HSBC downgraded Keurig Dr Pepper to ‘Hold’ from ‘Buy’ with a price target of $30, down from $42, and noted that the company did not need to lever up to exit the coffee business.

Keurig Dr Pepper (KDP) witnessed a 711% jump in retail user message count on Stocktwits in the last 24 hours after the beverage company said that it plans to acquire Dutch coffee and tea giant JDE Peet's for $18.4 billion.

Shares of Keurig Dr Pepper were down 5% during midday trading on Tuesday. HSBC downgraded the stock to ‘Hold’ from ‘Buy’ with a price target of $30, down from $42, according to TheFly. HSBC analyst Sorabh Daga noted that Keurig did not need to lever up to exit the coffee business, adding that the company paid a "rich" valuation for JDE while the deal margin is dilutive and comes with a heavy debt load.

Keurig Dr Pepper had highlighted its plan to separate its coffee business, which includes its existing coffee operations and those of JDE Peet's, from its other beverage operations.

HSBC also questioned Keurig Dr Pepper's ability to de-lever and how its debt will be split between the coffee and soft drink units post-separation.

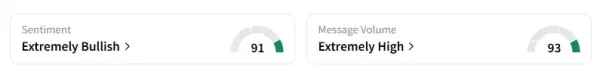

Retail sentiment on Keurig Dr Pepper remained unchanged in the ‘extremely bullish’ territory, with chatter at ‘extremely high’ levels, according to data from Stocktwits.

Deutsche Bank also lowered its price target on Keurig Dr Pepper to $38 from $40 and maintained a ‘Buy’ rating on the shares. The firm added that the JDE Peet's acquisition and planned spin-off are a complex and potentially higher-risk path to a beverage-only transformation.

While Keurig believes the rewards outweigh the challenges, the market disagreed initially, Deutsche Bank noted.

A bullish user on Stocktwits noted that Keurig Dr Pepper’s coffee business has become a drag, and tariffs and competition will affect coffee profit margin.

Keurig Dr Pepper’s shares have lost over 8% this year and declined nearly 20% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

Debutants Oman announce squad for upcoming Asia Cup

-

Daily Horoscope - August 27, 2025 (For All Zodiac Signs Today)

-

UP CM Yogi Adityanath Inaugurates Integrated Monitoring System For Atal Residential Schools

-

Murder probe launched after pensioner, 87, found strangled to death

-

UP Govt Empowers Women Through Surya Sakhi Program In Solar Projects