premium, Operating Expenses and the cost of maintaining Cash Reserves Ratio. Later, the loan is given on the basis of this calculation. It is cheaper than the base rate. It is mandatory for banks to declare their overnight, one month, three month, six month, one year and two year MCLR every month.

-

‘I am spiritual not…’: This actress finds peace in Hanuman Chalisa, keeps 9-day fast every years, her name is…

-

Good news for Jitendra Kumar’s Panchayat series, makers decide to…

-

Mukesh Ambani playing big role in making America great again, Trump will be happy because…, China is now…

-

Heavy Rain Predicted for Punjab, Himachal and J&K

-

Delhi-NCR wakes up to heavy rain, thunderstorm; orange alert issued