When we are at the age of 30-40, the retirement things seem far away. But time fly away with wings, and one day the job is over, as well as the process of salary coming every month. Think, how is it if you continue to get a certain amount every month after retirement, like a fine salary? This ‘tension-free’ guarantees the pension plan of Life Insurance Corporation of India (LIC). This is not a complicated rocket science, but a very straightforward and simple way to secure your future. How does it work LIC Pension Scheme? Consider it to be like a ‘Passe tree’. You put a part of the money you save by working hard in your youth (lump sum) in this plan of LIC. LIC invests that money safely and in return promises you to give a regular income (pension) throughout life. And they have a lump sum (eg PF or gratuity money). You deposit money today, and LIC starts giving you pension once every month, every three months, six months or year from next month. LIC’s ‘life Akshay’ is a great example of this. 2. After a few years, the pension starts (Deferred Annuity Plan): It is for the youth who are still doing jobs and want to plan their pension after the10-20 You invest money today, and you start getting pension from a date of your choice (eg 60 years old). During this time your money also keeps increasing. LIC ‘Jeevan Shanti’ comes in the new life stream. Pension keeps on getting, so that they do not depend on anyone. The trust of the government: Your money on LIC is considered to be the most safe, because the government is guaranteed on it. Your money will not drown. It is not just an investment, it is a way to buy your old age and buy self -reliance.

-

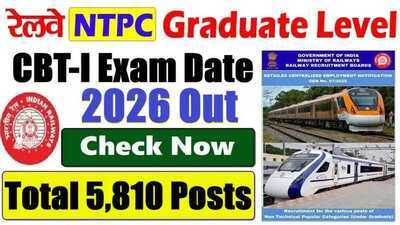

RRB NTPC Graduate Level CBT-I Exam City Information Released for 2026

-

UPSSSC Lekhpal Exam Date Announced for 2026 Recruitment

-

Coronation Street legend 'left with nothing' after losing entire soap fortune

-

Anil Kapoor's Subedaar: A Riveting Action-Thriller Now Streaming

-

Filming Commences for Season 2 of Amazon Prime's Hit Series Farzi