Although the company has managed to push back the maturity of the new debt to 2030, it is also offering cash and common stock to certain investors as part of the deal.

Sarepta Therapeutics, Inc. (SRPT) announced on Thursday that it has entered into agreements with investors to restructure about $700 million of debt.

The company said it will exchange approximately $700 million in aggregate principal amount of its existing convertible notes due 2027 for roughly $602 million in new 4.875% convertible senior notes due 2030, up to approximately 6.7 million shares of its common stock, and about $123.3 million in cash.

Although the company has managed to push back the maturity of the new debt to 2030, it is also offering cash and common stock to investors. A fear of a potential dilution appears to have disappointed investors. SRPT stock was down over 7% at the time of writing.

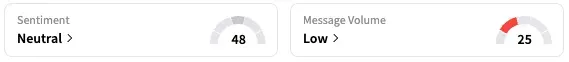

On Stocktwits, retail sentiment around SRPT stock stayed within ‘neutral’ territory over the past 24 hours, while message volume remained at ‘low’ levels. The stock is among the top ten trending names on the platform.

A Stocktwits user expressed optimism about the refinancing.

CEO Doug Ingram said that the exchange marks an important progress in the company’s long-term financial strategy. "By extending the maturity of a meaningful portion of our convertible notes to 2030, we have completed a shareholder-friendly transaction that significantly enhances our balance sheet flexibility and strengthens our financial position,” Ingram said.

Ingram also said that the company believes it is well-positioned to fully fund its pipeline and meet its near-term obligations.

Bank of America said that the debt refinancing transaction "makes sense" as it helps mitigate some near-term concerns about the company's ability to meet its obligations. Still, the firm continues to think clarity on uptake of Elevidys from here will be needed to get more comfortable with the long-term outlook.

Sarepta’s gene therapy, Elevidys, a medicine intended for the treatment of Duchenne muscular dystrophy (DMD), created safety concerns following the death of two patients after treatment earlier this year. Both non-ambulatory patients suffered from acute liver failure.

Sarepta has now resumed shipments for ambulatory individuals after a temporary pause initiated in late July. The company is now working with the FDA on the safety labelling process and risk-mitigation approach for non-ambulatory individuals. Citi on Wednesday said that the U.S. Food and Drug Administration may take a “more comprehensive look” at the regimen devised by Sarepta for non-ambulatory patients.

Last month, the company said that it had initiated immediate changes to reduce operating expenses, including a 36% workforce reduction and pipeline reprioritization, in a bid to meet its 2027 financial obligations.

Following the crisis with the gene therapy, Sarepta also unwound its equity position in Arrowhead Pharmaceuticals earlier this month, in less than a year of its investment.

SRPT stock is down by 84% this year and by about 87% over the past 12 months.

Read also: This Pharma Giant Is Set To Invest $2B To Expand Manufacturing In North Carolina, And It Just Received A Price Target Hike From Citi: Do You Own It?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Is the eyes watery only allergies or a sign of some disease? Know the opinion of the expert

-

Try some effective ways to protect the nails and to protect against fungal infection during the rainy season

-

Now photo editing will be in talks, Google will do wonders

-

Break technical relations with Israel, intensifies protest against Microsoft employees

-

Indian Cricket: Shubman Gill, not Shubman Gill, Shreyas Iyer BCCI’s first choice, what is the game behind the curtain