Mutual funds have become the favorite platform of investors today. Because it gives a good return. However, this return depends on the fluctuations of the market. Many things should be kept in mind before investing in mutual funds. For example, before investing in any fund, see how much risk there is in it.

You can check the risk from mutual funds in many ways.

How to find out the risk?

Beta

If this benchmark is less than 1, then the fund chosen by you is low risk. On the other hand, if there is more than one, then it is considered risky.

Standard Deviation

When we compare any two funds, the standard deviation is seen at that time. The lower its percentage, the less risky the fund is considered. Suppose the standard deviation of one fund is 5 percent and that of the other is 10 percent; then the first fund will be less risky.

Sharpe Ratio

You can easily find out the risk in a mutual fund through the Sharpe Ratio. If the Sharpe Ratio is less than 1.00, then the risk will be low. If the Sharpe Ratio is between 1.00 and 1.99, then the risk will be normal. Similarly, if the Sharpe Ratio is 2.00 to 2.99, then the risk will be quite high.

If the Sharpe Ratio is more than 3, then the risk in such a fund is very high.

Also, keep these things in mind.

Fund performance

While buying a fund, it is important to compare the returns received in different years, not just 1, 2, or 3 years. This will tell you how much return the fund is capable of giving. And how much stability is there in it?

Take care of the charges.

Many types of charges are often levied in mutual funds, which we do not pay attention to. These charges include Expense Ratio, Exit load, Management fees, etc. Usually, the company levies charges like exit load when someone withdraws within a year. So, check these charges thoroughly.

Comparing Funds

You should never compare funds of different categories. This can increase your confusion. Comparing general funds will be a good option to choose.

Disclaimer: This content has been sourced and edited from Dainik Jagran. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Vitamin B12 will increase in the body at the speed of a bullet. Just eat this dal in this manner, then vitamin B12 will not decrease

-

Potatoes are not bad for type 2 diabetes. But, here’s what you should know

-

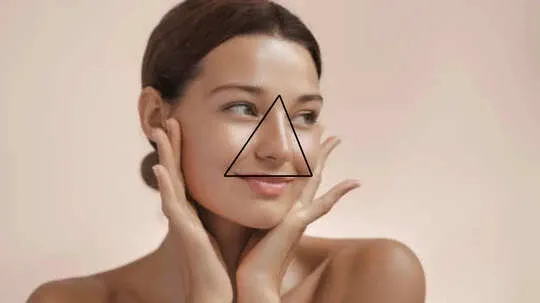

Why the Triangle of Death on Your Face Could Be a Serious Health Threat?

-

Covid’s hidden damage: How the virus is putting women’s hearts at risk

-

Doctor Reveals 5 Simple Hacks To Boost Brain Health, Make It Sharper