LIC is required to increase its public shareholding from the current 3.5% to 10% by May 16, 2027.

Life Insurance Corporation of India (LIC) shares fell 3% on Wednesday as reports emerged that the Indian government is preparing to set up roadshows over the next two weeks to divest stake in the country’s largest state-owned insurance company.

The first tranche is likely to involve the sale of 2.5% - 3% of its holding, with Motilal Oswal and IDBI Capital expected to serve as bankers for the offer for sale (OFS), according to a report by CNBC-TV18. The stake size and pricing are expected to be finalized after the roadshows.

Divestment Details

The Indian government currently owns 96.5% of LIC, while the public holds the remaining 3.5%. As per SEBI’s directive, LIC must raise its public shareholding to 10% by May 16, 2027, five years from its mainboard listing.

According to the report, the government could raise between ₹14,000 crore and ₹17,000 crore from the first tranche.

The divestment is part of the Centre’s broader FY26 disinvestment target of ₹47,000 crore from PSUs.

Q1 Snapshot

LIC posted a consolidated net profit of ₹10,957 crore in Q1 FY26, up 4% from ₹10,544 crore a year earlier, while standalone profit rose 5% to ₹10,986.51 crore.

Net premium income increased 4.7% to ₹1,19,618 crore, with assets under management climbing 6.47% to ₹57.05 lakh crore as of June 30, 2025. The value of new business (VNB) jumped 20.75%, with margins improving to 15.4% from 13.9%.

According to data from the Insurance Regulatory and Development Authority of India (IRDAI), LIC retained its leadership in the Indian life insurance market.

Retail Bullish

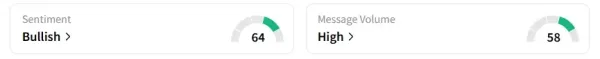

LIC was among the top 10 trending stocks on Stocktwits, with ‘high’ retail chatter. Sentiment remained ‘bullish’. It was ‘neutral’ a week earlier.

LIC shares were down 3% at ₹888.50 in afternoon trade.

YTD, the stock has seen a marginal 0.4% decline.

For updates and corrections, email newsroom[at]stocktwits[dot]com<

-

Hen do revellers spot something eerie in photograph and are left spooked

-

Queen Elizabeth's true feelings about Sarah Ferguson revealed

-

Parking on your own driveway could mean you're breaking the law

-

Women's Day 2026: Fashion Trends Women Love Because They're Dressing for Themselves

-

A Mother's Vengeance: The Shocking Courtroom Shooting of Marianne Bachmeier