The service allows users to make payments using a credit line across all merchant touchpoints, including scanning any UPI QR code, online shopping, recharges, bill payments, and bookings on the Paytm app.

One 97 Communications Limited, the parent company of Paytm, has announced the launch of Paytm Postpaid, a revolutionary credit line service integrated with UPI payments. Developed in partnership with Suryoday Small Finance Bank and powered by the National Payments Corporation of India (NPCI), this innovative financial product offers customers the convenience of making UPI payments through the month and paying for it later.

What is Paytm Postpaid?

Paytm Postpaid transforms everyday payments by providing instant short-term credit directly through the UPI ecosystem. Unlike traditional Buy Now, Pay Later (BNPL) services that require separate apps or checkout processes, this service seamlessly integrates with India's popular UPI payment infrastructure.

The service allows users to make payments using a credit line across all merchant touchpoints, including scanning any UPI QR code, online shopping, recharges, bill payments, and bookings on the Paytm app. Customers receive up to 30 days of interest-free credit, giving them the flexibility to spend instantly and repay the following month.

For consumers, there is instant credit access. No waiting period for credit approval once activated. The service works with any UPI QR code across India, and comes with interest-free short-term credit facility.

Vishal Singh, Chief Information Officer and Head Digital Banking at Suryoday Small Finance Bank, emphasized the collaboration's focus on responsible lending: "This collaboration reflects our commitment to expanding access to secure and responsible credit. By enabling Paytm Postpaid on UPI, we are empowering consumers with greater flexibility to manage their everyday spends, while ensuring the reliability of a regulated banking partner."

How to Activate Paytm Postpaid: Step-by-Step Guide

Getting started with Paytm Postpaid is a straightforward process that can be completed entirely within the Paytm app:

Step 1: Access the Feature

- Open the Paytm app on your smartphone

- Look for the "Paytm Postpaid" icon on the home page

- Tap on the icon to begin the activation process

Step 2: Account Setup

- Create your Credit Line on UPI account by providing basic personal details

- Complete the KYC (Know Your Customer) verification process

- Set up the payment mandate for automatic deductions

Step 3: UPI Integration

- Link your new credit line account with UPI to enable payment functionality

- This integration allows you to use the credit facility through the familiar UPI interface

Step 4: Bank Selection and Authentication

- Choose Suryoday Small Finance Bank as your credit provider from the available options

- Complete the authentication process using your Aadhaar details

- This step ensures secure verification of your identity

Step 5: Final Setup

- Set up a UPI PIN for secure transactions

- Once completed, you can start making payments through the linked credit facility

- Your Paytm Postpaid credit line is now active and ready to use

Current Availability and Future Plans

The service is currently being rolled out to a selected user base, identified through their spending behavior and transaction history. Paytm plans to gradually expand the feature to more consumers in the coming months, making it available to a broader audience.

This selective rollout approach allows Paytm to monitor the service's performance and user feedback before scaling it across their entire user base, ensuring a smooth experience for all customers.

-

Motorcycle Thief Sentenced to Three Years in Bhubaneswar

-

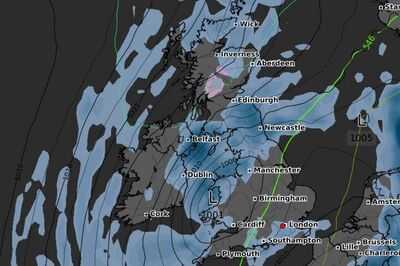

UK snow maps reveal five areas face shock SNOW as weather takes Arctic plunge

-

Robins will keep coming back to your garden if you feed them 1 food in September

-

Former Lawyer Arrested for Running Ponzi Scheme in Delhi

-

Spiders will stay away from your home if you spray 1 natural ingredient - not peppermint