Evercore analysts reportedly saw concerns over demand bringing risk to the company's near-term earnings estimates.

FedEx (FDX) stock slipped 0.4% in premarket trading on Wednesday after Evercore downgraded the stock to ‘In Line’ from ‘Outperform.’

According to TheFly, the brokerage also lowered the price target to $243 from $249. The new price target still implied a 6.7% upside compared to the stock’s previous closing price. According to fiscal.ai data, the stock has a consensus target price of $262.61.

Evercore analysts reportedly expressed concerns over demand, which could bring risk to the company's near-term earnings estimates. The analyst noted that volume and revenue pressures are mounting for the parcel delivery giant amid intensifying macroeconomic challenges, creating limited relative upside for the shares in the near term.

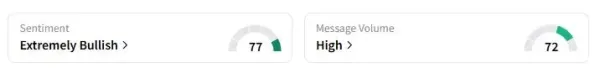

Retail sentiment on Stocktwits about FedEx was in the 'extremely bullish' territory at the time of writing.

The concerns were similar to the ones pointed out by Berenberg analysts on Tuesday. The brokerage saw incremental headwind from the expiration of de-minimis exemptions and cut its near-term estimates based on tariff changes.

FedEx and its peer UPS are reeling from the dynamic tariff policy of the Trump administration, which has impacted demand in some areas. They have also taken a hit as the Trump administration has moved to end the de minimis exemption, which was a trade policy that allowed low-value imported goods to enter the United States without companies having to pay customs duties or taxes.

The de minimis exemption was widely used by fast-fashion companies such as Temu and Shein, which used to ship their products in small batches.

FedEx is expected to post its quarterly earnings on Thursday. The Memphis-based company had projected fiscal first-quarter adjusted profit between $3.40 and $4 per share.

The stock has fallen 19% this year, compared with 12.5% gains of the S&P 500.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

-

206 bones in the body, the blood will also be stored in the blood; Take the mouth in the mouth when it appears for strong bone 4 foods

-

Samsung Galaxy S25 ULTRA: Such an opportunity will not be again! The price of premium smartphones before the cell, don’t miss deal

-

Airtel Perplexity Pro AI- Airtel’s Perplexity Pro AI plan how much is, know full details

-

Exclusive: ‘Young Professor is the challenge … “Kamali’s Kabaddi Coach Nikhil Damle experiences.

-

Varun Chakraborty topped the ICC rankings, put such a long jump