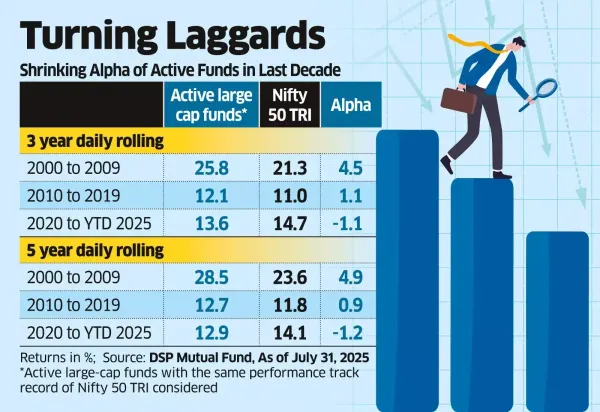

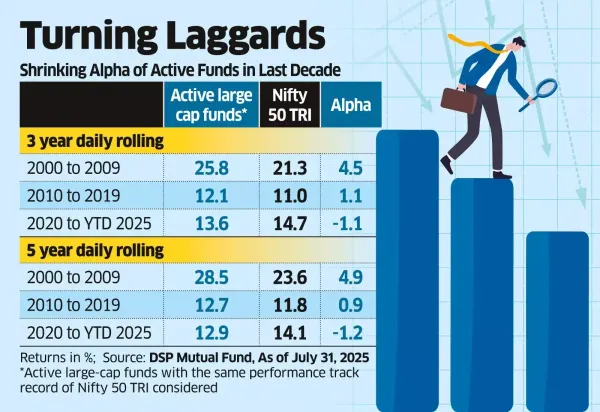

Mumbai: Large-cap mutual funds have slipped behind the benchmark in recent years. Between January 2020 and July 2025, they returned 13.6% over three years and 12.9% over five years, according to a study by DSP Mutual Fund. In comparison, the Nifty Total Returns Index (TRI) delivered 14.7% and 14.1% in three- and five-year periods, respectively.

That's a sharp reversal from earlier decades when these funds consistently beat the index, generating alphas - returns over the benchmark - of 4.5% and 4.9% in 2000-2009 and 1.1% and 0.9% in 2010-2019 on a 3-year and 5-year basis. Analysts said mandatory benchmarking to the Total Return Index (TRI) and the recategorisation of funds based on market capitalisation by Sebi have led to lower alpha generation. The Nifty TRI also includes dividends in addition to capital gains, assuming those dividends are reinvested. As per Sebi's mandate, large-cap schemes should have 80% of their portfolio in the top 100 stocks by market capitalisation.

"On account of Sebi rules on categorisation, the universe of large-cap stocks is restricted to top 100 stocks. Due to this, many large-cap active funds are seen hugging their benchmarks, leading to low alpha generation," says Harshvardhan Roongta, founder, Roongta Securities.

Passive funds in India are most popular around large-cap indices such as Nifty, Sensex, and Nifty 50 Equal Weight Index. With large-cap schemes struggling to beat benchmark, investors are shifting preference to index funds or exchange traded funds over actively-managed funds.

While an ETF may cost between 5-30 basis points, and index funds between 10-75 basis points, active funds under regular plans can cost between 75 bps and 200 bps every year.

Passive funds tend to work well for investors who are keen to stay invested for more than 10 years. Over long horizons, cost gap compounds significantly, resulting in better net returns for passive fund investors. "Annual recurring costs for a passively managed large-cap fund would be lower, which is an important point to consider if you are investing for long term," says Anil Ghelani, head of passive investments and products, DSP Mutual Fund.

That's a sharp reversal from earlier decades when these funds consistently beat the index, generating alphas - returns over the benchmark - of 4.5% and 4.9% in 2000-2009 and 1.1% and 0.9% in 2010-2019 on a 3-year and 5-year basis. Analysts said mandatory benchmarking to the Total Return Index (TRI) and the recategorisation of funds based on market capitalisation by Sebi have led to lower alpha generation. The Nifty TRI also includes dividends in addition to capital gains, assuming those dividends are reinvested. As per Sebi's mandate, large-cap schemes should have 80% of their portfolio in the top 100 stocks by market capitalisation.

"On account of Sebi rules on categorisation, the universe of large-cap stocks is restricted to top 100 stocks. Due to this, many large-cap active funds are seen hugging their benchmarks, leading to low alpha generation," says Harshvardhan Roongta, founder, Roongta Securities.

Best MF to invest

Looking for the best mutual funds to invest? Here are our recommendations.

Passive funds in India are most popular around large-cap indices such as Nifty, Sensex, and Nifty 50 Equal Weight Index. With large-cap schemes struggling to beat benchmark, investors are shifting preference to index funds or exchange traded funds over actively-managed funds.

While an ETF may cost between 5-30 basis points, and index funds between 10-75 basis points, active funds under regular plans can cost between 75 bps and 200 bps every year.

Passive funds tend to work well for investors who are keen to stay invested for more than 10 years. Over long horizons, cost gap compounds significantly, resulting in better net returns for passive fund investors. "Annual recurring costs for a passively managed large-cap fund would be lower, which is an important point to consider if you are investing for long term," says Anil Ghelani, head of passive investments and products, DSP Mutual Fund.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!