Denmark is famous for many things — cycling culture, excellent coffee, and a knack for making complex systems feel simple. Its approach to business and accounting is no exception. For anyone moving here to start or grow a company, understanding how the Danish accounting world works is the first step toward a smooth and stress-free business life.

It’s not just numbers – it’s a rhythm

Accounting in Denmark is less about end-of-year panic and more about an ongoing rhythm that runs alongside your business activities. From the moment you register your company with the Central Business Register (CVR)you’re expected to keep your financial story up to date — every sale, every expense, every invoice.

The Bookkeeping Act (Accounting Act) sets the tone: keep your records accurate, keep them chronological, and hold onto them for at least five years. The beauty? You can keep everything digital. Paper archives gathering dust? Not in Denmark.

The VAT reality check

Sooner or later, every business here has to face moms — VAT. At 25%, it’s one of the higher rates in Europe, but the system is refreshingly straightforward. If your turnover stays under 50,000 DKKyou can avoid VAT registration for a while. Cross that threshold? You’ll be filing through TastSelv Businessthe tax agency’s online platform.

How often you file depends on your turnover: small businesses might do it twice a year, growing companies every quarter, and the big players every month. It’s predictable, and with the right software, it can feel almost automatic.

Why software is your best friend

Ask any Danish entrepreneur about accounting, and you’ll hear the same advice: don’t do it manually. Whether you’re a freelancer or a fast-growing startup, cloud-based accounting tools make life easier.

Billy and Money are the go-to choices for small operations, offering clean interfaces and mobile apps that let you snap a receipt and log it instantly. Economic and Visma eAccounting serve bigger companies, with more advanced features and integrations. Connect your accounting system to your bank, and you’ll see transactions flow in automatically — no more typing numbers into spreadsheets at midnight.

The calm approach to audits

If the word “audit” makes you nervous, here’s some relief: Denmark reserves mandatory audits for larger companies — those exceeding two out of three thresholds for two consecutive years:

- total assets over 44 million DKK,

- net revenue over 89 million DKK,

- more than 50 employees.

For everyone else, inspections are rare and usually digital. The tax agency might send you an email requesting certain documents. If your records are already organised, it’s just a matter of uploading files and carrying on with your day.

Building trust from day one

Denmark’s business environment runs on trust — between the state, companies, and the people who run them. Meeting your accounting obligations isn’t just about avoiding fines; it’s about signalling that you’re part of this trust-based ecosystem.

Foreign entrepreneurs who adapt to this mindset quickly find that the system works with them, not against them. Clear rules, digital tools, and responsive institutions create a space where you can focus less on bureaucracy and more on building something that lasts.

-

Vitamin B12 will increase in the body at the speed of a bullet. Just eat this dal in this manner, then vitamin B12 will not decrease

-

Potatoes are not bad for type 2 diabetes. But, here’s what you should know

-

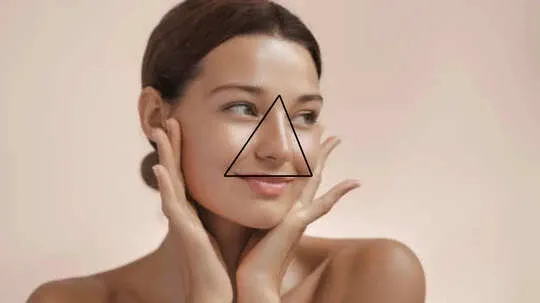

Why the Triangle of Death on Your Face Could Be a Serious Health Threat?

-

Covid’s hidden damage: How the virus is putting women’s hearts at risk

-

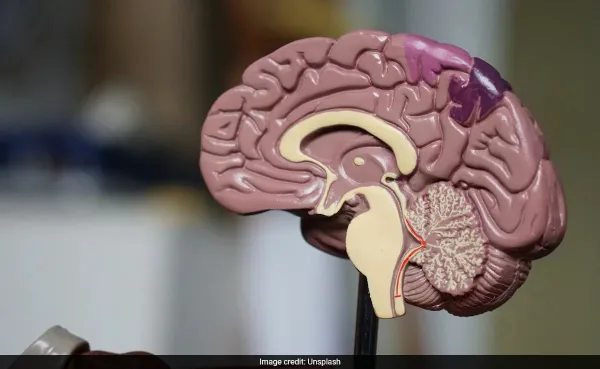

Doctor Reveals 5 Simple Hacks To Boost Brain Health, Make It Sharper