Thousands of grieving families are reclaiming overpaid inheritance tax and experts say it's never been more important to check whether you're due a refund. New HMRC data obtained by NFU Mutual reveals more than 18,000 families have reclaimed inheritance tax (IHT) since 2022, up 65% in two years. But many are still unaware they may be entitled to money back.

IHT is calculated on the value of an estate at the date of death, and must usually be paid within six months. If a property or stocks and shares fall in value before being sold, families can reclaim some of the tax, but only if they act proactively.

A large inheritance tax bill can be a nasty shock for grieving families, said Sean McCann, chartered financial planner at NFU Mutual. "More people are waking up to the possibility that they could reclaim overpaid inheritance tax."

Families can make a claim if asset values dip between calculating the entire tax bill for HMRC, and actually disposing of the asset.

Even if house prices generally rise, a reclaim may be possible. "The property might have been overvalued on the inheritance tax return or deteriorated between the death and subsequent sale."

Staying on top of your IHT liabilities is more important than ever as the HMRC's tax take increases, with IHT thresholds frozen until 2030.

Inheritance tax pulled in £8.2billion in 2024-25, and the Treasury expects that to hit £14.3billion by 2030, but McCann said reclaiming overpaid IHT isn't automatic. "Executors need to apply to HMRC using the correct forms, and there are important rules to follow."

If a property is sold for less than its value at the time of death, and the sale takes place within four years, submit an IHT38 form to reclaim the difference.

A separate IHT35 form can be used if shares or qualifying investments fall in value and are sold within 12 months of death.

McCann warns that all qualifying investments sold must be declared. If some have risen in value, this will reduce the refund. "In some cases, it's better to transfer the more valuable shares directly to beneficiaries to maximise the claim."

With inheritance tax affecting more families each year, McCann encourages people to seek advice early. "It can be a complex process, but families shouldn't miss out on money that's rightfully theirs."

Families will soon face another probate challenge, as Chancellor Rachel Reeves plans to impose IHT on unspent pension pots from April 2027.

Legal expert Fiona Mainwaring at ORJ Law said the move will make sorting out a loved one's estate even more difficult. "Many people have multiple pension schemes, and executors will face delays locating and valuing them. HMRC will be more involved than ever, and that risks serious delays."

Families are already reporting long waits. And with HMRC charging 8.25% interest on unpaid IHT after six months, regardless of the cause, delays can be costly.

Mainwaring is urging families to get their paperwork in order. "Talk to your executors, and consider making gifts while you're alive. The system is only getting more complex and early planning is essential."

-

India cement Vitality IT20 series in Manchester

-

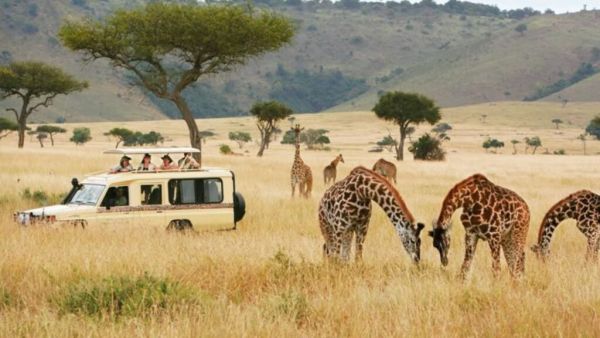

Get ready, Asia’s largest jungle safari is starting in this Indian state; know what will be special…

-

Why you still need sunscreen in Monsoon: How to apply it right and why is SPF important

-

Why curd should not be eaten in the rainy season, know its disadvantages too

-

Today’s Horoscope- 10 July 2025: Pisces, Leo and Taurus may get success