The analyst identified bullish setups driven by strong fundamentals for these midcap stocks.

Laxmi Organic Industries, Madhya Bharat Agro Products, and Garuda Construction are showing promising near-term opportunities.

SEBI-registered analyst Palak Jain has flagged these three stocks. Let’s take a look at her recommendations:

Laxmi Organic Industries

Jain highlighted that Laxmi Organic has a strong asset base (total reserves and surplus at ₹1,856 crore) supporting business stability and growth. On the technical charts, the stock has seen a resistance breakout with strong volumes, signaling bullish momentum ahead. It is trading above key moving averages, which confirms a short-term uptrend.

Jain recommended buying above ₹224, for targets of ₹231, ₹237 and ₹251, with a stop loss at ₹197.

Madhya Bharat Agro Products

Madhya Bharat Agro charts show a formation of a symmetrical triangle pattern, indicating price compression. A breakout from here often leads to strong directional moves. The stock is approaching a breakout zone, which may trigger increased volatility and trend continuation, according to Jain.

On the fundamental front, the company has recorded a 131% year-on-year (YoY) rise in profits in FY25, with sales up 30%, showing rapid expansion and solid demand. Its return-on-equity (RoE) and return-on-capital-employed (RoCE) stand at 14.2% and 18%, indicating efficient use of capital and good management.

Garuda Construction & Engineering

On its technical charts, she noted a rounding bottom pattern and a breakout above resistance levels, signalling a bullish move ahead. A spike in columns confirms buying interest and that positive momentum is likely to continue.

Jain recommended buying Garuda above ₹189 for targets of ₹195, ₹200, and ₹211, with a stop loss at ₹166.

On its fundamental front, the company has shown consistent profit growth and strong reserves that ensure business stability and future expansion.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Vitamin B12 will increase in the body at the speed of a bullet. Just eat this dal in this manner, then vitamin B12 will not decrease

-

Potatoes are not bad for type 2 diabetes. But, here’s what you should know

-

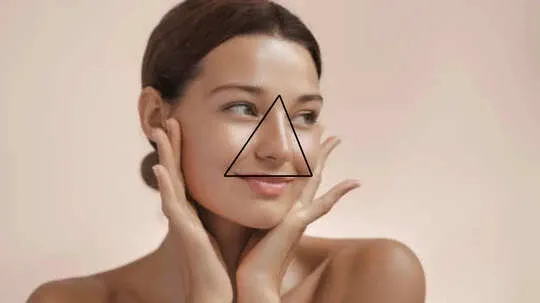

Why the Triangle of Death on Your Face Could Be a Serious Health Threat?

-

Covid’s hidden damage: How the virus is putting women’s hearts at risk

-

Doctor Reveals 5 Simple Hacks To Boost Brain Health, Make It Sharper