Usually, young people come to big cities in search of jobs. Then, after some time, they think of staying here. But often there is confusion about whether it is right to live on rent after having a family, or in the future, or should one buy a house through a loan.

If you are also confused about this, then this article can help you. First, we will talk about the advantages and disadvantages of both.

Home vs Rent: Advantages and disadvantages of living on rent

Advantages

If you keep changing cities due to a job every day, then a rented house will be a better option.

At the same time, you can live comfortably by paying a security deposit for 2 or 3 months.

You can live comfortably in premium areas by paying rent. It is difficult to buy your own house in such areas.

At the same time, you can invest the remaining money in both secure and unsecured platforms.

Disadvantages

There can be countless restrictions imposed by the landlord.

If you rent a house in a premium area, then you may have to pay a huge amount.

Home vs Rent: Advantages and disadvantages of taking a house on loan

Advantages

The house becomes yours after repaying the entire loan. Then there is no tension of paying rent every month.

If you take a loan at a floating rate, then your interest keeps increasing or decreasing. In such a situation, you can also take advantage of the reduction in repo rate.

At the same time, you can take advantage of the tax exemption of sections 80C and 24B.

If your CIBIL score is good, then you can easily get a loan even at a low interest rate. Due to low interest, your EMI also decreases.

Disadvantages

If a loan is taken at a high interest rate, then it can cost us heavily.

Under the article of Paisa Bazaar, banks and financial institutions provide home loans according to the salary. Under the multiplier method, the home loan amount can be 72 times the monthly salary.

It is said that only 30 to 40 percent of the salary should go into EMI. If the expenses are high, then keep the EMI as low as possible. People often do not pay attention to these things, and EMI becomes a burden for you.

What do experts say?

MyMoneyMantra.com founder, MD Raj Khosla says that sometimes it is more sensible to live on rent. If you do not have a down payment of at least 15-20% of the house price, then it may be better to wait a bit and save. If your credit score is less than 700, the loan interest rate may be high, which can make buying a house expensive. If you do not have an emergency fund of 6 months' expenses, then buying a house can be risky. If there is a possibility of changing your job or city, or property prices and interest rates are very high, then living on rent is better.

Disclaimer: This content has been sourced and edited from Dainik Jagran. While we have made modifications for clarity and presentation, the original content belongs to its respective authors and website. We do not claim ownership of the content.

-

Vitamin B12 will increase in the body at the speed of a bullet. Just eat this dal in this manner, then vitamin B12 will not decrease

-

Potatoes are not bad for type 2 diabetes. But, here’s what you should know

-

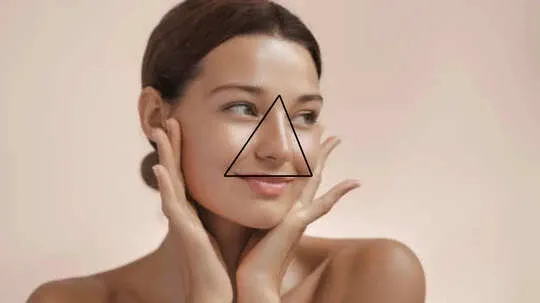

Why the Triangle of Death on Your Face Could Be a Serious Health Threat?

-

Covid’s hidden damage: How the virus is putting women’s hearts at risk

-

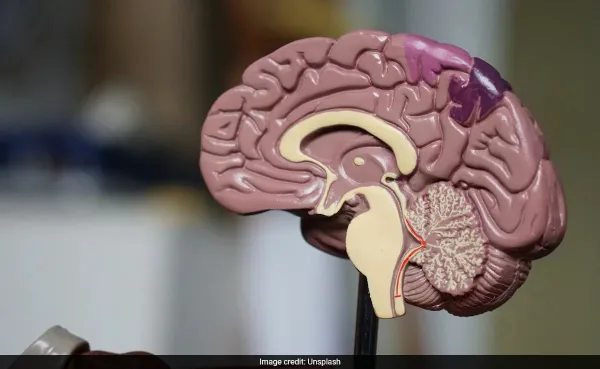

Doctor Reveals 5 Simple Hacks To Boost Brain Health, Make It Sharper