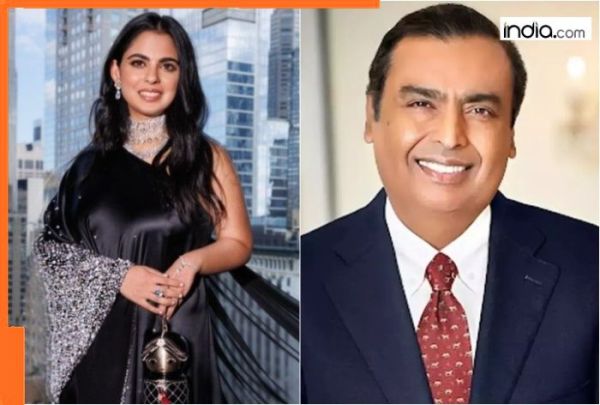

Mukesh Ambani has announced that Reliance Jio the telecom arm of Reliance Industries will launch its IPO next year. At the same time he is also preparing for a separate stock market listing of Reliance Retail which could be valued at nearly USD 200 billion. According to a report in told thehindubusinessline.com Reliance has already started reorganising its retail business. This includes separating the fast-moving consumer goods (FMCG) business Reliance Consumer Products which will now become a direct subsidiary of Reliance Industries. The company is also shutting down underperforming retail stores to improve profitability. These steps are aimed at strengthening Reliance Retail’s financial performance so it can achieve a higher valuation when listed. Although still at an early stage the retail arm is likely to go public in 2027 a year after Reliance Jio’s listing. The IPO will also give exit opportunities to key investors such as GIC of Singapore Abu Dhabi Investment Authority Qatar Investment Authority KKR TPG Silver Lake and others. After carving out Reliance Consumer Reliance Retail will continue to run formats like Reliance Smart Freshpik Reliance Digital JioMart Reliance Trends 7-Eleven Reliance Jewels and more. The demerger of Reliance Consumer is expected to be completed by the end of this month once all regulatory approvals are in place. In FY25 Reliance Retail posted an operating profit of USD 2.9 billion on revenues of USD 38.7 billion. The company’s EBITDA margin stood at 8.6 per cent for the year and improved slightly to 8.7 per cent in the June quarter. Recently Reliance Retail has been streamlining its store network by shutting down underperforming outlets. The goal is to boost profitability and reach a double-digit operating margin.

-

'Not so cheap, won't sleep on same bed with a man': Tanushree Dutta claims she rejected Rs 1.65 crore Bigg Boss offer

-

Viral picture shows Huma Qureshi getting engaged to boyfriend. Who is Varanasi-born Rachit Singh? His career and accomplishments

-

Hospitalised in emergency, employee requests sick leave. Boss demands prior intimation and proof. Internet furious

-

Rs 3 lakh monthly salary but still in paycheck-to-paycheck trap? CA explains bitter truth about true freedom

-

AMFI reshuffle: Swiggy, Dixon Tech likely to move to largecap; HDB Financial may join midcap segment