The Financial Action Task Force (FATF) has highlighted growing concerns over the use of online platforms, including e-commerce and digital payment services, in facilitating terror-related activities.

In its latest report titled 'Comprehensive Update on Terrorist Financing Risks,' the global terror watchdog cited key terror incidents in India, including the 2019 Pulwama attack and the 2022 Gorakhnath Temple incident, to emphasise the vulnerabilities in digital infrastructure being exploited for terror financing.

The FATF underscored that both e-commerce portals and online financial tools are increasingly manipulated to raise, move, and manage funds for terror operations. Among its findings, the report also noted the emergence of "state sponsorship" as a significant factor, citing open-source data and inputs that point out "certain terrorist organisations have been and continue to receive financial and other forms of support from several national governments".

"Delegations reported on this trend by referring to the use of state sponsorship for TF (terror financing) either as fundraising technique or as part of the financial management strategy of the certain organisations engaging in terrorist acts. Several forms of support have been reported, including direct financial support, logistical and material support, or the provision of training," the FATF said.

FATF Says Aluminium For IED Bought On E-Commerce Platform

The FATF had earlier, in June, condemned the April 2025 terror attack in Pahalgam, Jammu and Kashmir, in which 26 lives were lost, saying that such attacks cannot happen without financial support. It had also promised a detailed examination of terror financing methods based on data from its 200-jurisdiction member network.

The report details how aluminum powder, an essential component in the improvised explosive device used during the Pulwama attack, was purchased via Amazon, a major e-commerce platform. Authorities determined that this material enhanced the severity of the explosion.

The February 2019 attack, targeting a convoy of Indian security personnel in Pulwama, Jammu and Kashmir, resulted in the deaths of 40 CRPF officers and was linked to the Pakistan-based group Jaish-e-Mohammed (JeM). Indian law enforcement later filed charges against 19 individuals under the Unlawful Activities (Prevention) Act (UAPA), including seven foreign nationals. Investigators also identified and seized assets linked to the operation, such as vehicles and hideouts.

India has consistently pointed to Pakistan’s alleged role in providing safe havens and funds to designated terrorists, actions which it argues warrant Pakistan’s inclusion on the FATF’s "grey list."

Terrorists Misused EPOMs, VPNs In Operations

In a broader assessment, the FATF warned that e-commerce platforms are used not only for procurement of chemicals, electronic devices, or weapon components, but also to finance terrorist agendas and operations. These platforms may also serve as a means for fundraising through the sale of goods, even low-value ones that typically escape regulatory scrutiny.

"EPOMs (can be used for fund-moving purpose inspired by trade-based money laundering schemes. Traded goods can indeed offer disguise to value being transferred from an accomplice to another member of the network. In such scheme, the first actor would purchase items, send them to his accomplice through an EPOM, for the latter to sell items in another jurisdiction and use profit to finance terrorism," the FATF said.

The report also includes a detailed case study of the April 2022 attempted breach at the Gorakhnath Temple, where an individual motivated by ISIL ideology assaulted security forces before being detained.

A subsequent investigation revealed that the accused had transferred nearly Rs 6.7 lakh (approximately USD 7,685) through PayPal to multiple foreign accounts, utilising VPN services to mask digital traces. He also received a foreign transfer amounting to Rs 10,323.35 (about USD 188). These transactions, spread across 44 international third-party payments, were flagged as suspicious.

The individual also paid for VPN services via his bank account to further hide his digital footprint. Based on transaction records accessed through email, authorities uncovered that the accused had routed funds to several individuals linked with ISIL in other countries to support terrorist activities.

"Due to the suspicious nature of these transactions and the potential for TF, PayPal suspended the accused's account, thereby preventing further illicit fund transfers," the FATF said in the case study as sourced from India's finance ministry.

The FATF also highlighted that fintech growth over the past decade has increased the use of these services by terrorist entities, offering them low-cost and rapid transfer options with limited oversight. These platforms, often used under false identities, provide anonymity that is not possible through traditional wire transfers.

The report added that Europol identified widespread usage of these tools by various types of terror groups. In particular, smaller cells and foreign terrorist fighters (FTFs) reportedly employ peer-to-peer services (P2P) for obtaining weapons, chemical substances, and or propaganda materials on e-commerce platforms.

The watchdog also mentioned that Ethnically or Racially Motivated Terrorism (EoRMT) groups use online payment channels to sell merchandise, items promoting and converying extremist ideologies, all of which generates substantial revenue.

"Such online payment services can also be used to convey donations to larger organisations, especially in the extent that some payment mechanisms are directly integrated into social networks and content hosting services. In those cases, a single platform can be used to recruit donators, launch a crowdfunding campaign, and proceed to the transfer of funds through an online payment service," it added.

Lastly, FATF reiterated the challenges posed by these digital services in tracing and identifying those involved. Their capacity to discover the source and destination of funds continues to be a critical concern for global counter-terrorism efforts.

-

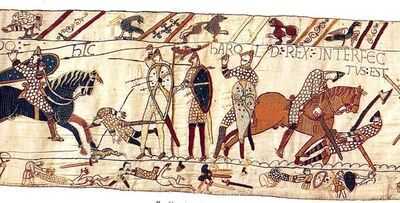

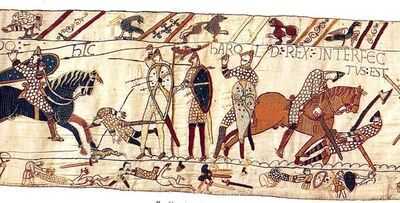

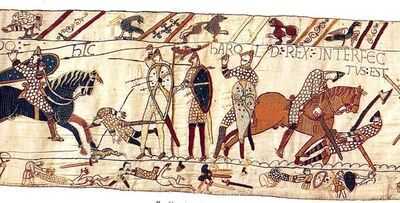

Bayeux Tapestry to go on display in UK for first time in almost 1,000 years

-

Bayeux Tapestry to go on display in UK for first time in almost 1,000 years

-

Bayeux Tapestry to go on display in UK for first time in almost 1,000 years

-

Arsenal make first team announcement as former Man Utd ace joins Mikel Arteta

-

Diarrhoea Outbreak in Odisha: Current Status and Health Measures