Bank loan news: Whenever a bank gives a loan to a consumer, it sets many terms and conditions (Loan Prepayment rules) at the very beginning. The borrower repays the loan only by abiding by these terms and conditions.

One of these rules is also about the loan prepayment penalty. Many people are confused about this rule, which states whether a borrower wants to repay the loan before the time, and whether he has to pay a penalty (loan prepayment charges) or not. Let us tell you what the rule is regarding this.

It is important to know all the terms of the loan-

There are many types of loans, and different banks have different terms and conditions for every type of loan (loan repayment rules). In such a situation, it is important to know all the terms and conditions (bank loan rules) related to the loan at the time of taking the loan. Most banks have a rule that if a borrower repays the loan amount before the time (loan repayment rules), then they will have to pay a penalty. Some banks also waive this penalty.

The benefits and losses depend on this-

If you are deciding to prepay the loan, then first decide how much loan tenure is left. It will depend on this whether you have a loss or a profit. Generally, there can be benefits as well as losses in repaying the loan before the time. It also depends on the loan terms and conditions and the rules of the bank.

Why do banks charge a loan prepayment penalty?

If a customer repays the loan before the time, the bank does not get as much benefit as it gets when the customer repays the loan within the stipulated period. Therefore, to compensate for this loss, the bank imposes a penalty on the borrower.

What should the loan holder do before repaying the loan?

If you are deciding to repay the loan before time, then first calculate (Loan EMI Calculation) how much loss or benefit you are getting from the penalty imposed on doing so. If you are going into a loss, then there is benefit in paying the EMI on time, i.e., from time to time (loan EMI rules).

You should also check in your loan agreement whether the bank will impose a penalty on loan prepayment or not. If there is no mention of a penalty on repaying the loan before time, then you can make a loan prepayment (loan prepayment kab kre) without any tension.

Consider for investment -

One more thing becomes clear here that delaying in paying the EMI of any loan (loan chukane ke Niyam) or repaying the loan before time will also lead to a penalty.

If you incur a loss in repaying the loan (bank loan news) before time and you have the money, then you can invest this money in mutual funds or FD (investment tips). By doing this, you will not only save yourself from the penalty of loan prepayment, but you will also get good returns in the future.

Disclaimer: This content has been sourced and edited from Hr Breaking. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

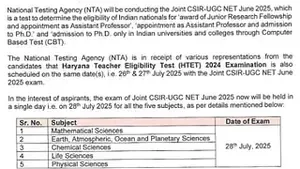

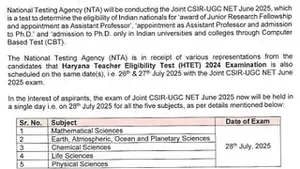

CSIR UGC NET June 2025 Exam Rescheduled Due To HTET 2024 Date Clash; Check New Dates Here

-

CSIR UGC NET June 2025 Exam Rescheduled Due To HTET 2024 Date Clash; Check New Dates Here

-

RRB NTPC UG: Application status of Railway NTPC UG recruitment released, check this way whether the form is accepted or rejected..

-

RRB NTPC UG: Application status of Railway NTPC UG recruitment released, check this way whether the form is accepted or rejected..

-

Concerns Rise Among Landless Farmers in Dharapur Over Land Rights Promises