The rating agency attributed the “stable” outlook to the “continued resilience in the U.S. economy,” among other things.

The U.S. sovereign credit ratings were reaffirmed by Standard & Poor’s, according to a note by the ratings agency published late Monday.

The long-term rating was reaffirmed at ‘AA+,’ with the outlook maintained at ‘stable,’ and the short-term unsolicited sovereign credit rating at‘A-1+.’

The rating agency attributed the “stable” outlook to the “continued resilience in the U.S. economy; credible, effective monetary policy execution; high, but not rising, fiscal deficits that underpin the increase in net general government debt; and the $5 trillion increase in the debt ceiling.”

The U.S. fiscal deficit wouldn’t improve meaningfully, but at the same time wouldn’t see a persistent deterioration over the next several years, S&P stated.

“This incorporates our view that changes underway in domestic and international policies won't weigh on the resilience and diversity of the U.S. economy.”

It expects the “broader revenue buoyancy, including robust tariff income,” to offset any fiscal slippage from tax cuts and spending increases.

S&P believes that meaningful tariff revenue from President Donald Trump’s levies will offset any potential fiscal weakness stemming from his tax bill, dubbed “One Big Beautiful” bill, which envisages both cuts and increases in tax and spending.

The U.S. stock market has held its own despite the uncertainties surrounding the tariffs and their impact on growth and inflation, and in turn, the monetary policy.

The Invesco QQQ Trust (QQQ), an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index, and the SPDR S&P 500 ETF (SPY) are up over 13% and 10%, respectively, for the year.

The Treasury Department’s monthly budget report released last week showed that the deficit for July was $291.14 billion, taking the fiscal year-to-date deficit to $1.63 trillion. This is despite the customs revenue coming in at $27.67 billion for July and $135.69 billion for the fiscal year-to-date (YTD) period, more than doubling from the $62.74 billion received a year earlier.

S&P said the net general government debt will likely approach 100% of the GDP due to rising nondiscretionary interest and aging-related expenditure.

The rating agency, however, expressed hopes for positive outcomes in cross-party negotiations on contentious issues, with the government's debt ceiling expected to be resolved in a timely fashion.

S&P did not rule out a rating cut over the next two to three years if the “already high” deficit increases, amid political inability to contain rising spending and revenue management after the new tax code.

S&P’s previous rating change was in 2011, when it lowered its U.S. debt rating from the top ‘AAA’ tag, following a debt ceiling squabble.

In mid-May, Moody’s downgraded the U.S. long-term issuer and senior unsecured ratings to Aa1 from Aaa but changed the outlook to “stable” from “negative,” citing rising government debt and a rise in interest costs.

Fitch issued a downgrade in 2023, reducing the U.S. Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘AA+’ from ‘AAA.’

The futures market hasn’t reacted much to the ratings action and traded modestly lower early Tuesday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Vitamin B12 will increase in the body at the speed of a bullet. Just eat this dal in this manner, then vitamin B12 will not decrease

-

Potatoes are not bad for type 2 diabetes. But, here’s what you should know

-

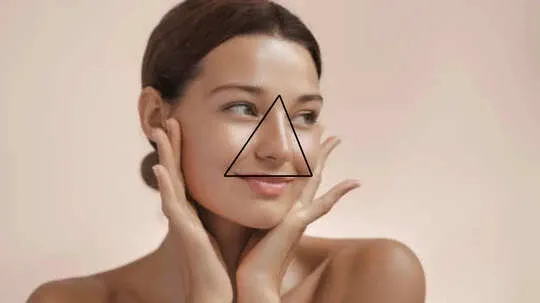

Why the Triangle of Death on Your Face Could Be a Serious Health Threat?

-

Covid’s hidden damage: How the virus is putting women’s hearts at risk

-

Doctor Reveals 5 Simple Hacks To Boost Brain Health, Make It Sharper