Labour Left-wingers have set out their list of demands to the weakened Chancellor, calling for an unprecedented rise in taxation to fund their socialist spending programmes. Prominent backbencher Nadia Whittome has listed 10 new tax hikes she wants to see at the Budget, after forcing Rachel Reeves into a humiliating U-turn on welfare cuts last week.

The Left-winger set out the list of demands that would increase Britain's record-high tax take by a whopping £120billion, a move that would cripple economic growth and send the wealthy packing. The shopping list comes as the Government refuses to rule out levying an unprecedented wealth tax on Britain's highest-rate taxpayers. Ms Whittome said: "The problem is an exploitative, extractive economic system rigged against most people and our planet. The solution is not further cuts - we need to tax extreme wealth instead."

Ms Whittome's 10-strong list of desired tax hikes included:

She also cited former Labour leader Lord Kinnock, who this week endorsed a wealth tax on those with more than £10million of assets.

However, tax expert Dan Neidle, who is linked to the Labour Party, said Ms Whittome's list is a fantasy that would raise nowhere near what she claims.

Taking each suggestion in turn, he said some would raise almost no money at all, or worse lose Britain money.

Taking on calls for a wealth tax directly, Mr Neidle schooled the Nottingham MP: "No country has introduced a tax like this. Actual real-life wealth taxes either raise little or hit the middle-class more than the mega-wealthy."

He suggested the ending of subsidies for banks would raise as little as £5billion, just 10% of what Ms Whittome demanded, while Britain already has one of the highest dividend tax rates in the world. Raising it further may lose revenue.

Mr Neidle concluded with a warning that the Labour Left "has stopped making the argument for a more expansive state funded by most people paying more tax", adding: "Instead, we're left with the false claim that other people will always pay."

He was backed by the former head of the Institute of Fiscal Studies, Paul Johnson, who simply added: "We can have bigger state and more tax on average earners. We can have smaller state and real cuts in public services/benefits. That's it. The choice."

Despite warnings that wealth taxes have never worked when tried by other European countries, this week Ms Reeves sent rumours flying that she is considering one.

The Chancellor, who previously called for wealth taxes on five different occasions during her parliamentary career, is now refusing to rule one out as she works out how to fill her fiscal black hole caused by multiple spending cut u-turns in recent weeks.

The PM's official spokesman said: "I can't comment on future tax policy."

Britain already has its highest taxation rate in history, with the top 25% of earners paying around 75% of the total tax take.

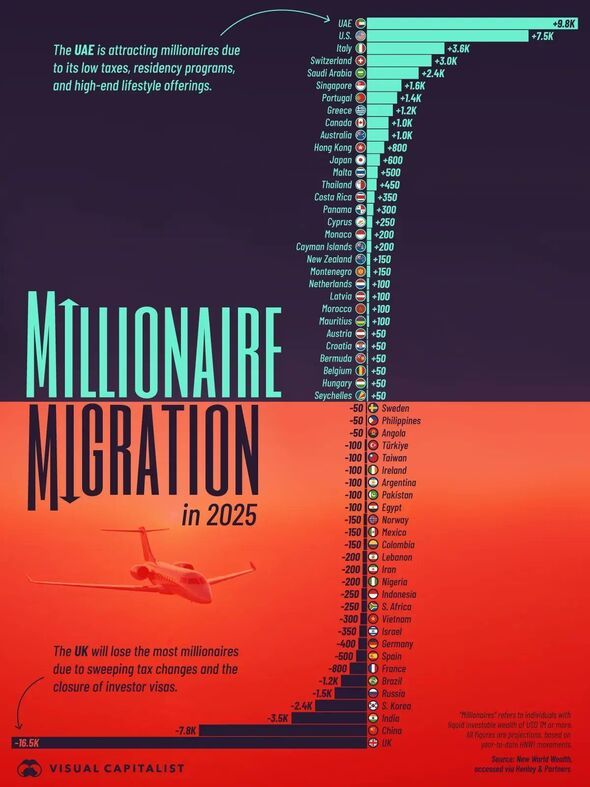

At the same time, the UK is set to lose more millionaires than any other country in the world this year, more even than China and Russia, with as many as 16,500 having fled, or planning on jetting off, before the end of the year.

-

Chris Gayle SLAMS Wiaan Mulder for passing up chance to break iconic Brian Lara’s 400-run Test record

-

Lionel Messi could reignite rivalry with Cristiano Ronaldo in Saudi Arabia amid uncertain future with Inter Miami

-

Premium Smartphones, Laptops, and Tablets See Strong Growth In India, Amazon Executive Says

-

India Women Vs England Women Highlights, 4th T20I: IND Take 3-1 Lead

-

Jofra Archer returns after 4 years, no Atkinson as England announce Lord's Playing XI